Learn SIP Investment

Chapter 2.3

Investing regularly through SIP

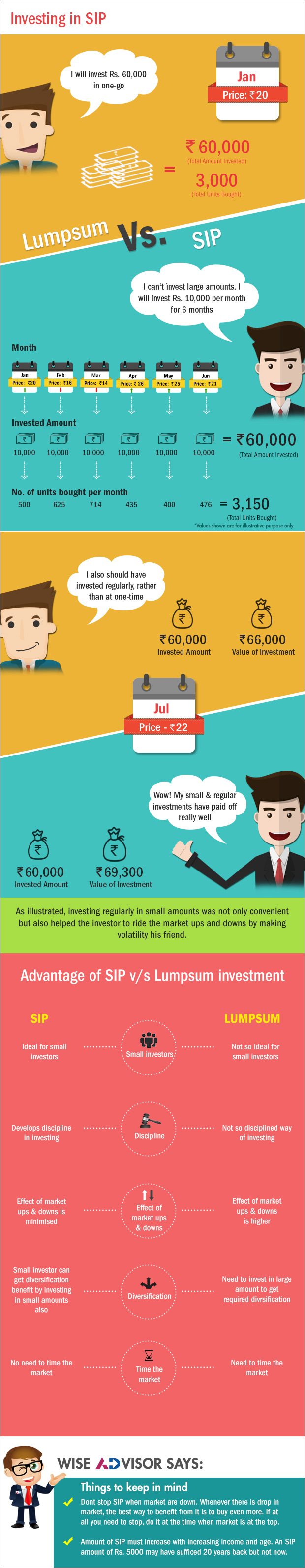

This chapter explains how investing regularly through SIP can help you in developing a disciplined and carefree way of investing for people across all income levels and help achieve financial goals

A financial journey must begin with setting a goal. A lot of us save or Invest money without any particular financial goal in mind, and therefore pay the price in terms of lower returns. A financial journey cannot be given up on, just because one's goals seem remote, or there are difficulties on the way. It can't be abandoned for the hardships one may have to suffer during the journey. One cannot take just the first step and expect goals to be met. One must take one step after another to eventually attain financial liberty. One's financial goals are achieved after taking a number of relentless steps. This continuous journey can be called regular investing or systematic Investment.

The rising Sensex chart is known to all investors. But in spite of this towering performance, equity remains under-owned. Most savers worry about the volatility of the market, and refrain from investing in equities. The fear of losing capital, even for a temporary period on a notional basis, stops savers from investing in equities. Regular investment or systematic investment is the answer to countering this fear, as it makes volatility your friend. If you keep investing on a regular basis, in a market that goes up and down, like the road to the holy shrine, you will meet your final goal. The hardship of suffering notional losses in the intervening period can be easily brushed aside by focusing on the ultimate goal.

If you keep investing on a regular basis, in a market that goes up and down, like the road to the holy shrine, you will meet your final goal. The hardship of suffering notional losses in the intervening period can be easily brushed aside by focusing on the ultimate goal.

Perhaps such returns may not exactly repeat in the future. In spite of that, regular investment across a basket of blue-chip stocks, equity index or mutual fund schemes are bound to deliver good returns to investors in the long run. A simple SIP (Systematic Investment Plan), where an investor invests a fixed amount of money every month, is a time-tested way of increasing long-term returns. Adhering to this simple formula allows you to avoid nervous selling during market panics, something that has pushed so many retail investors to the sidelines of the market for a long period of time and prevented them from participating in the inevitable up turns of coming out of a down market.

Many mutual funds in India have special SIP schemes of their flagship funds for retail investors. This SIP mechanism helps you average the cost of shares or mutual fund unit that you purchase periodically. SIP thus acts as an automatic market timing mechanism. SIP forces you to buy more units (you are buying more quantity for same amount of money) when the price is down and fewer units (you are buying less quantity for same amount of money) when price is up.

This SIP mechanism helps you average the cost of shares or mutual fund unit that you purchase periodically. SIP thus acts as an automatic market timing mechanism. SIP forces you to buy more units (you are buying more quantity for same amount of money) when the price is down and fewer units (you are buying less quantity for same amount of money) when price is up.

Through this mechanism you can't but help reduce your average cost of purchase of shares or mutual fund units over its highs and lows, thus often enhancing the returns from your investments. As evident, SIP is truly a smarter way of investing. The basic idea of SIP is simple. If the investment vehicle chosen for implementing this method is a well-diversified equity fund or an index fund, the growth of the portfolio value will co-relate to the movement of the broader stock market. Hence, essentially, the investor ends up buying more units when in a sliding market and less in a growing market. Over the long run, assuming the equity markets generally trends upwards (more so in a growth market like India), this process holds the promise of better risk adjusted performance.

Key Takeaways:

- A common error which investors must safeguard against is the tendency to stop SIP when markets are down. When there is a drop in the market, one must buy more rather than stopping the investment. Don’t stop your SIP just because markets are falling. If at all, one should consider stopping SIP only when markets have become expensive on valuation.

- Another thing an investor must keep in mind about SIP is that the amount of SIP should increase with an increase in income. An SIP which was started 14 years ago, when the income was much lower than it is today, is not adequate. Regular investment and early investment are simple concepts, but they are the most effective guru mantras in achieving financial nirvana.

Next Course of action:

- Check out the Top performing Mutual Fund schemes if you had invested in SIP form

- Check out the SIP Ideas if you wish to invest in an equity SIP

- Check out our range of offerings and start investing to grow your investments

- Start Investing in SIP today

India

India NRI

NRI