Chapter 12.3

NAV computation of Mutual Fund

Like the above scenario, in investing also we cannot make random decisions. We need to make the buying or selling decisions based on some parameter. This is where the NAV of the Mutual Fund plays a key important role. Let us understand the NAV now.

Understanding NAV

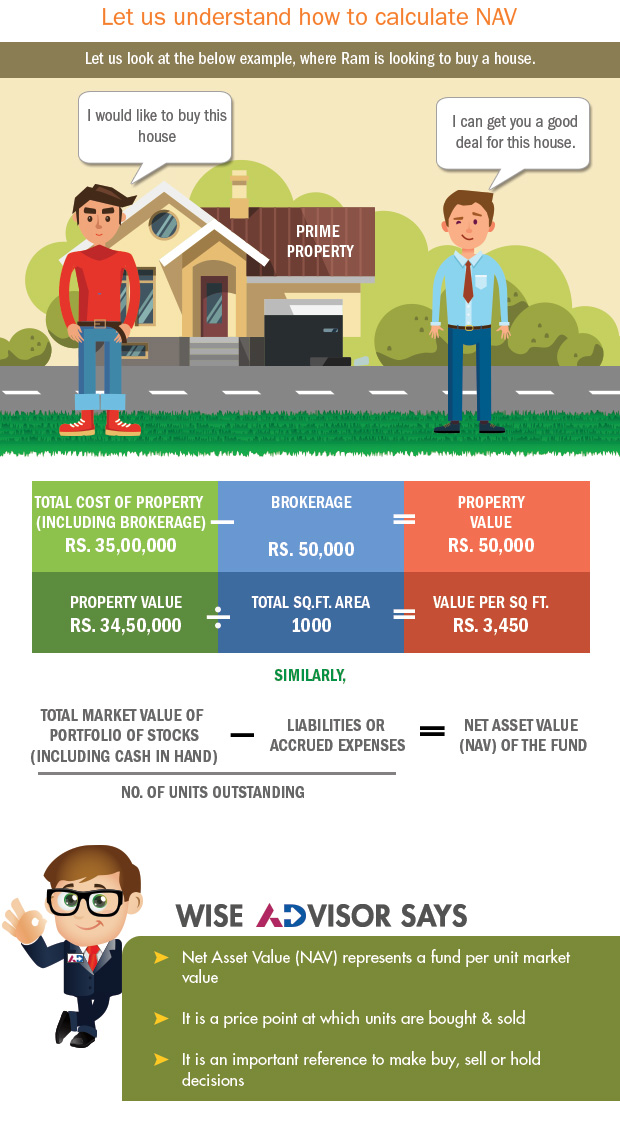

The Net Asset Value (NAV) of a mutual fund is the price at which units of a mutual fund are bought or sold. It is the market value of the fund after deducting its liabilities. The value of all units of a mutual fund portfolio are calculated on a daily basis, from this all expenses are then subtracted. The result is then divided by the total number of units. The resultant value is the NAV. NAV is also sometimes referred to as Net Book Value or book Value. Let’s discuss its calculation in a bit more detail.

NAV indicates the market value of the units in a fund. So, it helps an investor keep track of the performance about the mutual fund. An investor can calculate the actual increase in the value of their investment by determining the percentage increase in the mutual fund NAV. NAV, therefore, gives accurate information about the performance about the mutual fund.

NAV can give you an idea of what your investment is worth on a daily basis and can tell you how well your mutual fund is doing. Normally, the higher the mutual fund net asset value, the higher the value of the mutual fund.

A lot of investors think of a mutual fund asset value in the same vein as a stock price. This causes them to believe that a fund with a lower Net Asset Value is cheaper and hence, a better investment. In truth, it is not an indicator of a mutual fund performance. A lower value alone does not make a fund a better investment or vice versa. The NAV only impact the number of units you may get. You will receive fewer units if you select a scheme with high NAV but the value of your investment will remain same. It is the performance and the returns generated by the mutual fund scheme that matters.

In short, a fund’s NAV is more useful in understanding how the fund performs on an everyday basis. It is not a predictor of lucrativeness. Always look at the fund’s historical performance and current cost among other parameters before investing.

