Chapter 11.1

Classification of Funds

Similarly in investments, it is always about what is appropriate in a given situation and is in line with your investment objective & time horizon to achieve the goals. For long term goals there are different funds compared to short term needs. There are aggressive funds vastly different from moderate funds or even conservative funds. There are different funds for income generation as compared to wealth accumulation or for liquidity.

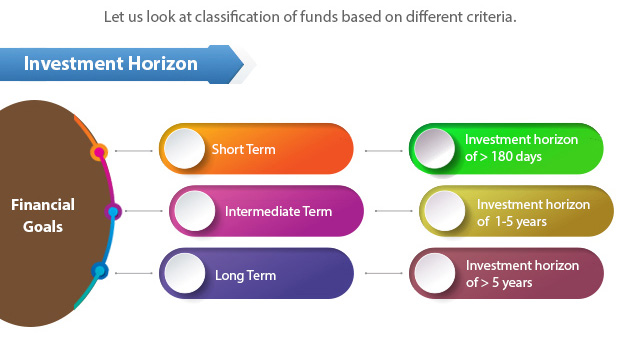

Investment Horizon:

Investment horizon is the total length of time that an investor expects to hold a security or a portfolio. The investment horizon determines the investor's income needs and desired risk exposure, which aid in security selection. Establishing an investment horizon should be one of the first steps to creating a portfolio.

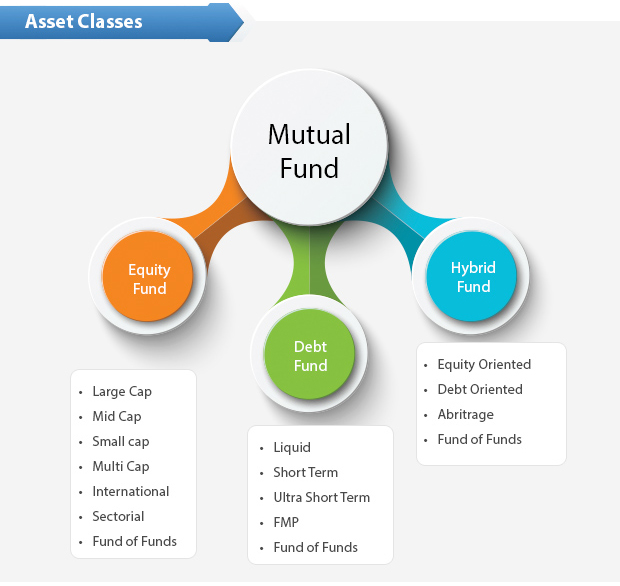

Asset Classes

Equity Scheme

• Can focus on individual sector or diversify across sectors

• Certain schemes can also help save tax

• Certain schemes invest in global markets

Debt Scheme

• Invest in interest bearing securities like Government & Corporate bonds, Money market Instruments and Term Deposits

• Some schemes provide easy liquidity suitable to park surplus cash for short term

• Some schemes provide investment opportunities across different time periods

• Some schemes try to benefit from changing interest rates

Hybrid Scheme

• Invest in range of securities like stocks & bonds depending upon the scheme.

• There are also schemes that allow you to invest in other asset class like Real Estate, Gold etc.

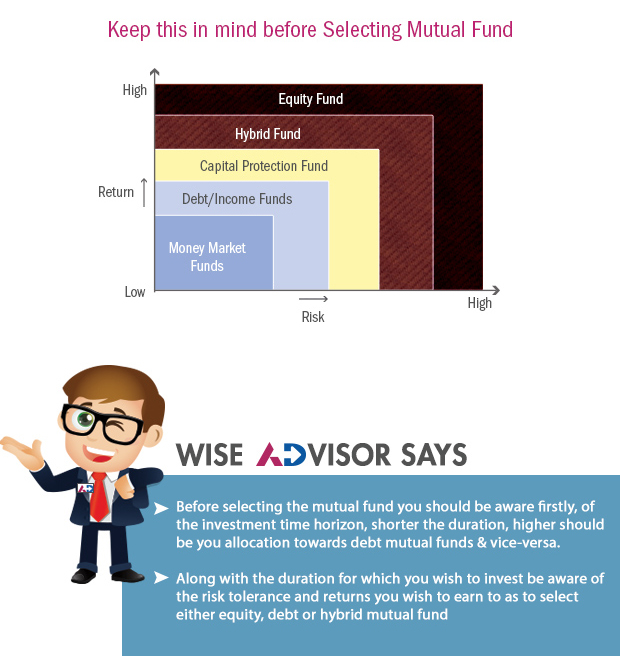

The level of risk in a mutual fund depends on what it invests in. Usually, the higher the potential returns, the higher the risk will be. For example, stocks are generally riskier than bonds, so an equity fund tends to be riskier than a fixed income fund.

Key Takeaways:

- When it comes to allocating your money in MF it is important to select funds considering their strengths and offerings and your goals and needs.

Next Course of action:

- View the Top performing Stocks that would have created wealth for you

- Start investing with AxisDirect. View our best in class Investing ideas

- Check out our range of offerings and start investing to grow your investments

India

India NRI

NRI