Chapter 11.3

Different types of Mutual Fund

Let us understand the unique and positive features of various investment options:

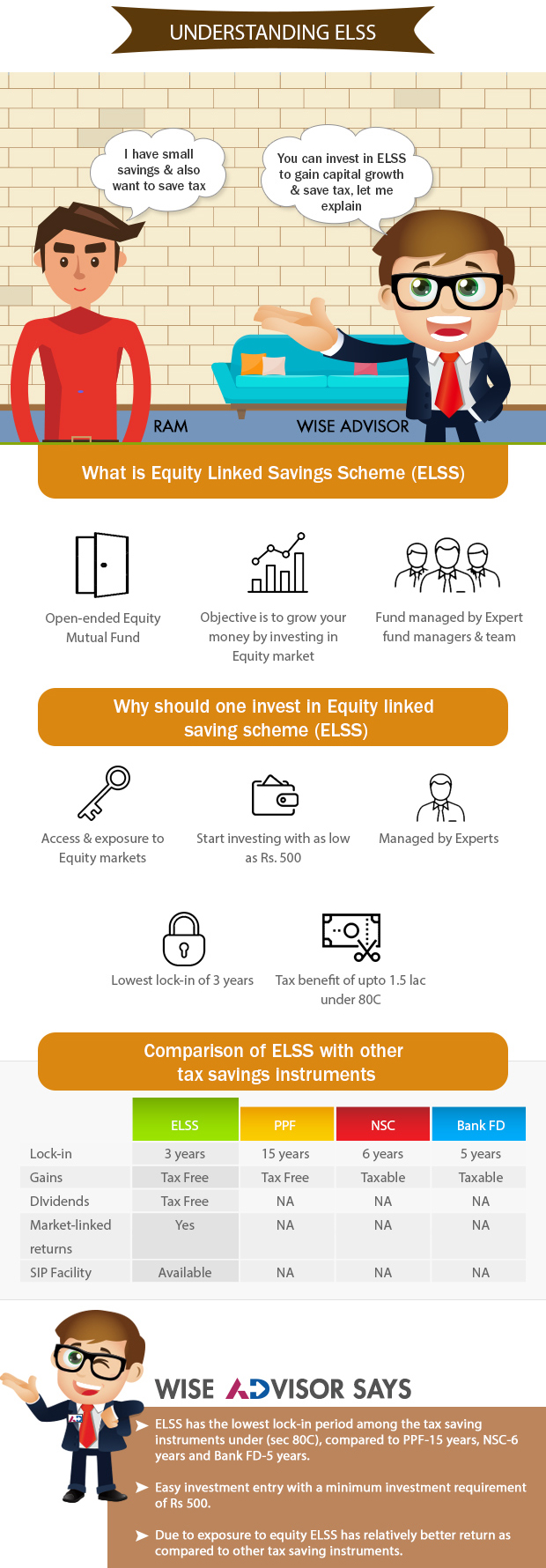

Equity Linked Saving Scheme (ELSS) is a type of equity mutual fund that invests major portion of its corpus into equity and equity related instruments. It is an equity diversified scheme that invests across stocks and sectors. In terms of its structure and where it puts its money in, it is very similar to any other plain vanilla equity diversified equity scheme. The only difference is that ELSS offers tax deduction benefits.

