How to Place an E-Margin Buy Order?

What is E-Margin?

E-Margin is a convenient product allowing you to trade with a margin provided by our platform when you have insufficient funds for a particular trade. This margin is available on a case-by-case basis for T+240 days in both exchanges. Daily delayed payment charges apply until you square off or convert the positions to delivery starting from T+3 days, at an annual interest rate.

Unlike a 'Cash' order, E-Margin orders do not require you to pay the full order value upfront.

For example: If you wish to buy 100 shares of RELIANCE at Rs. 1500 on T day, with an E-Margin percentage of 40%, you only need to pay Rs. 60,000 as margin. This margin can be paid by debiting your linked bank account or utilizing collateral limits, such as pledged securities in your demat account.

Positions created under this facility can be squared off or converted to delivery until T+240 days or before a specified time set by Axis Direct.

Important: Whenever you BUY positions using E-Margin, you will receive an SMS from NSDL/CDSL requesting you to pledge the stocks. Pledging is mandatory to avoid auto square off on T+6th day.

Steps to Place an E-Margin Buy Order:

Step 1: Click Here to log in to your account, then click on ‘SWIFT TRADE’ and select ‘Equity’.

Step 2: Select ‘E-Margin’ under the ‘BUY’ column.

Step 3: Select the desired ‘Exchange’, enter the scrip name, select the order type (Limit/Market), and click on ‘PLACE ORDER’.

It is advisable to click on the 'Know Your Margin' link to check the approximate margin required.

Step 4: Check your order details and click on ‘Confirm Order’ to proceed.

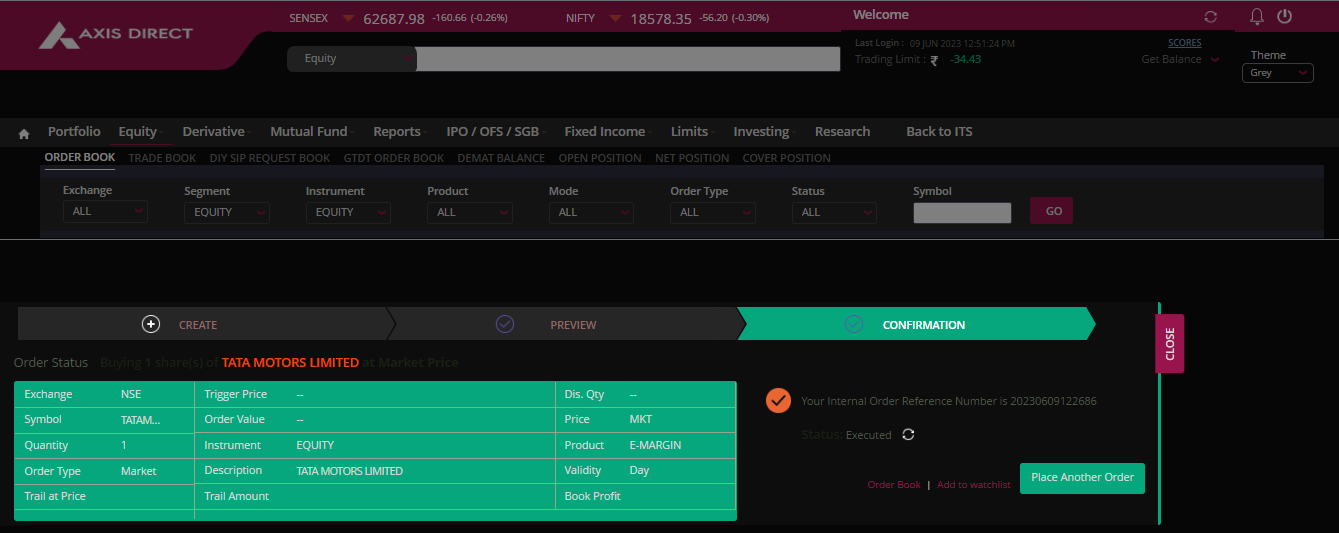

Step 5: Your order has been placed.

You can click on the refresh icon next to ‘Sent to Exchange’ to know the order status.

OR:

Click on ‘Equity’ >> ‘Order Book’ under the ‘REPORTS’ column.

Click Here to download a document on the above process.

END

India

India NRI

NRI