Chapter 12.4

Performance Evaluation of Mutual Fund

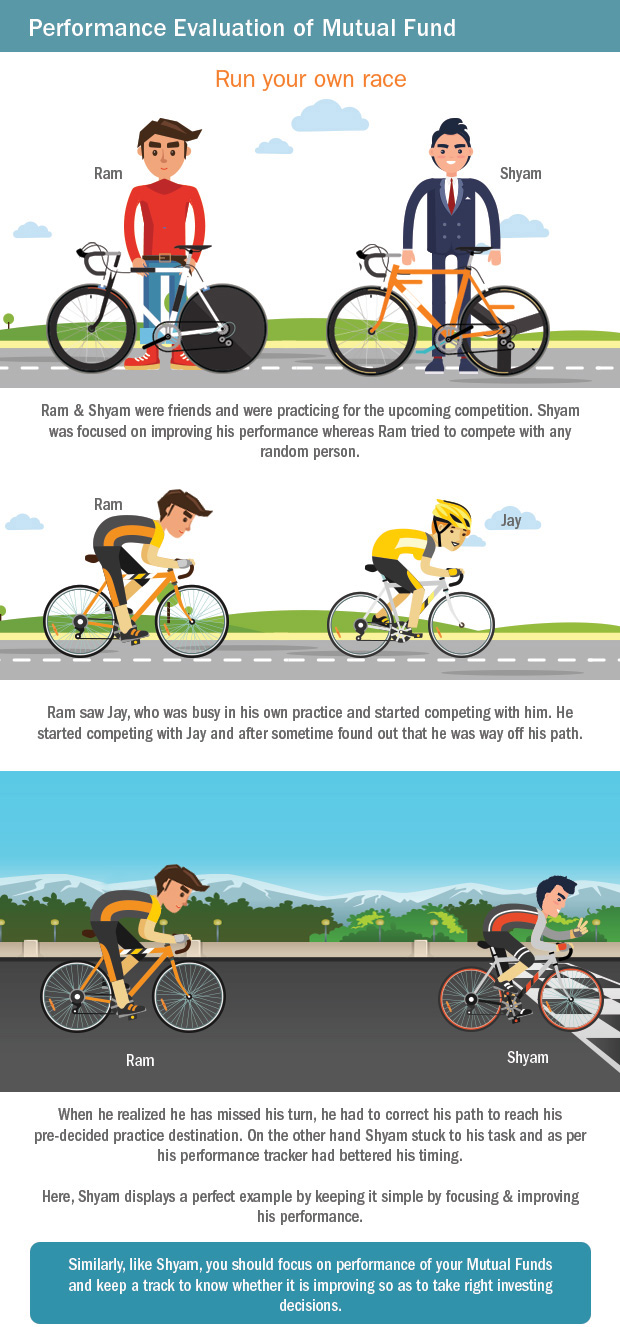

Similarly investors are confused about the evaluation of the performance and quality of their mutual funds. Assessing the performance by means of rate of return alone is not an appropriate measure. There are some parameters which should be considered while assessing the performance of your mutual funds.

Let us discuss them in detail below:

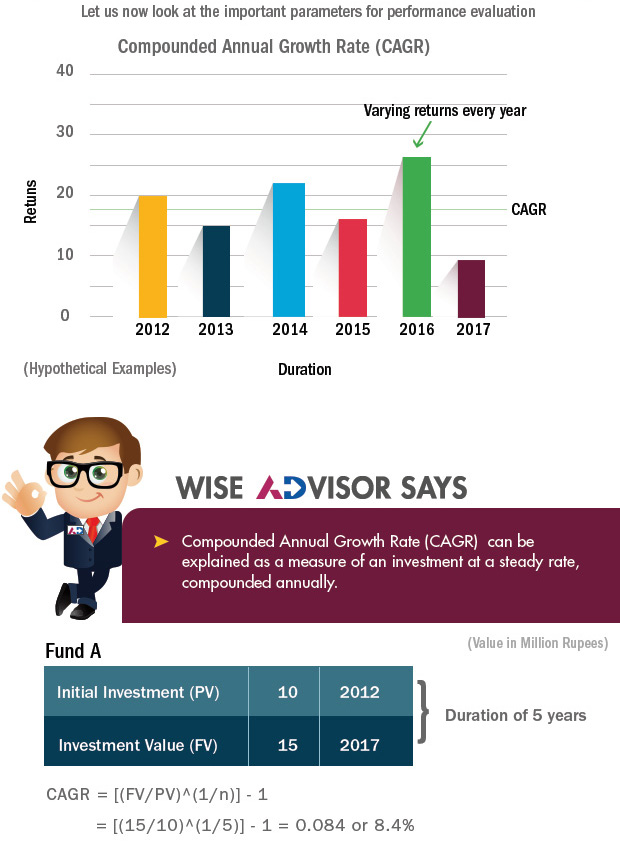

CAGR is used in case of investments whose returns are not fixed but fluctuate from year to year. The annualized return or compound annual growth rate (CAGR) approach includes time (normally in years) and thus enables to calculate the annualized return of an investment whether it is a short or long term.

