Chapter 3.3

Axis Direct Courses

What not to do while Investing?

Sometimes, the best way to solve a problem is to invert it and solve it backwards. This chapter introduces a unique approach based on this concept to avoid common mistakes while investing

Sometimes, the best way to solve a problem is to invert it and solve it backwards. If asked, "What would you do as a parent to make your child a better person?" we might find it easier to answer if it was reframed as, "What would you do if you were to spoil your child?" Jacobi, the renowned German mathematician, used to urge his students, "Invert, always invert". He believed the best way to solve a difficult mathematics problem was to solve it in reverse. Charlie Munger, Vice Chairman of Berkshire Hathway, applied this principle to his own life and his investment decision-making process. He is fond of a famous saying: "All I want is to know where I'm going to die, so I'll never go there."

In 1986, he gave a thought-provoking speech before the graduating class of Harvard Westlake School in Los Angeles, sharing insights on his approach of 'inversion'. Most speakers on a similar occasion would have given the young students a speech on how to lead a happy life and be successful. Instead, Charlie inverted the question at hand and told his intrigued audience how to reach a state of unhappiness and failure. He outlined the road map for an unhappy life, which included living with envy, resentment, unreliability, taking drugs in an effort to alter mood or perception. It also included giving up after facing one of life's inevitable defeats, and learning life's lessons from experience, not from others' mistakes (i.e. put your own hand on the hot stove). With this simple yet profound argument, Munger was able to communicate what one must not do, in order to become happy and successful. The principle of inversion can act as a handy tool for the common man in making better investment decisions by helping identify the mistakes that need to be avoided.

Warren Buffet, the Chairman of Berkshire Hathway, is arguably the most respected long-term investor alive. Instead of focusing on how much money he could make if his investments went right, he asks himself how much he could lose if they went wrong. Being aware of the downside of his decision has helped him build a fortune, while limiting his losses. A large number of seasoned retail investors have experienced how a few unwise and emotional decisions can erase the hard work and efforts that go into building wealth. Many of them have abandoned their journey towards long-term wealth creation mid-way, blaming the stock market.

Instead of focusing on how much money he could make if his investments went right, he asks himself how much he could lose if they went wrong. Being aware of the downside of his decision has helped him build a fortune, while limiting his losses.

To get insights on how to grow wealth by investing in the stock market, the crucial question we might want to ask ourselves is, "What are the sure shot ways to lose money in the stock market in the long-term?". The classic book, 'The Art of Contrary Thinking' by Humphrey B. Neil gives dependable tips for stock traders to lose money for sure.

Here's an adaptation of the tips, relevant to our times, for losing money in the Indian market:

