How to Apply for a Buyback on Swift Trade?

Buyback means a company purchases its own shares from the investors through the stock market.

The strategy is to reduce the number of shares available in the market, which shows positive earnings per share for the stock and often the value of the stock increases due to lesser shares available.

Please Note: You must have enough shares in your Demat balance before applying for a buyback on the record date.

Open Market Buyback: The company buys back its shares by actively buying them from the sellers on the exchange. The buyback period is mentioned in the buyback offer and can last for months to ensure no significant price movement occurs due to the buyback activity.

In these kinds of buybacks, you have to place a limit order for the desired amount and wait till the order is executed.

What is the difference between open and tender buyback?

A tender offer has a fixed price at which each shareholder can participate, but that is not the case in the open market route. A company may declare a maximum price for an open market buyback, but that does not mean that each investor will get the same price as buying happens in tranches at varying prices.

These kinds of buybacks can be applied through the Swift Trade platform, as given in the process below:

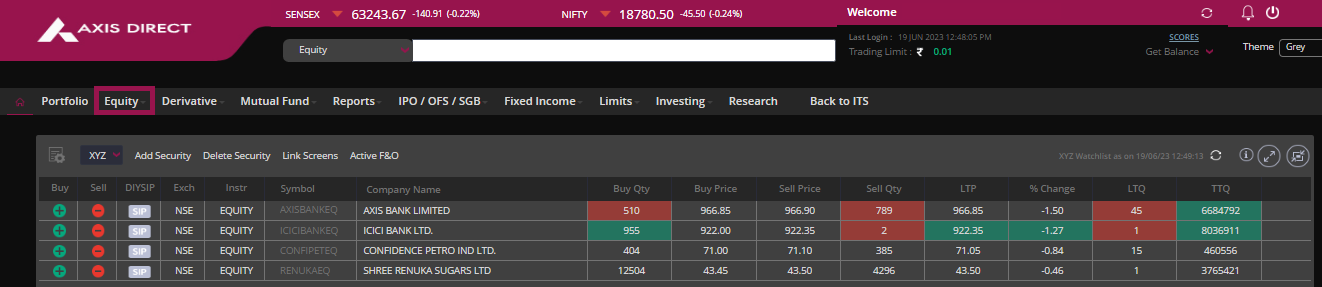

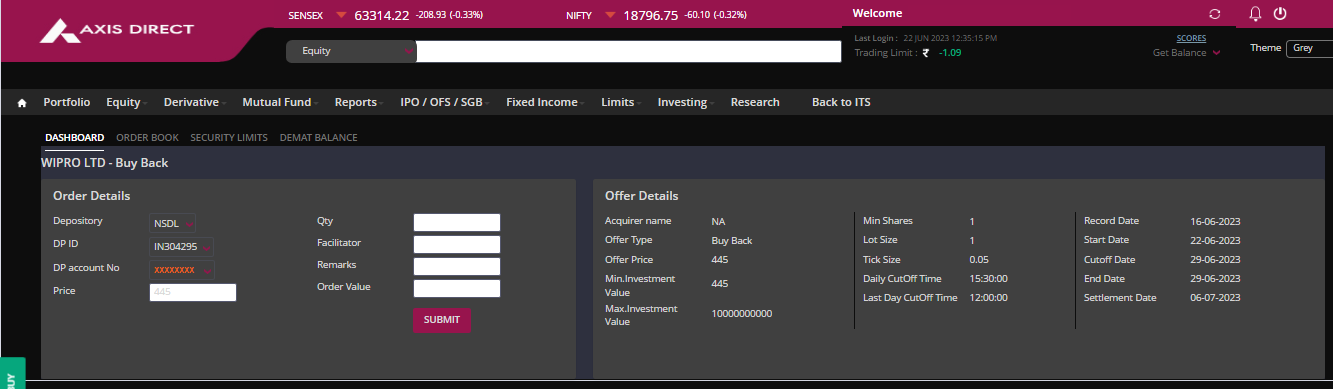

Step 1: Click Here to login to your account, click on ‘SWIFT TRADE’ and then on the ‘Equity’ tab.

