Fixed Income Guide & Financial Courses

Chapter 2.4

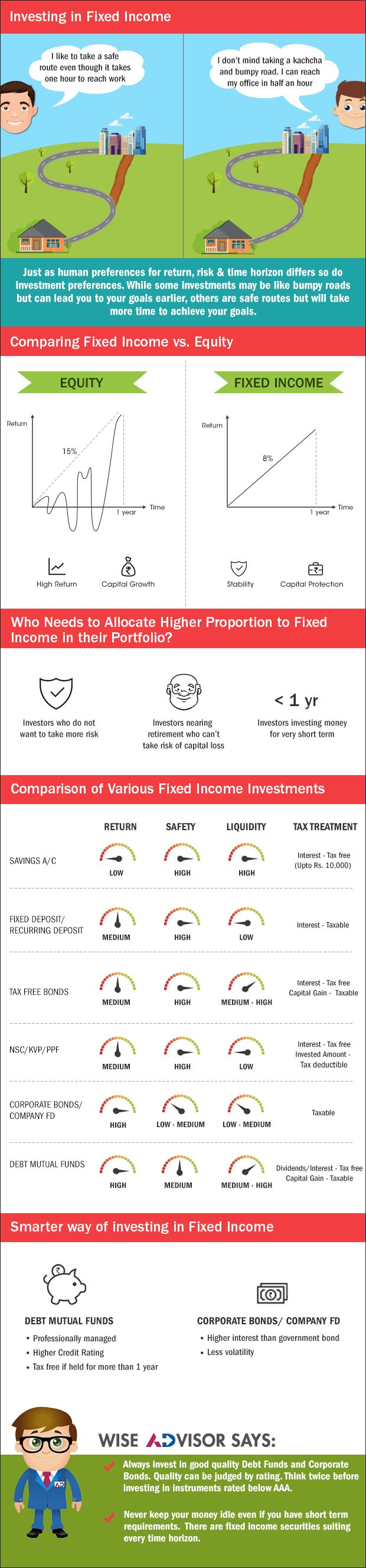

Investing in Fixed Income

This chapter explains the various fixed income investments, their pros and cons and why they should be a part of your portfolio

The first thing that comes to most of our minds when we think of fixed income is Bank Deposits. For many of us, Bank Fixed Deposits or Recurring Deposits were the first set of investments we had made in our lives other than gold, of course. Throughout our lives, 'fixed income' remains a significant part of our overall investment. Therefore, it is very important to understand why one must invest a part of one's savings in fixed income securities/investments and how should one go about it.

A fixed income instrument would typically be for a fixed tenure and promise a fixed return either at periodic intervals or a lumpsum return along with principle at the end of the tenure.

Any fixed income investment decision should be evaluated against four criteria:

• Return (Post Tax)

• Safety

• Liquidity

• Tax advantages

RETURN

Any fixed income investment, by its very nature cannot assure abnormally high returns to an investor. The Indian investor has a wide range of options ranging from extremely liquid bank accounts and bank deposits to Gilts (Government of India bonds), small savings instruments like National Savings Certificates (NSCs), Kisan Vikas Patra (KVP), compulsory savings instruments like Provident Fund, Public Sector Unit (PSU) Bonds (taxable and tax free), Company Fixed Deposits (FDs), corporate debt and open-ended fixed income Mutual Funds (MFs) for fixed income investment. While government backed bonds and bank deposits give low returns; Debt Mutual Funds, Corporate bonds and Company FDs give high returns.

SAFETY

Safety of investment, i.e. the timely payment of principal and interest is of paramount importance to a debt investor as the objective is to meet precaution needs. When we invest in fixed income, the intention is to avoid huge swings and fluctuations in the value of the investment as the money may be required for precaution needs. We often hear or read about ponzi schemes defrauding hundreds and thousands of investors.

While investing in debt instruments, the return of the principal is far more important than the return on the principal (interest), and an investor must evaluate such an investment accordingly. Investing in Indian government bonds or government guaranteed bonds can be considered as the least risky investment option. Given their low risk profile, these investments also provide lower returns as compared to other debt investments. It might be more rewarding to invest in other options like PSU bonds, NSC, KVP, PPF etc. Bank deposits of well managed banks are also considered safe.

When we invest in fixed income, the intention is to avoid huge swings and fluctuations in the value of the investment as the money may be required for precaution needs.

The safety of a debt instrument can easily be ascertained from the credit rating of the instrument, as given by reputed rating agencies in India like CRISIL, ICRA, CARE, India Ratings, etc. It is therefore advisable to invest the bulk of your fixed income allocation in high rated instruments having a rating between AA and AAA. Any decision to invest in unrated bonds or bonds below AA should be evaluated very carefully and such investments should form a very small percentage of your portfolio.

