Chapter 1.5

START INVESTING EARLY

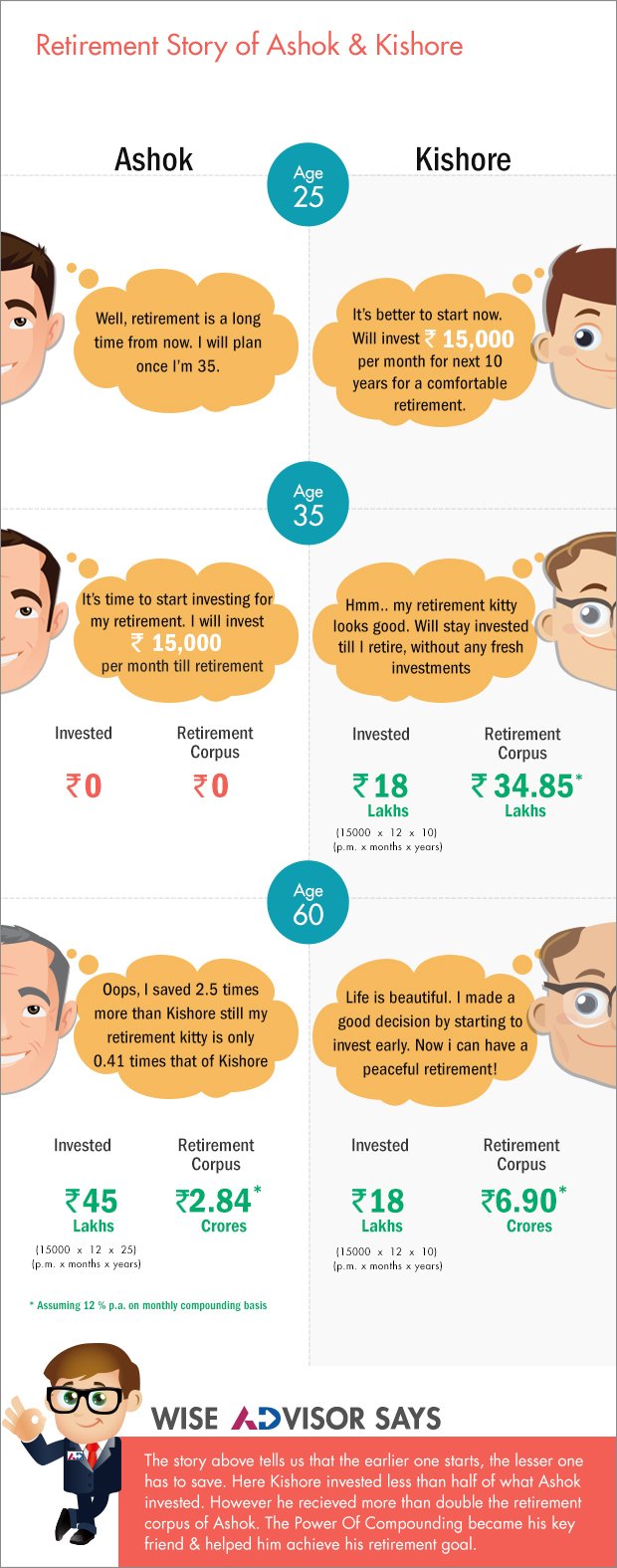

This chapter helps you understand why you should start investing early for their long term goals in order to allow the magic of compounding to work in your favor. It also explains how severe the cost of delay could be while investing.

As illustrated in the earlier image, Mr Ashok invested Rs15000 every month for 25 years (albeit 10 years after Kishore had started saving), resulting in a principal saving of Rs. 45 Lakhs. Kishore has saved Rs. 15,000 per month for just 10 years (albeit ahead of Ashok), resulting in a principal saving of Rs. 18 Lakhs. Ashok has saved 2.5 times more, in amount and time, than Kishore. However, to everyone’s surprise, Ashok's bank balance is Rs. 2.84 crores, whereas Kishore's bank balance is Rs. 6.90 crores (assuming 12% p.a. monthly compounding with no tax payable). Ashok has saved 2.5 times more in terms of the amount and time, but Kishore's bank balance is over 2.42 times more than Ashok's.

The reason behind this surprising turn of events is compounding. As Albert Einstein mentioned, "It just does not stop". The earlier you save, like Kishore did, the better are your prospects. Compounding is an investor's best friend. Use it to your advantage, as much as you can. Don't wait for an opportune time to save money. Start saving whatever you have, whenever you have it. Early saving is like planting a seed in fertile land. Give it some time, and soon, the seed will sprout into a plant that will eventually yield fruits.

Compounding is an investor's best friend. Use it to your advantage, as much as you can. Don't wait for an opportune time to save money. Start saving whatever you have, whenever you have it

After reading this story, perhaps you will choose to start investing right away and apply the power of compounding on the savings.

Key Takeaways:

- The 'Sachaai' of financial independence starts with early saving in order to allow the magic of compounding to work in your favor.

- The cost of delay while investing could be very severe which might impact your long term goal by a great margin.

Next Course of action:

- Check out our range of offerings and start investing to grow your investments

- Start investing with AxisDirect. View the best in a class research ideas

India

India NRI

NRI