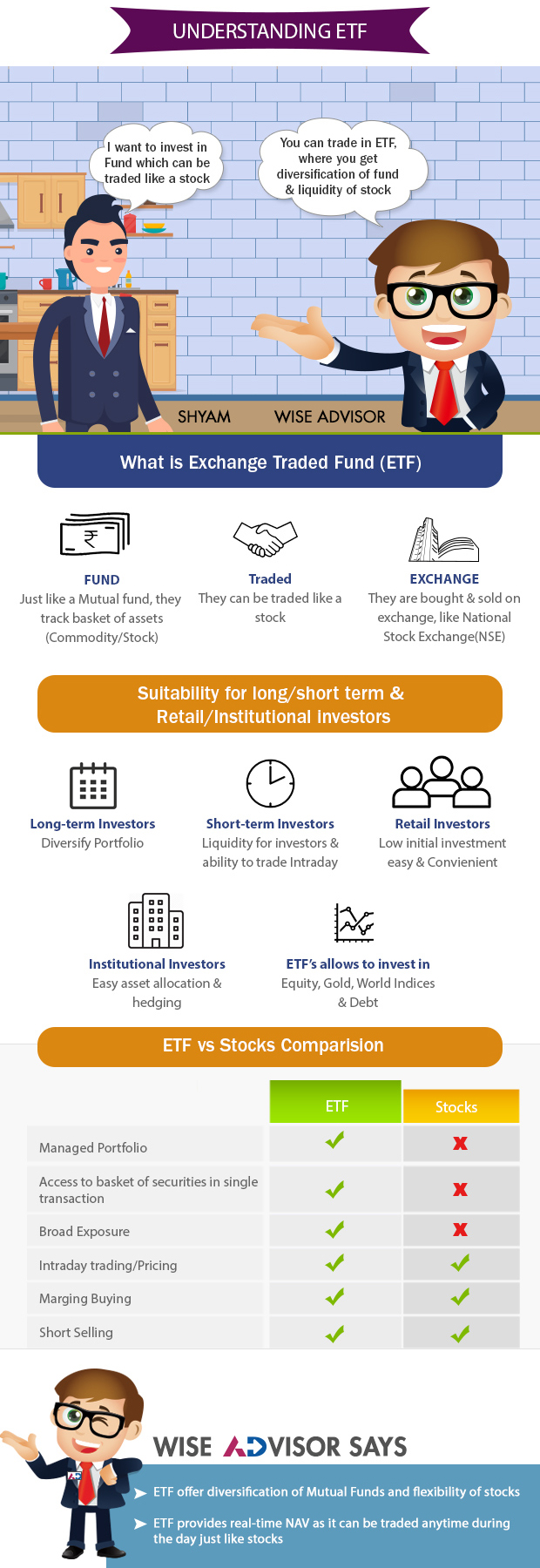

ETFs are a type of mutual funds that tracks an index, a commodity or a basket of assets like an index fund. However, unlike regular mutual funds, Exchange-Traded Funds are listed on an exchange, and trades like a stock. It, thus, experiences price changes throughout the day as and when it is bought and sold.