LIQUIDITY

The liquidity of an investment, i.e. the ease with which an investment can be sold when the need arises, is important in order to take care of unforeseen circumstances. Liquidity is also associated with the price risk as selling before an investment matures could potentially result in a capital loss. Post-tax return and not pre-tax return should be considered while comparing different investment opportunities.

Most investors invest in fixed income securities and then forget about the investment till it matures. This is not always the right approach. Interest rates are cyclical in nature and go up and down over a long period of time. Investing in such instruments when the interest rates are high and selling when they are low can help generate additional returns from fixed income securities. Therefore, it is important that you keep the liquidity features of a debt instrument in mind the next time you invest in debt instruments.

Most investors invest in fixed income securities and then forget about the investment till it matures. This is not always the right approach. Interest rates are cyclical in nature and go up and down over a long period of time. Investing in such instruments when the interest rates are high and selling when they are low can help generate additional returns from fixed income securities.

That way you can take advantage of the interest rate cycle and maximize your returns. The return on investment of a debt instrument should always be considered from a post-tax perspective. One must consider the post-tax return over the entire life cycle of the investment rather than just the tax implications at the point of investment.

A few important things to consider while you're investing in fixed income securities:

1. Never put all your eggs in one basket. Diversify your portfolio across various instruments so that even if one or two debt instruments may get delayed in crediting interest or default on payment of principal, it does not lead to an unbearable loss for you.

2. Always go for quality, quality and quality. Avoid investing in poorly rated or unrated investment schemes, however lucrative the returns might seem on paper. Invest the bulk of your portfolio in companies that are highly rated or are backed by the Government of India. This discipline will ensure that the bulk of your portfolio is with reputed blue chip companies or banks.

3. "If something is too good to be true, it is unlikely to be true." History does not support scenarios of high interest payment for a long period of time. And it is wise for one to assume that debt instruments offering a very high rate of interest are likely to default sooner or later.

1. Never put all your eggs in one basket. Diversify your portfolio across various instruments so that even if one or two debt instruments may get delayed in crediting interest or default on payment of principal, it does not lead to an unbearable loss for you.

2. Always go for quality, quality and quality. Avoid investing in poorly rated or unrated investment schemes, however lucrative the returns might seem on paper. Invest the bulk of your portfolio in companies that are highly rated or are backed by the Government of India. This discipline will ensure that the bulk of your portfolio is with reputed blue chip companies or banks.

3. "If something is too good to be true, it is unlikely to be true." History does not support scenarios of high interest payment for a long period of time. And it is wise for one to assume that debt instruments offering a very high rate of interest are likely to default sooner or later.

Don't keep your money idle; not even for a single day. No one can give you back even a day's worth of interest lost on idle funds from your hard earned income. Someone once asked Albert Einstein what amazed him the most. His reply was, “The power of compounding. It never stops; it keeps on accruing." You too must make the power of compounding work in your favour by never keeping your money idle.

Debt Mutual Funds: The smart way of investing in Fixed Income

For a busy investor in the high income bracket, lacking the time and expertise to analyze different debt Instruments, the open-ended debt fund emerges as a preferred choice for fixed Income Investment. This is because It provides several advantages as detailed below:

• It provides a simple way to avoid putting all eggs in one basket. As a debt fund pulls money from numerous investors, it has the resources to purchase a large number of instruments at varying maturity and yields across a large number of companies, thereby minimizing the risk.

• It provides very high liquidity as there is a time-bound exit at the prevailing Net Asset Value (NAV) by regulation.

• It provides a very convenient way of investing, as there is no need of maintaining voluminous records and remembering various interest/redemption dates. It does not have a waiting period and so the meter starts running from day one.

• It provides access to the expertise to the professional fund managers who work towards optimizing the risk-return ratio by containing risk and maximizing returns.

The income earned by an investor on the units of the mutual fund, by the way of dividend is tax free as the mutual funds are required to pay dividend distribution tax in debt-oriented schemes. In case of capital gains (long term) the investor can take advantage of paying tax either at 10% without indexation or 20% with indexation, whichever is lower.

The investor should evaluate and differentiate between mutual funds not only from the point of view of return but also on the basis of service standards, disclosure level of information, ethical conduct of business, fair and transparent valuation process and an effective 'checks and balances system for internal control and regulation. There is no shortcut to generating wealth. It is the end result of a disciplined approach of early and regular saving and wise investing.

Key Takeaways:

- Always make sure that the quality of the Debt mutual funds is ascertained before taking a decision to invest.

- The golden rule of not putting all the eggs in one basket applies to Investment In debt mutual funds as well. The Investor should diversify between four to five funds with different styles of Investments to optimize the risk-return ratio.

Next Course of action:

- Check out the best performing Debt Mutual Funds.

- Check out our range of Offerings and start investing to grow your investments.

India

India NRI

NRI