Chapter 12.2

Risk Profiling and Building Mutual Fund Portfolio

Similarly just like the businessman the investor also faces some issues in financial planning. Understanding the complexity of the markets, the nature of financial instruments, and the risks you are exposing yourself to can be daunting to the investor. This is where the expert plays an important role in helping you navigate these issues. Also keeping in mind some important elements can help the investor build a strong portfolio.

Let us now look at these elements:

Understanding Risk Tolerance

Risk tolerance is an important component in investing. Risk tolerance is the degree of variability in investment returns that an investor is willing to withstand. Factors affecting risk tolerance are the time horizon you have to invest, your future earning capacity, and the presence of other assets such as a home, pension etc.

Understanding Fund Ratings

Risk-adjusted Rating is a convenient composite measure of both returns and risk. It is purely quantitative and there is no subjective component to the Fund Rating.

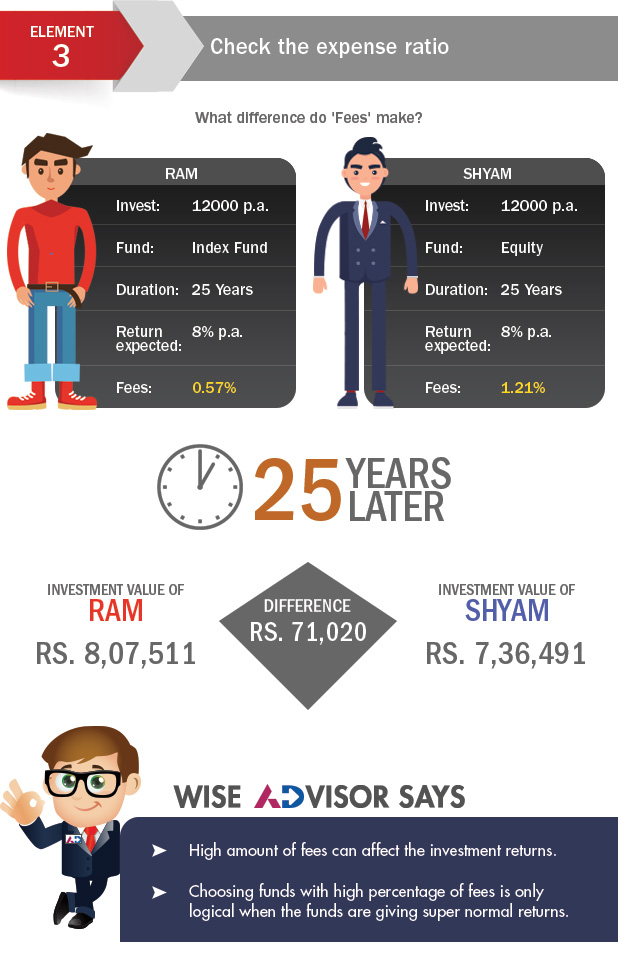

Understanding Expense Ratio

All mutual funds and exchange-traded funds (ETFs) charge their shareholders an expense ratio to cover the fund’s total annual operating expenses. Expressed as a percentage of a fund’s average net assets, the expense ratio can include various operational costs such as administrative, compliance, distribution, management, marketing, shareholder services, record-keeping fees and other costs. The expense ratio, which is calculated annually and disclosed in the fund’s prospectus and shareholder reports, directly reduces the fund’s returns to its shareholders, and, therefore, the value of your investment.

