What is Demat Account?

Like savings account holds money, demat account holds your investments in Shares, Bonds, Mutual Fund units etc. in an electronic or dematerialized format.

Know More-

Once you open a Demat Account, you can get rid of the trouble of physical possession of investments by dematerializing the same. The Demat account holds Shares, Exchange traded funds, Mutual Fund Units, Bonds etc. at one place in an electronic format. The process of sale, purchase and transfer of shares etc becomes significantly easier and the risks associated with paper certificates are mitigated.

Step 1:

To open a demat account; you must select a Depository Participant (DP). Most of the banks, broking houses and financial institutions provide DP services. The list of DPs can be checked on the websites of depositories: CDSL (www.cdslindia.com) and NSDL (nsdl.co.in). You can easily open a Demat account with AxisDirect.

Step 2:

Do you want to open a Demat Account? You can follow a simple process to open a Demat Account online. Just fill an account opening form and provide copies of relevant documents along with a passport size photograph to get started. PAN card is a mandatory document. All original documents are also required for verification.

Step 3:

You will then be provided with the rules and regulations, terms and conditions and schedule of demat charges levied.

Step 4:

There will also be in-person verification, where the DP staff would meet the client (resident Indian) in person, check the details in the account opening form & verify the same.

Step5:

Post this, the demat account will be opened and you will be given a demat account number. With this number you can access your account online.

Click here to get the details of Demat Account charges.You have to provide address proof, identity proof, passport size photograph and the account opening form.

Address proof documents: Aadhaar Card, Driving license, Electricity bill etc.

Identity proof documents: PAN card, Voter's ID, Passport, Aadhaar Card etc.

Depository

There are two Depositories in India namely, the CDSL and NSDL. They hold all the demat accounts. The Depository holds your shares on your behalf.

Depository Participants

Access to the Depository is provided by the Depository Participants (DPs). They act as the intermediary between the Depository and the investor. DPs are banks, brokers, and financial institutions empowered to offer demat services. AxisDirect is one such Depository Participant. You can open a demat account or a Beneficial Owner (BO) accounts with a DP, who will provide you a unique access to the Depository.

Unique ID

Each demat account has a unique number for identification purposes. This is the number you need to provide for transactions. The number will help the Exchanges and companies to identify your investments in your account.

Portfolio Holding

The demat account displays all your securities. So, whenever you check your account, you can see your portfolio holding and its details.

To close your existing demat account, please visit the DP office or branch of your existing demat account provider and submit requisite form and documents.

Requirements for demat account closure:

Closure form:

You can download the closure application form from the website of your demat account provider. You can also visit their branch to get the closure form.

Following details must be mentioned in the form during submission:

1. DP ID and Client ID

2. Existing details, like name and address. The details should match your records.

3. Reason for closing the account. All holders are required to sign the closure request form. POA holder (if any) cannot sign the closure request.

If the demat account has any balance (holdings), details of the account to which this balance needs to transferred must be mentioned in the form. The transfer can also be carried out by filling up a delivery instruction slip (DIS) before the account closure. If the account has any negative cash balance, it must be settled before submitting the request for its closure.

Process:

It takes 7 to10 business days to close an account after you have submitted the closure form and requisite approval.

Charges:

Closing your existing demat account is completely free of charge.

You can use your demat account to invest in any of the following instruments

Equities:

Equities are stocks representing an ownership interest in the company issuing the stocks. Equity consists of funds that shareholders invest in a company plus a certain amount of profit earned by them and retained by the company for further growth and expansion.

IPO:

An initial public offering, or IPO, is the very first sale of stock/equity issued by a company to the public.

SIP:

Systematic Investment Plan (SIP) is an investment vehicle offered to investors for investing in mutual funds and also in equities. This vehicle allows an investor to invest small amounts periodically instead of a lump sum investment. The frequency of investment can be daily, weekly, monthly or quarterly. SIPs offer benefits like an early start, small installments, reduced risk due to rupee cost averaging and no need to time the markets for investing.

On purchase, all the above-mentioned instruments will be held in your demat account.

