Chapter 3.2

Axis Direct 1285 Courses

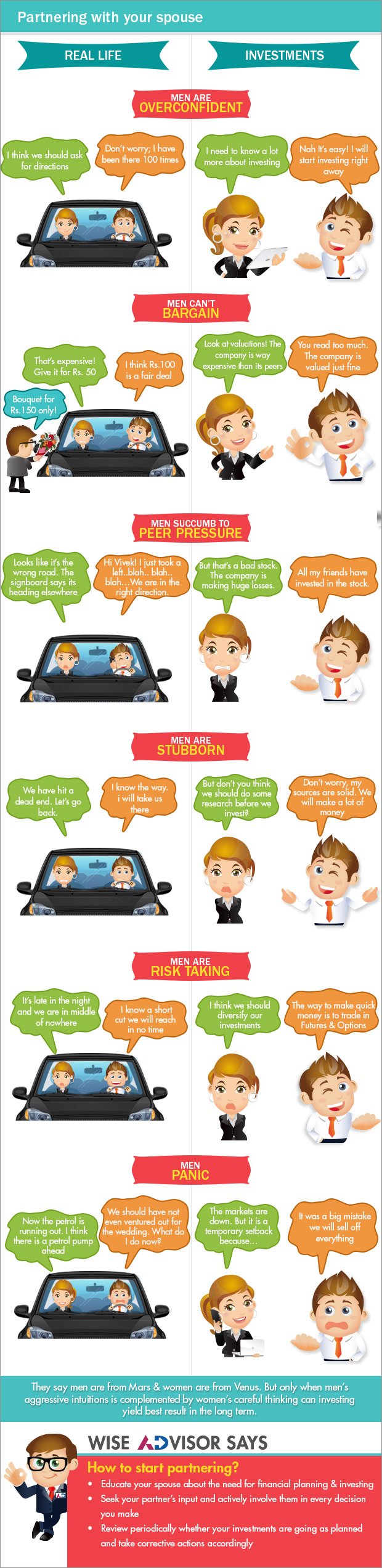

Partnering with your Spouse

This chapter explains how you and your spouse together can make better investment decisions by partnering with each other

We all know that a happy and successful family is the one where the husband and wife come together and work as a team in sharing various responsibilities, especially in a manner that helps leverage each other's strengths-be it running the home, raising a child or planning a holiday.

Interestingly, the same holds true for investment decisions. Traditionally in India, investment in stock markets is associated more with men than with women. Female fund managers in India are much fewer than male fund managers. In an average Indian household, women are not as involved as men are in taking decisions on stock market investing. However, there is a growing body of research which suggests that women may be better long-term investors than men.

Women, on an average, tend to display behavioural traits that are more aligned to successful long-term investing. Closely involving your wife in stock market investments can lead to better investment decisions and help you avoid common mistakes. Terrance Odean and Brad Barber, professors of finance at the University of California, prepared a study in 2001 called, "Boys Will Be Boys: Gender, Overconfidence, and Common Stock Investment". In this study, they concluded that men, in general, tend to be overconfident when it comes to investing. "We found that men traded more actively than women, and so attributed that, at least in part, to overconfidence, being too sure of themselves in terms of stock picking and too willing to trade on perhaps too little information", explained Odean.

Another study in 2008 by the University of British Columbia found that women CEOs are much less willing to pay a high price when acquiring another company. The takeover premium paid by women CEOs is over 70% lesser than that paid by men CEOs. From a stock market perspective, one could view it as an example of women being more risk-averse than men. For a value investor, the price paid for a stock is critical. It must be sufficiently lower than the estimated intrinsic value of the purchased stock, so that the chances of making a profit are high. The study concludes that women have a more realistic sense of corporate value. They tend to keep a higher 'margin of safety' when deciding what to pay for a particular stock. In contrast, men may be more willing to overpay for an acquisition because of their desire to 'win' or build a corporate empire. It also has to do with their inability to bargain better than women.

