Chapter 2.2

Axis Direct 1272 Courses

Mutual Funds: An easy start

This chapter helps you understand why mutual funds are the most useful investments for a retail investor and what the advantages of investing in mutual fund are.

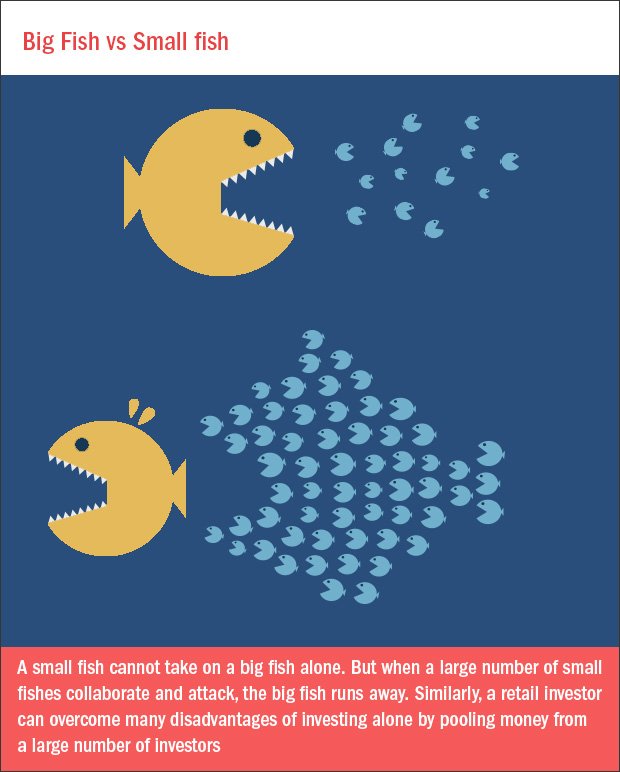

A small fish can never take on a big fish alone. However a big fish can be driven away when a large group of small fish unite together and attack. Investing in Mutual funds also works in the same way. While small investors investing individually with their limited knowledge cannot beat the market consistently but when investors pool their money and invest in a Mutual fund which is managed by a Fund manager who knows about the markets, it is easier for the investors to make money by beating the market.

Thus, Investing through mutual funds is a convenient way of creating long-term wealth for retail investors, especially investors new to the securities market or who do not have the time or the inclination to do detailed security level research before making any investment.

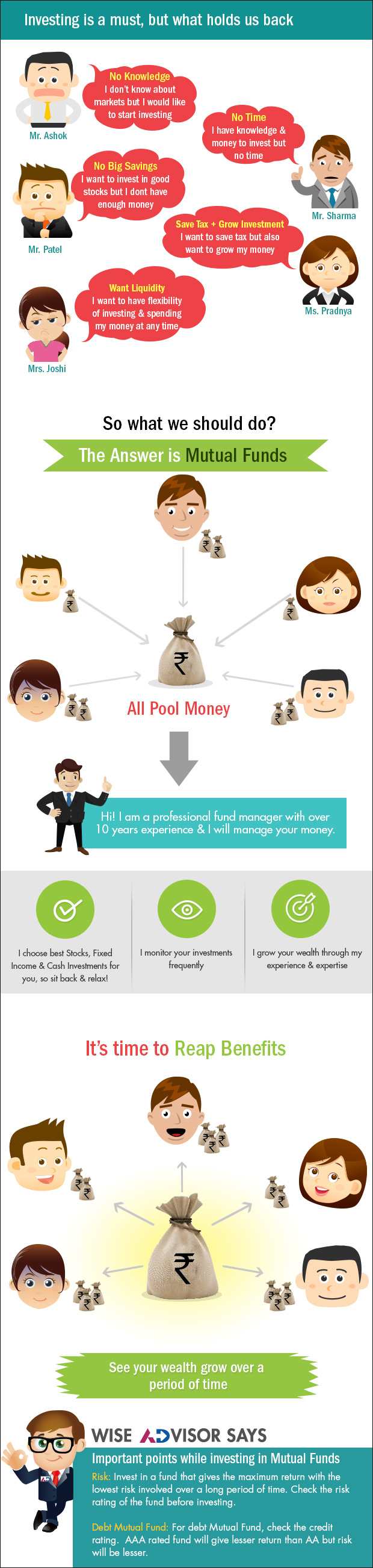

A lot of people stay away from investing for many reasons: be it they may not have proper knowledge, be it they have very less time to follow the markets, they don’t have proper savings to start investing or they may not be able to afford to invest in large amounts. Also there are people who invest only in tax saving instruments as they want to gain tax waiver while others want liquidity in investments. There is a single solution for all these needs i.e., they can invest in Mutual Funds.

The basic principle of a mutual fund is that it pools money from a large number of investors. Investors receive a proportionate share in the pool in the form of units. A mutual fund manager then takes the pool of money and decides what securities to buy and sell within the mutual fund on behalf of the individual investors. As the corpus gains profits, these profits are then redistributed back to the investors in the proportion they have invested.