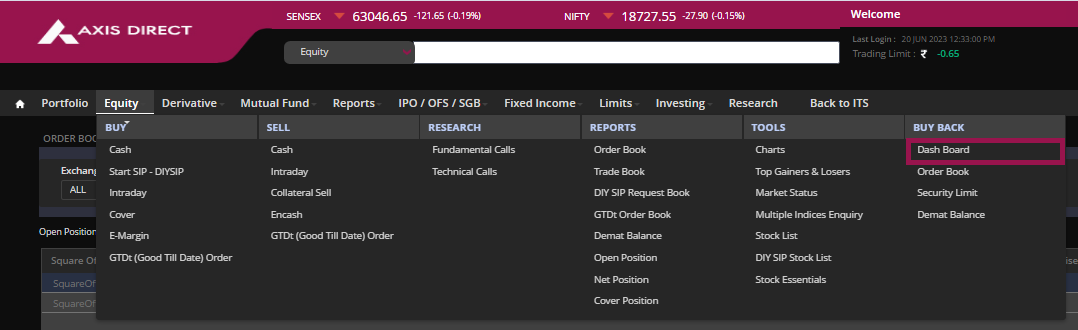

Step 2: Select ‘Dashboard’ under the ‘BUY BACK’ column.

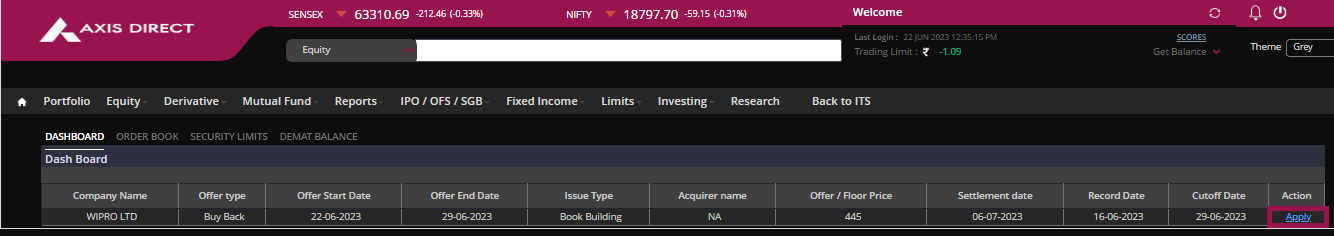

Step 3: Enter the desired quantity you wish to apply for; the order value will be automatically calculated. Click on ‘SUBMIT’ to proceed.

Some points to make a note of on this page:

1) Minimum Investment Value: Is the maximum price on which the company will buy back the shares.

2) Record Date: Date on which the shares should be available in your Demat account.

3) Start Date: Date from when the company will begin accepting your applications for the buyback offer.

4) Cutoff Date: Last date to apply for the buyback offer.

5) END Date: Same as the cutoff date.

6) Settlement Date: The day when the amount is expected to be credited to your account for the buyback offer.

Step 4: Click ‘OK’ to proceed on the information message.