Women have a more realistic sense of corporate value. They tend to keep a higher 'margin of safety' when deciding what to pay for a particular stock. In contrast, men may be more willing to overpay for an acquisition because of their desire to 'win' or build a corporate empire

Warren Buffet puts it as 2 simple rules of making money, "Rule No. 1: Never lose money. Rule No.2: Never forget Rule No. 1." Women also tend to succumb less to peer pressure, which allows them to take a more level-headed approach towards investments in the long-term. Men, in the company of other men, tend to take more risks because of their competitive drive.

Globally, research has also shown that women don't trade as much as men. They are more patient. They tend to buy and hold for the long-term. They also are naturally more risk-averse, a characteristic of women that shines not only when it comes to investing, but also in other aspects of life. Besides this, they are generally better at managing their emotions than men are. While men are stubborn and are less willing to accept that their choices are wrong, women are more open to accepting their mistakes and learning from them.

Women tend to take less risk; they spend more time on researching investment ideas and seeking out information. This prevents them from making investments based on 'hot tips'. Men are greater risk takers. This may be manifested in having more concentrated portfolios, less diversification, more investment in small-cap and higher volatility stocks as compared to women. The result is that women's greater risk averseness makes them less likely to suffer big losses. The best long-term investors are risk-averse because they realize that avoiding big losses is the key to building substantial wealth in the long-term. Avoiding losses is probably the single most important rule in stock market investing. Think about this: If your portfolio loses 50%, you need to earn 100% just to break even. Losses throw a huge 'catch-up' pressure on your portfolio.

A Vanguard study in 2009 found that men were more likely to panic and sell their stocks at the bottom during the 2008-2009 bear market than women were. If the market is in freefall, men panic and sell out at any price. In a normal market, men's overconfidence makes them too stubborn to admit they were wrong about an investment, and so they tend to hold on to it.

If the market is in freefall, men panic and sell out at any price. In a normal market, men's overconfidence makes them too stubborn to admit they were wrong about an investment, and so they tend to hold on to it

To sum up, it is temperament and not intellect that makes one a successful long-term investor. In the words of Warren Buffet, "Investing is not a game where the guy with an Intelligence Quotient (IQ) of 160 beats the guy with an Intelligence Quotient (IQ) of 130.

Besides having intelligence, what you need is the temperament to control the wages that get other people into trouble in investing." Women seem to have more of that temperament along with patience and healthy scepticism. They also tend to take a deliberate approach to their nuances.

Whatever the reason for female outperformance may be, it is important for men to note that nothing is cast in stone. Good investment behaviour can be practiced and cultivated. Men can consciously avoid their biases in order to become better investors (i.e. Invest more like women). This would be easier, if men were to partner with their spouses In Investment decision-making.

Whatever the reason for female outperformance may be, it is important for men to note that nothing is cast in stone. Good investment behaviour can be practiced and cultivated. Men can consciously avoid their biases in order to become better investors

For this investment partnership between a husband and wife to be successful in the lndian context, Women need to educate themselves about investing, especially in the stock market and mutual funds. As her husband, you can help enable that process. Once you've got her interested, your wife can be a great support to your family's investment decisions. Many successful investors proudly claim, 'When my wife got involved in helping me make investment decisions for our family, the performance of our investment portfolio was much better. And l became a happier person."

So what is the action plan for the man of the house? Here it is:

• Get your spouse interested in financial planning and investing in stock markets. Take her to quality investment seminars in your city, and hand-hold her initially, if need be.

• Hire a professional advisor for the family. This would help her become familiar with the nuances of investment decisions.

• Seek her inputs in key investment decisions. While making investment decisions, work together as a team.

• Jointly review your investment portfolio periodically.

Key Takeaways:

- Finally, both of you must understand that the key to your investment success is your ability to control the urge to act irrationally, and consistently execute simple steps.

- If you get your asset allocation right, build a diversified portfolio, periodically review your portfolio to check if you are on track, and then set up automatic contributions (Systematic Investment Plans) each month, you will emerge a successful investor.

Next Course of action:

- Check out our range of offerings and start investing to grow your investments

- View the Top performing Stocks that would have created wealth for you

- Open 3 in 1 account with us and start investing in stock market

India

India NRI

NRI