Series 34: Volume Weighted Average Price (VWAP)

Feb 03, 2025

Series 34: Volume Weighted Average Price (VWAP)

Volume-Weighted Average Price (VWAP) is an intraday indicator that represents the average price of a security weighted by its trading volume for the current day.

How is VWAP Calculated?

The calculation involves combining price and volume data to determine the weighted average price for a given period. It is calculated cumulatively throughout the trading session and resets at the start of each new session. The formula for VWAP is as follows:

VWAP = Cumulative (Price × Volume) / Cumulative (Volume)

Steps to Calculate VWAP:

1. Calculate the Typical Price (TP) for each period:

TP = (High Price + Low Price + Closing Price) / 3

2. Multiply the Typical Price by the Volume for each period:

TP × Volume = Price-Volume

Calculate the Cumulative (Price-Volume) and Cumulative Volume:

Cumulative (Price-Volume) = Sum of (TP × Volume) for all periods

Cumulative Volume = Sum of Volume for all periods

Divide the Cumulative Price-Volume by the Cumulative Volume:

VWAP = Cumulative (TP × Volume) / Cumulative Volume

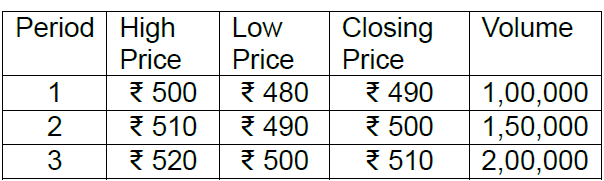

Example: Calculating VWAP

Assume the following data for a stock over three periods:

Step 1: Calculate the Typical Price (TP) for each period:

Period 1: TP = (500 + 480 + 490) / 3 = ₹490

Period 2: TP = (510 + 490 + 500) / 3 = ₹500

Period 3: TP = (520 + 500 + 510) / 3 = ₹510

Step 2: Multiply TP by Volume for each period:

Period 1: ₹490 × 100,000 = ₹49,000,000

Period 2: ₹500 × 150,000 = ₹75,000,000

Period 3: ₹510 × 200,000 = ₹102,000,000

Step 3 : Calculate the Cumulative Price-Volume Product and Cumulative Volume:

Cumulative Price-Volume Product = ₹49,000,000 + ₹75,000,000 + ₹102,000,000 = ₹226,000,000

Cumulative Volume = 100,000 + 150,000 + 200,000 = 450,000

Step 4: Calculate VWAP:

VWAP = ₹226,000,000 / 450,000 = ₹502.22

How to use VWAP?

VWAP is used to identify liquidity points. As a volume-weighted price measure, it reflects price levels weighted by volume. It helps determine the liquid and illiquid price points for a specific security over a very short time.

Limitations of VWAP:

1. VWAP is a lagging indicator, as it is based on historical data and does not predict future price movements.

2. It is most effective for intraday analysis and resets at the start of each trading session, making it less useful for long-term analysis.

3. By combining price and volume data, VWAP provides a comprehensive view of intraday market activity, making it a valuable tool for traders and investors alike.

Disclaimer: This information is for educational purposes only. Consult a financial advisor before engaging in such trading activities.

Axis Direct Disclaimer This is for educational purposes only. Axis Direct is a brand under which Axis Securities Limited offers its. Retail broking and investment services. Investments in the securities market are subject to market risks. Read all the related documents carefully before investing. Disclaimer & Statutory Information

Related Keyword

Technicals

Options

Call Centre

Put Option

Futures

TechnicalAnalysis

India

India NRI

NRI