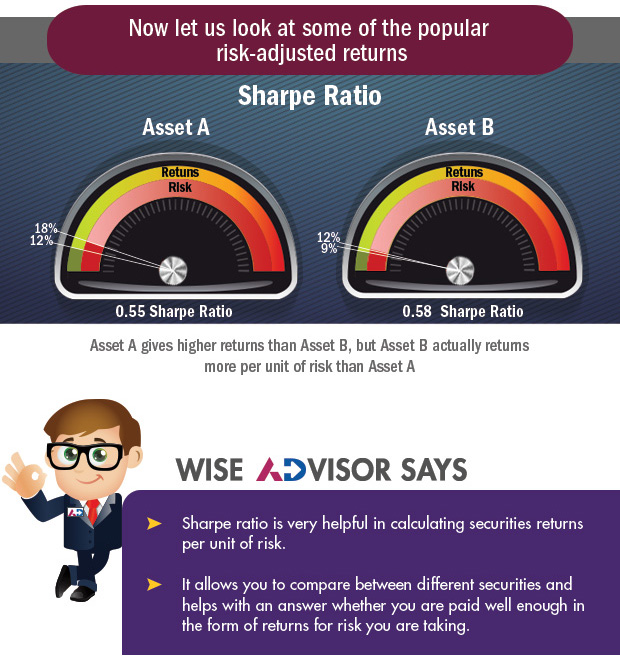

Understanding Sharpe ratio

The relationship between risk and return is an essential concept in finance, which argues that riskier investments should compensate investors with higher returns and safer investments should not experience exorbitant price fluctuations.

When comparing the performance of two securities, funds or portfolios, investors must consider risk-adjusted returns to see if they are being adequately compensated for the risk they are assuming. The goal is to achieve the largest return per unit of risk. This is where Sharpe ratio is useful for investors.

While analyzing the Sharpe ratio, the higher the value, the more excess return investors can expect to receive for the extra volatility they are exposed to by holding a riskier asset. Similarly, a risk-free asset or a portfolio with no excess return would have a Sharpe ratio of zero.

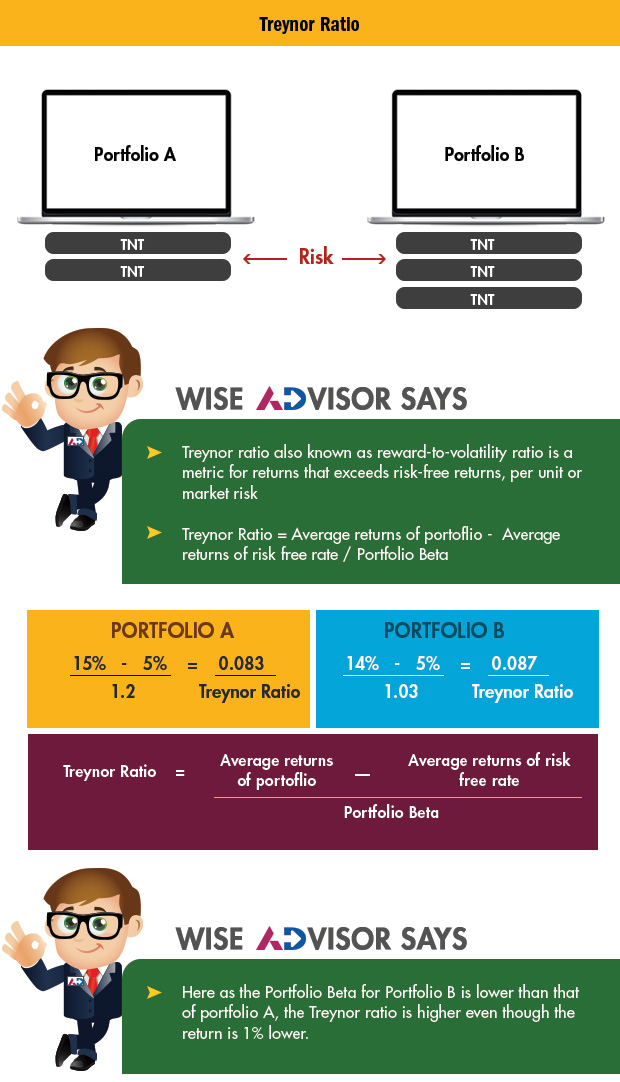

Understanding Treynor Ratio

The Treynor Ratio, named after Jack L. Treynor, one of the fathers of modern portfolio theory, helps analyze returns in relation to the market risk of the fund. The Ratio, also known as the reward-to-volatility ratio, provides a measure of performance adjusted for market risk. A fund with a higher Treynor ratio implies that the fund has a better risk adjusted return than that of another fund with a lower Treynor ratio.

Understanding Jensen’s Alpha

Jensen’s Alpha, also known as the Jensen’s Performance Index, is a measure of the excess returns earned by the portfolio compared to returns suggested by the Capital Asset Pricing Model (CAPM) model. The value of the excess return may be positive, negative, or zero. The CAPM model itself provides risk-adjusted returns, i.e., it takes into account the risk of the security. So, if the security is fairly priced, its actual returns will be same as CAPM. The Alpha in this case will be 0. If, however, the security earns even more than the risk-adjusted returns, it will have a positive Alpha. Negative alpha indicates that the portfolio has not earned its required return. A higher Alpha is always desirable by portfolio managers.

Key Takeaways:

- There are 3 common ratios that measure a portfolio's risk-return tradeoff: Sharpe's ratio, Treynor's ratio, and Jensen's Alpha.

- A higher Jensen’s Alpha is always desirable by portfolio managers..

- CAGR is used in case of investments whose returns are not fixed but fluctuate from year to year.

Next Course of action:

- View the Top performing Stocks that would have created wealth for you

- Start investing with AxisDirect. View our best in class Investing ideas

- Check out our range of offerings and start investing to grow your investments

India

India NRI

NRI