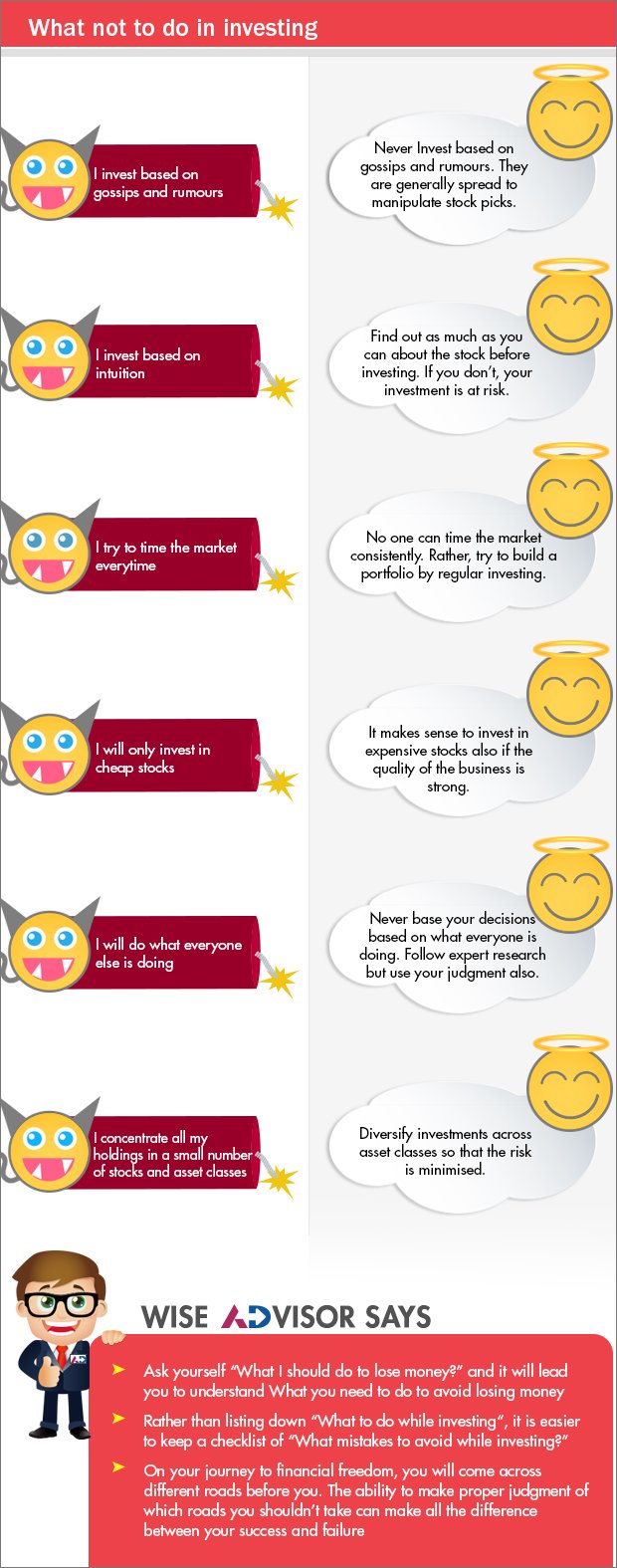

1) Trust gossip and market rumour. Ignore the fact that rum our mongers spread their lies with the intention of manipulating share prices for their benefit, with you nursing the losses.

2) Before investing in a stock, do not do any due diligence. Believe everything you hear, especially tips from friends, family and your taxi driver.

3) Be bold and try to time the market perfectly, every time. Greedily hang on for the top tenth of the return. Do not get out of a stock, even if it gets highly overvalued. Try to exit only when you are sure the stock price has reached its peak.

4) Think of low-priced shares as cheap stocks. Regularly scout for stocks trading at historical lows and invest in them, irrespective of their fundamentals. Focus especially on investing in penny stocks. How much fun it is to be able to buy 25,000 shares of a company for Rs. 2, and then see it rise to Rs. 10 in a few days!

5) Follow the herd. Do what others are doing blindly, as you think collective wisdom cannot be wrong. Invest in the most popular stocks of the day. Follow different TV channels blindly for stock tips. When everyone is buying, buy. When everyone is selling, sell.

6) Concentrate all your holdings In as few stocks as possible. Diversification, both In terms of stock ldeas as well as asset class, just limits your options to earn very high returns from a few very good Ideas.

7) Be impatient. After investing in a stock, focus on immediate returns. Sell it off if it does not give desired returns within a couple of months, even if the management and fundamentals of the company are the same.

8) While buying a stock, think only about the price you're paying. If the valuation is cheap, buy it. Do not think about the quality of the business or the quality of its management.

9) Trade on thin margins. Enter a stock with the target of making 1-2% profits. Do this every day with all your money, because you believe you have the rare ability to predict short-term movements in the stock market with uncanny precision.

10) Always hold on to your opinion. Never pay attention to opposing points of view. Do not learn from past failures because you believe that you are always right. Always believe that all the positive returns on your portfolio are due to your skill, and negative returns are because of bad luck or an incompetent advisor.

If one's aim is to lose weight one could ask the question, "What can make me gain weight" Weight gain can be caused by overeating, being physically Inactive, drinking too many colas, etc. Once one has the answer, he or she can counter it by asking, "How can I avoid that?" If the easiest way to gain weight is by overeating, then to improve one's chances of losing weight, one must focus on ways to avoid overeating.

If one's aim is to lose weight one could ask the question, "What can make me gain weight" Weight gain can be caused by overeating, being physically Inactive, drinking too many colas, etc. Once one has the answer, he or she can counter it by asking, "How can I avoid that?"

Key Takeaways:

- Similarly, once we have found the answers to the question, "How to lose money In the stock market" we must remind ourselves to Invert the answers once again, and figure out how we can avoid making the lnvestment blunders, as mentioned earlier.

- You would find it easier to follow a checklist of 'what not to do' and 'what errors to avoid', as compared to listing down and following all the things that you would need to do correctly.

- On your journey to financial freedom, you will always find many different roads before you. The knowledge and judgment, of which roads you shouldn't take, can make all the difference between your success and failure.

Next Course of action:

- Start investing with AxisDirect. View the best in a class research ideas

- Check out our range of offerings and start investing to grow your investments

- Open 3 in 1 account with us and start investing in stock market

India

India NRI

NRI