Chapter 12.1

Risk and Returns in Mutual fund

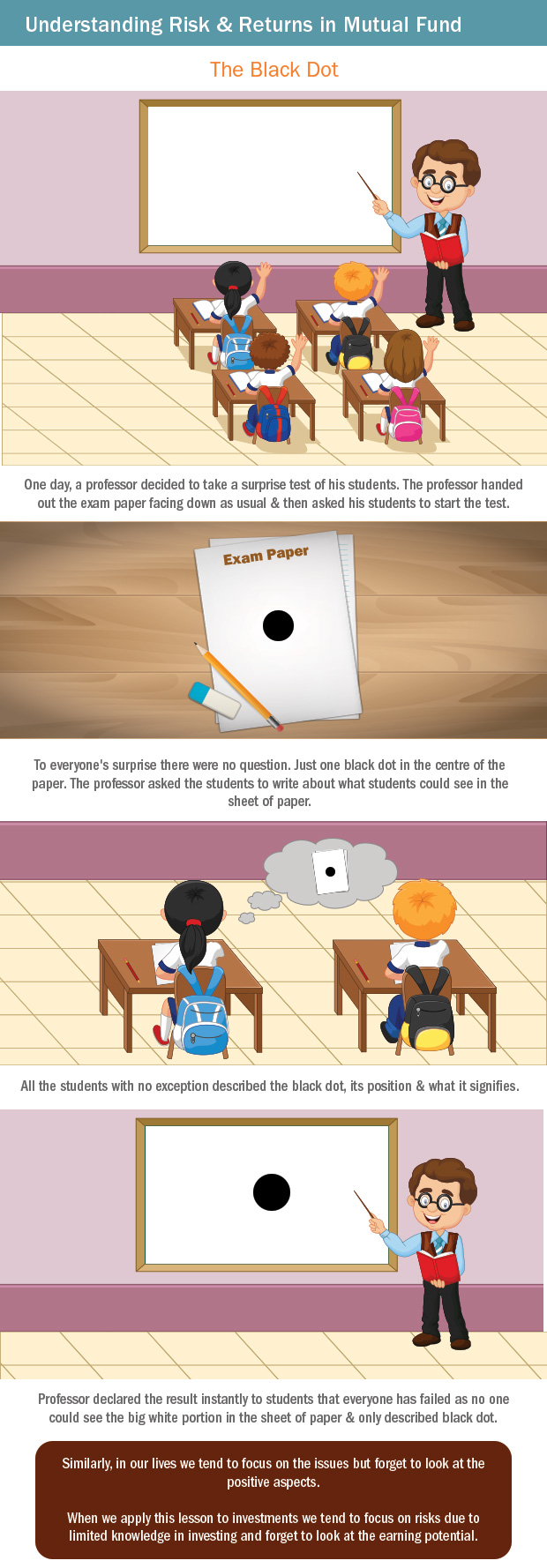

Just like the students not being able to see the big white portion, investors forget to look at the earning potential and only focus on the risks.

Let us understand risks in this chapter.

What is Riskometer?

In 2015, SEBI introduced the new way of describing scheme’s risk with the help of Riskometer. It looks just like the car’s speedometer and helps in determining the exact risk involved in any scheme. Then onwards, as per SEBI specifications, every fund house started showcasing the riskometer in the offer document of the schemes to display their risk profile.

The Association of Mutual Funds in India (AMFI) has formed a committee which is responsible for presenting the guidelines and basic standards of using the riskometer so as to ensure standardization. Accordingly, the risk level shown in the riskometer is determined by the fund houses after following the guidelines specified in this respect.

How beneficial is Riskometer for the investors?

While selecting the mutual fund plan for your investment portfolio, you must want to opt for the one that suits your requirements. If you have a low-risk profile and don’t want to take exposure to the market volatility, then you can check the risk level of the scheme from riskometer and select the fund accordingly. Hence, it is very useful for the investors while buying the best-suited fund for their portfolio.

Let us understand the market risk and the measures of risk :

Standard Deviation

Standard Deviation as a Measure of Risk. The standard deviation is often used by investors to measure the risk of a stock or a stock portfolio. The basic idea is that the standard deviation is a measure of volatility: the more a stock's returns vary from the stock's average return, the more volatile the stock.

Understanding Beta

Beta, also known as the "beta coefficient," is a measure of the volatility, or systematic risk, of a security or a portfolio in comparison to the market as a whole.

Understanding Alpha

Alpha is a measure of an investment's performance on a risk-adjusted basis. It takes the volatility (price risk) of a security or fund portfolio and compares its risk-adjusted performance to a benchmark index.

Key Takeaways:

- The mutual funds are subject to market risks.

- There are various measures such as standard deviation, beta to measure risk.

- There are also measures of return such as alpha..

Next Course of action:

- View the Top performing Stocks that would have created wealth for you

- Start investing with AxisDirect. View our best in class Investing ideas

- Check out our range of offerings and start investing to grow your investments

India

India NRI

NRI