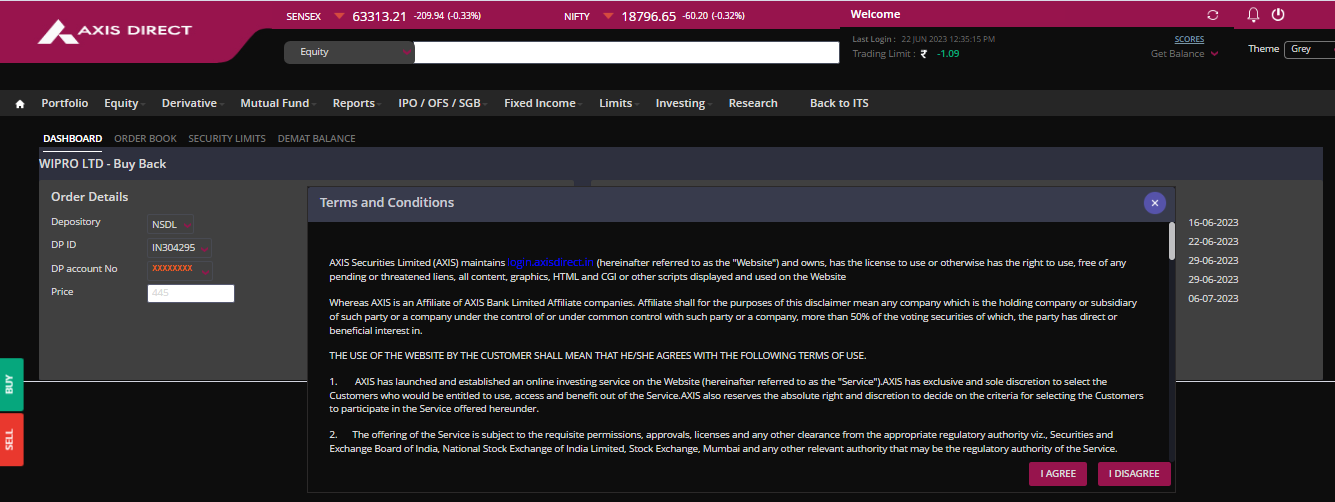

Step 5: Click on ‘I AGREE’ to accept the Terms & Conditions for the order.

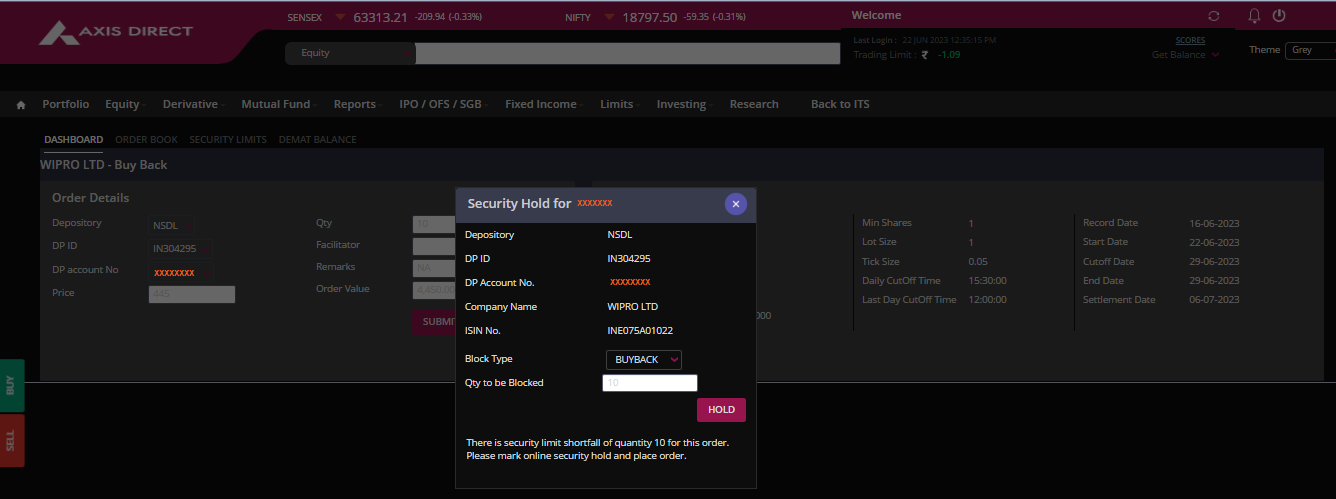

Step 6: Enter the desired ‘Quantity to be blocked’ for the order.

Once you click on ‘HOLD’ in Step 6, the shares will be debited from your Demat account and will be blocked for the buyback offer.