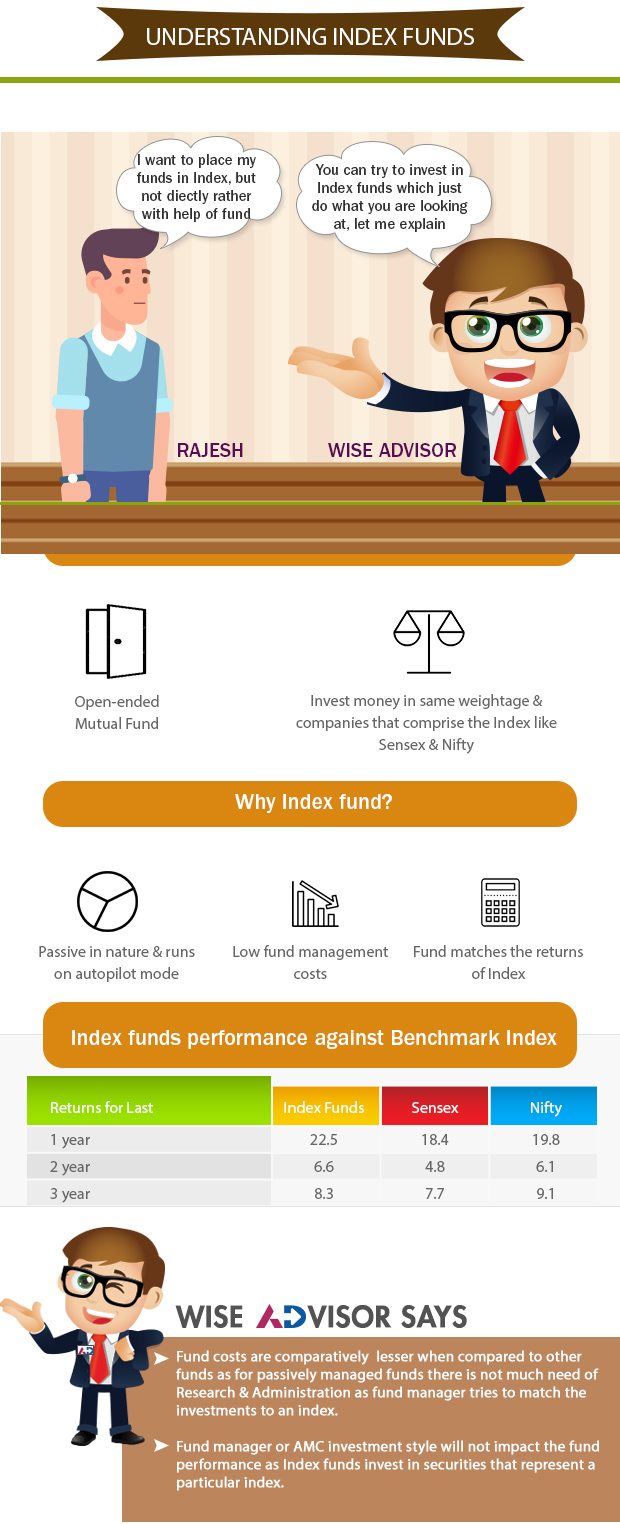

An index fund is a type of mutual fund with a portfolio constructed to match or track the components of a market index, such as BANKEX, MIDCAP, and S&P500 etc.

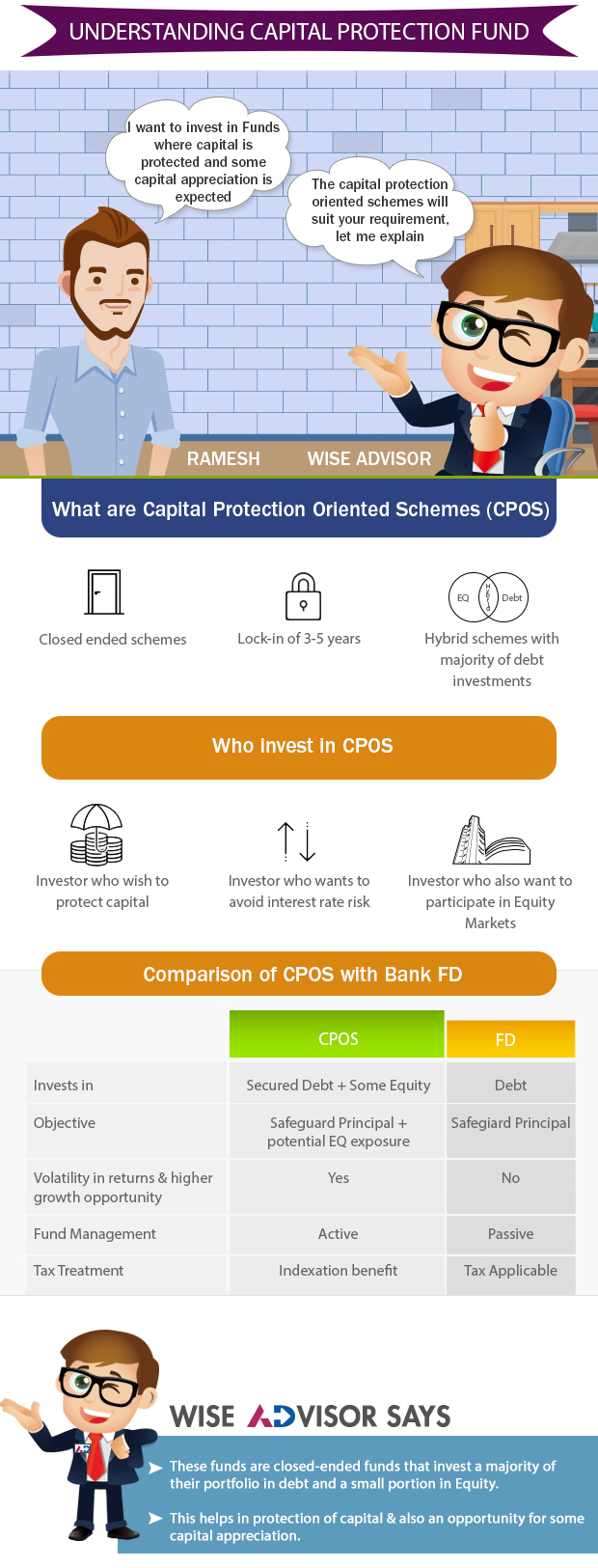

Capital protection oriented funds (CPF) are closed-ended debt mutual funds that aim to invest a significant amount of money in top-rated fixed income instruments and the rest in equities. The tenure of the schemes can be one, three or five years.

An international fund is a fund that can invest in companies located anywhere outside of its investors country of residence.

Key Takeaways:

- There are various types of investment options with its unique features

- Each investment option has its pro and con.

Next Course of action:

- View the Top performing Stocks that would have created wealth for you

- Start investing with AxisDirect. View our best in class Investing ideas

- Check out our range of offerings and start investing to grow your investments

India

India NRI

NRI