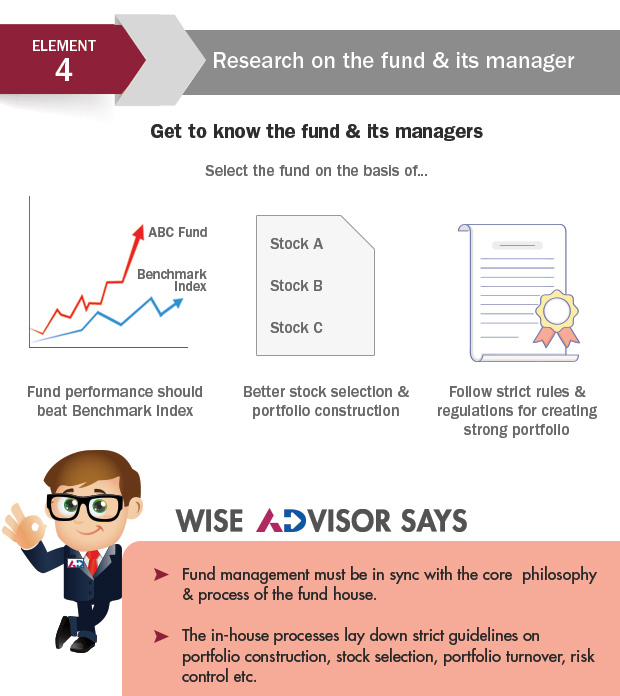

Importance of Fund Manager

A fund manager is responsible for implementing a fund's investing strategy and managing its portfolio. A fund can be managed by one person, by two people as co-managers, or even by a team of three or more people. For actively managed mutual funds, the fund manager is basically in charge of stocks, bonds or other assets the fund will buy with the money given by investors. Essentially, the fund manager will function as a stock-picker. He is responsible to attain returns consistent with the level of risk for the particular scheme.

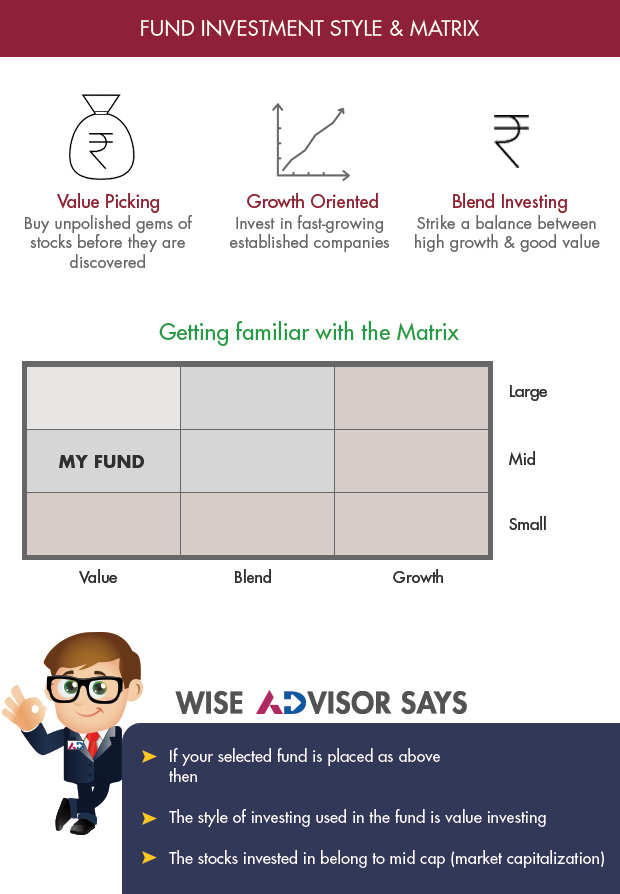

Fund Investment Styles and Matrix

This matrix shows the investment style that the fund manager is following to manage the fund’s portfolio.

For Equity funds, the horizontal axis shows the Valuation and the vertical axis shows the Market capitalization of the fund. Valuation is divided into Growth, Value and Blend. Growth stocks are those that are expected to grow at a pace that outpaces the average market growth rate.

However these stocks are not cheap and are available at a price higher than their intrinsic values. Value stocks are those that are available at a price lower than their intrinsic values but have the potential to unlock values in the long run. Blended style of investing is a intermingling of growth and value style of investing. Market capitalization on the vertical axis is divided into large, medium and small.

Key Takeaways:

- The important elements for building portfolio include understanding risk tolerance, analyzing the MF ratings, checking the expense ratio, researching the fund and the fund manager.

- The fund ratings are based on a fund’s recent risk-adjusted returns score relative to its peers.

- Growth stocks are those that are expected to grow at a pace that outpaces the average market growth rate.

Next Course of action:

- View the Top performing Stocks that would have created wealth for you

- Start investing with AxisDirect. View our best in class Investing ideas

- Check out our range of offerings and start investing to grow your investments

India

India NRI

NRI