Following documents are required to open a demat account:

1) PAN Card

2) 1 passport size photograph

3) Proof of address like Passport, Aadhar Card, Electricity Bill, Ration Card

Dematerialization offers flexibility along with security and convenience. Holding share certificates in physical format carried risks like certificate forgeries, loss of important share certificates, and consequent delays in certificate transfers. Dematerialization eliminates these hassles by allowing customers to convert their physical certificates into electronic format. Shares in the electronic format are held in a demat account.

Benefits of Demat Account

-

Single Account to hold all Investments

Demat account is not just for shares but also for Mutual Funds, IPOs, ETFs etc.

-

Easy to hold & transfer

Dematerialized format is a safe way to hold securities and receive corporate action entitlements like dividend etc.

-

Freeze or lock accounts

Keep your accounts frozen or locked for the desired span of time to avoid any debits in that period.

-

No Delivery Risks

Dematerialization has eliminated delivery risk, reduced the paperwork and time involved.

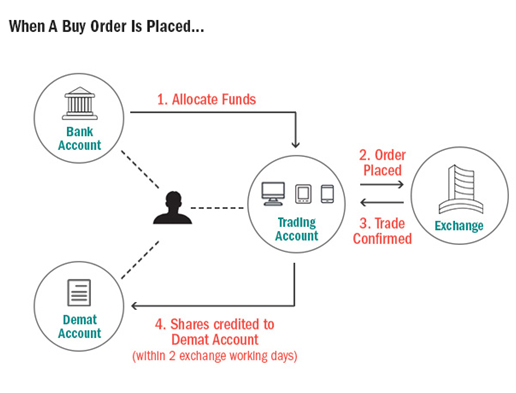

Role of Demat Account in Buying/Selling of Shares

When buy order is placed

1.The funds are allocated from bank account to trading account.

2.The order is sent to exchange.

3.Once matching sell order is received the trade is confirmed.

4.Shares get credited to demat account in 2 working days

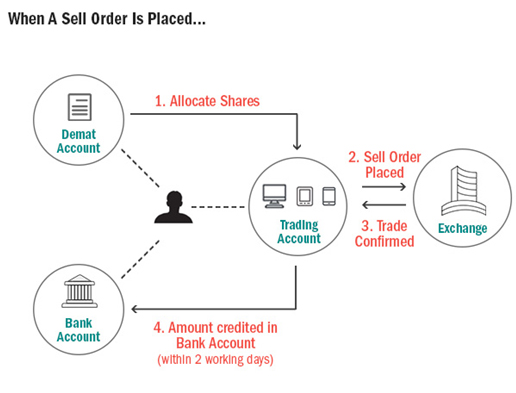

When sell order is placed

1.The shares are allocated from demat account to trading account.

2.The sell order is sent to exchange and executed once a buy and sell matching trade is received.

3.Once matching buy order is received the trade is confirmed

4.Amount gets credited to bank account in 2 working days

Why AxisDirect?

AxisDirect account brings all investment options together under one roof, giving you the power to diversify your portfolio. Demat, Savings and Trading account are linked together for ease of buying and selling. Trade in Equity, Derivatives, Mutual Funds, IPOs, ETFs, Bonds etc. through your 3-in-1 account.

Stay on top of your investments at all times. Choose the platform which suits you the best- simple to use AxisDirect Portal that works on all devices, Swift Trade – web platform with streaming market feeds, DIRECTTrade – a lightning fast desktop trading application, Mobile App, with which you have the markets at your fingertips.

Gaining investment knowledge mustn’t be boring neither should the lack of knowledge be a barrier to investing wisely. We have turned learning on its head and made it super fun!

The real success behind the art of investing is picking the right opportunities at the right time. That is why we have experienced professionals that do all the hard work so that you invest with confidence viz. Investment Ideas, Trading Ideas, SIP Ideas, MF Ideas and Derivatives Strategies.

AxisDirect is a great place to execute your investments. Don’t just take our word for it. Let our awards speak for themselves, few latest being Top Equity Broker of the Year by BSE Commodity Equity Outlook Award, Effectiveness in Financial Products and Services by DMA Asia ECHO Awards (Gold) and Best Use of Email Marketing by DMA International ECHO Awards (Gold)

India

India NRI

NRI