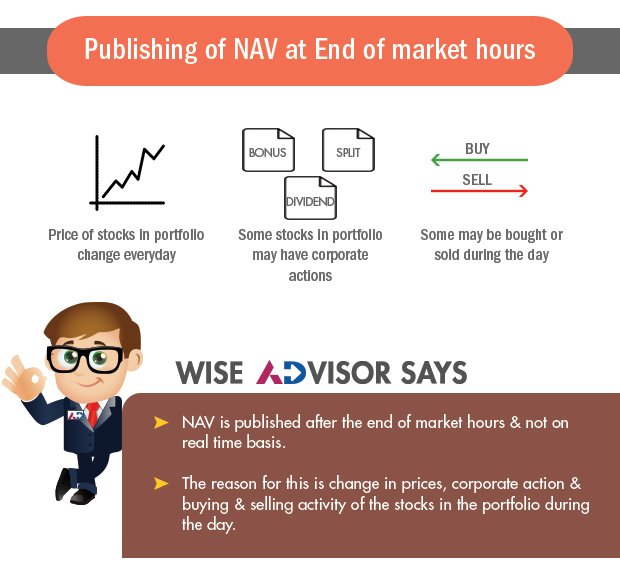

All mutual fund schemes estimate their portfolio worth once the stock market closes at 3.30 PM, each day. The market opens again the next day with the previous day’s closing share prices. The fund house deducts every payable and expense accordingly to calculate Net Asset Value of the day using the given formula.

Money remaining in the bank is added and the money payable to others are subtracted to determine the asset value of the fund. The fund manager also deducts the daily expenses incurred to manage a fund from the asset value. This total asset value is divided by the number of units issued so far, resulting in that day’s cost per unit.

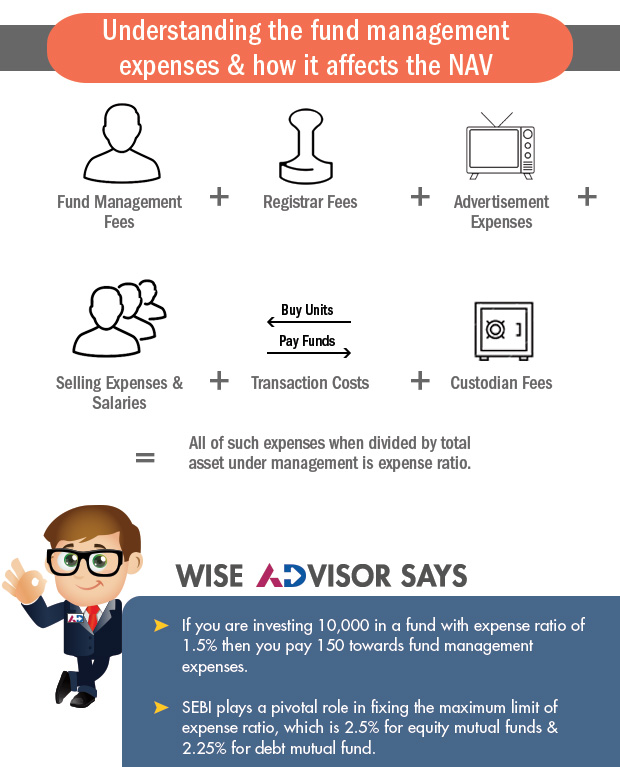

Understanding Expense Ratio

Like a doctor who charges you for his service, mutual funds too charge a fee for managing your money. This involves the fund management fee, agent commissions, registrar fees, and selling and promoting expenses. All this falls under a single basket called expense ratio.

Since this is charged regularly (every year), a high expense ratio over the long-term may eat into your returns massively through power of compounding. The largest component of the expense ratio is management and advisory fees. From management fee an AMC generates profits. Then there are marketing and distribution expenses. All those involved in the operations of a fund like the custodian and auditors also get a share of the pie.

Key Takeaways:

- NAV is published daily at the end of market hours and not on a real-time basis.

- The NAV impacts the number of units you may get.

- A high expense ratio may eat into your returns.

Next Course of action:

- View the Top performing Stocks that would have created wealth for you

- Start investing with AxisDirect. View our best in class Investing ideas

- Check out our range of offerings and start investing to grow your investments

India

India NRI

NRI