My Portfolio:

Advantage AxisDirect

- 20 investment products

- 3 great platforms to invest

- 5 fun-tastic learn courses

- 5 powerful research segments

- 4 prestigious awards

- 9 lakh+ happy investors

Quotes

Quotes

Back To Menu

-

Offerings

- Overview

- Products

- Platforms - RING

- DIGITAX

- Managed Accounts

- Private Client Group

- Business Associates

- NRI

- REFER & EARN

- Insurance

- SGB

- Markets

- Research

- Learn

- PORTFOLIO

- PROFILE

Strengthening Rupee and Falling Inflation may Push the RBI for a Rate Cut - AxisDirect

AxisDirect-O-Nomics

Jul 20, 2017 | Source: AxisDirect

Falling Inflation rate and Strengthening Rupee to watch out for

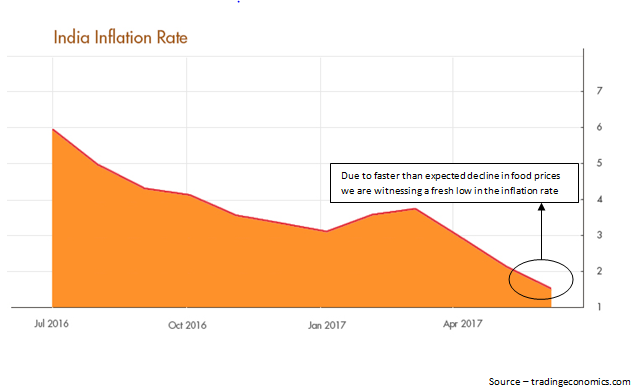

India Inflation Rate Falls to Fresh Low Of 1.54% amid favorable monsoon

- Consumer prices in India increased 1.54 percent year-on-year in June of 2017, slowing sharply from a 2.18 percent rise in May and below market expectations of 1.7 percent.

- The inflation rate fell to a fresh record low for the third month.

- Low rate of inflation could nudge the RBI to reduce the interest rates.

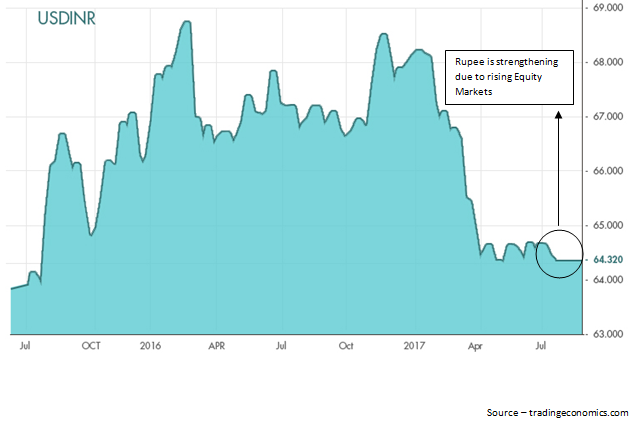

Appreciating rupee on the back of strong foreign capital inflows

- So far this year, Foreign Portfolio Investors (FPIs) have net bought USD 16.1 billion and USD 8.4 billion of Indian debt and equities, respectively, which has led to an appreciation of the Indian rupee and has made it one of the strongest gainers among Asian peers.

- These gains are driven partly by global liquidity and partly by the improving fundamentals of the Indian economy.

- Though strengthening rupee will make import of oil cheaper, but at the same time will impact export oriented industries like IT and Pharma.

India

India NRI

NRI