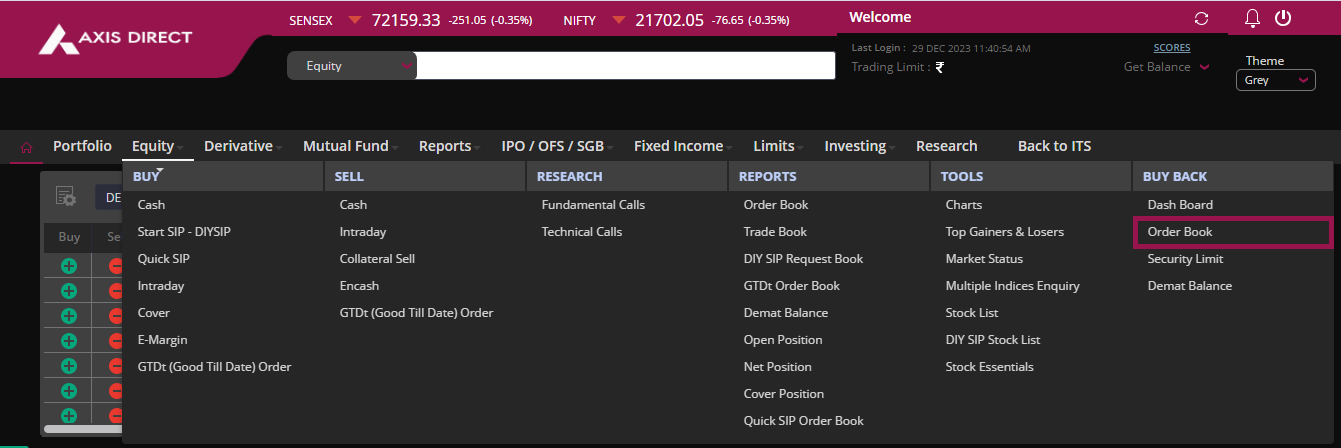

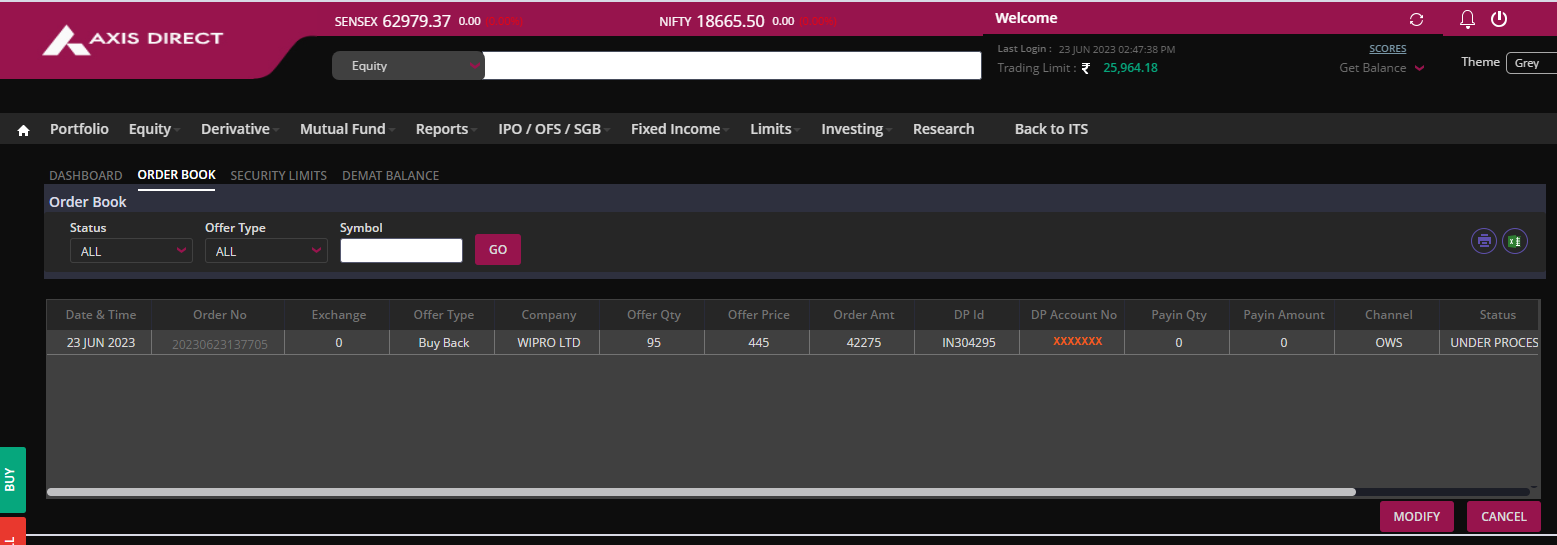

To check the order status:

Select 'Equity' and then select 'Order Book' under the 'BUY BACK' column.

Order Book

END

India

India NRI

NRI