The basic principle of a mutual fund is that it pools money from a large number of investors. Investors receive a proportionate share in the pool in the form of units. A mutual fund manager then takes the pool of money and decides what securities to buy and sell within the mutual fund on behalf of the individual investors. As the corpus gains profits, these profits are then redistributed back to the investors in the proportion they have invested.

An investor requires safety, liquidity and return from an investment. Depending upon the precedence of one over the other, he can decide to invest in various asset classes - debt, equity, real estate, gold and other commodities. A young person starting his career has a completely different risk profile as compared to a retiree. The key to long-term wealth creation is the careful composition of a balanced portfolio, across different asset classes to match one's risk profile.

The key benefit provided by a Mutual fund is it provides diversification. A mutual fund provides a diversified portfolio of various securities across different maturities and sectors, even with a small amount to invest with. This helps in considerable risk mitigation, enabling you to invest an amount as little as Rs. 1,000 at one go and still get the benefits of diversification. Trying to build a diverse portfolio by buying into shares I bonds of individual companies requires significantly larger outlay.

Apart from diversification, Mutual Funds provide the following key benefits to you:

1) Professional Expertise: Professional money managers manage Mutual Funds. They have access to detailed company research, Indian and global economic data, understand how various data points and events affect your investments, and act to take advantage of the same. As they follow the markets regularly, this helps him to make much better decisions on where to invest rather than individual investors investing on their own. For example, a fixed income fund manager typically as a better understanding of the volatility of interest rates and can play the interest rate cycle better than a retail investor, thereby being more adept at optimizing returns.

2) Save time: Most of us work day-in and day-out in our jobs and do not have enough time to follow financial markets daily and do not have time to do proper research before investing. By investing in Mutual fund, you are actually able to save time as these tasks will be done by a professional fund manager who keeps an eye on the market at all times while you can continue with your work and need not put any extra effort in managing your investments.

3) Need only small amount to invest: Since there is a concept of pooling money from a large number of investors in Mutual funds, retail investors are not required to invest in huge amount to achieve required level of diversification. They can achieve diversification even by investing in small amounts. This is especially useful for retail investors who have very little amount to invest but need diversification and access to professional advice.

4) Tax Advantage: The dividend declared by mutual funds is completely tax-free in the hands of the investor (although after dividend distribution tax). Cost indexation for investment in a growth plan of mutual funds makes post-tax return of mutual funds more attractive as compared to other investments.

5) Liquidity: Mutual Fund companies buy back and sell mutual fund units at net asset value on a daily basis from an investor for all open-ended schemes. You can buy an open-ended mutual fund unit without having to worry about whether a liquid market is available for the underlying shares or the bonds. If a retail investor invests directly in equities, his ability to execute a trade {buy I sell) depends on the availability of a counterparty that is willing to take the opposite position (sell / buy). For many mid cap or small cap stocks in India, liquidity is a concern for retail investors. Similarly, secondary market in retail debt products is very shallow in India. This liquidity feature makes mutual fund investment very attractive to retail investors.

While we invest in various mutual funds seeking superior returns, keep on one thing in mind. An investment decision based solely on absolute return is not the right one for long-term investment for you. For example, while investing in a debt mutual fund, it is necessary for you to be aware of the credit quality of the fund's portfolio.

While we invest in various mutual funds seeking superior returns, keep on one thing in mind. An investment decision based solely on absolute return is not the right one for long-term investment for you. For example, while investing in a debt mutual fund, it is necessary for you to be aware of the credit quality of the fund's portfolio.

Obviously, AAA rated portfolio will yield lesser than AA rated portfolio, and so on and so forth. Similarly, different debt funds carry a different risk profile from the interest rate point of view. For example: Fund A is generating 10% return with average portfolio maturity of 1 year and Fund B is generating 11% return with average portfolio maturity of 5 years.

Which of the funds is better? Actually, both the funds have a different risk profile. In a rising interest rate scenario, Fund B will be riskier than Fund A. In a falling interest rate scenario, Fund B has a better chance of giving higher return. Therefore, a fund's absolute return should be evaluated against the credit risk and or market risk being undertaken and your ability to bear the risk within your investment time horizon.

You should also be aware of the fund's risk profile from the point of view of liquidity. If the fund is investing in instruments that are not saleable or tradable, how will it pay for redemptions? It is better to invest in funds that have tradable assets.

You should also look at the consistency of return, rather than focusing just on higher returns. You should evaluate the return based on the risk taken in order to generate it. The ideal fund is the one that gives the maximum return with the lowest risk involved over a long period of time.

Key Takeaways:

- Mutual Funds provide an easy and convenient way for retail investors to invest in diversified portfolios in small amounts and provide access to professional investing

- Before investing in a mutual fund make sure its return-risk characteristics are as per your risk taking ability and in case of debt mutual funds, look out for Credit rating of the fund

Next Course of action:

- Check out the Top performing Mutual funds and start investing

- Check out our range of offerings and grow your investments by investing and beating inflation

- Start investing with AxisDirect. View our best in class Mutual Fund research ideas

- Start Investing in Mutual Funds today

India

India NRI

NRI