Chapter 11.2

Understanding different investment options

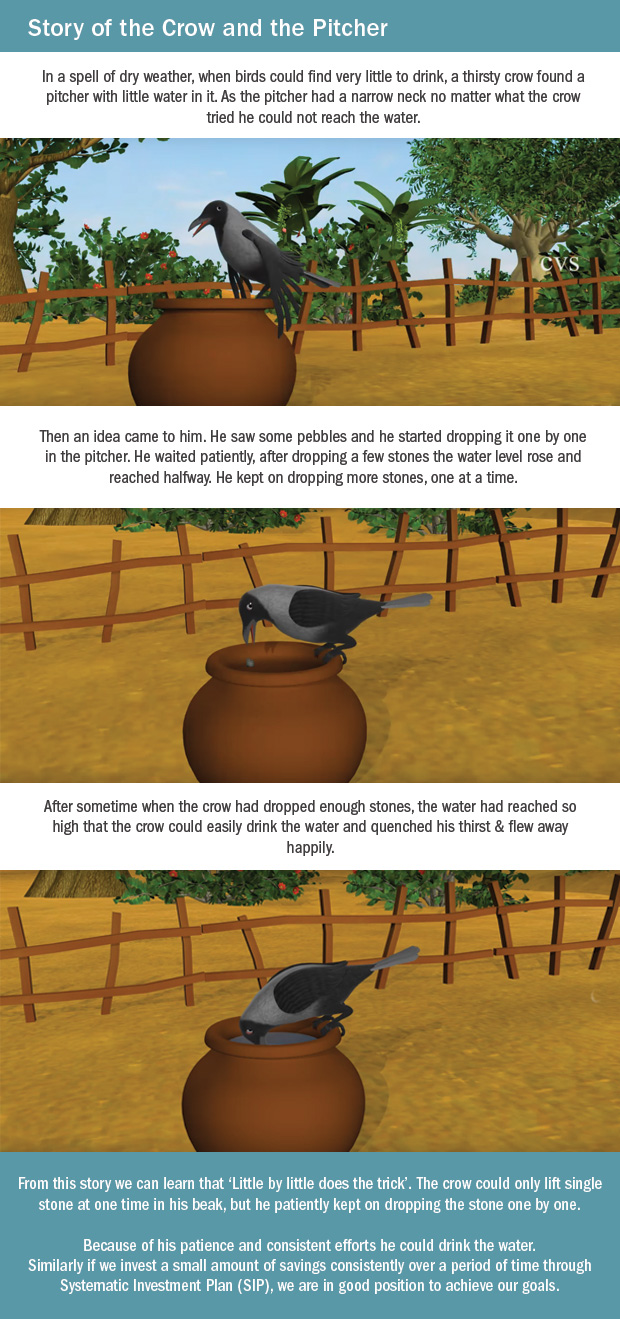

Similarly in life, every individual has various life goals like buying a car, planning a foreign holiday, children's education and retirement being some of them. While some are short term in nature, others could be more than 10 years away. Goal based investing helps you to be systematic and disciplined. It helps you to remain focused and unaffected by the short-term volatility of the equity markets. Systematic Investment Plan (SIP) offers a good way to achieve our goals.

Let us see the benefits of SIP

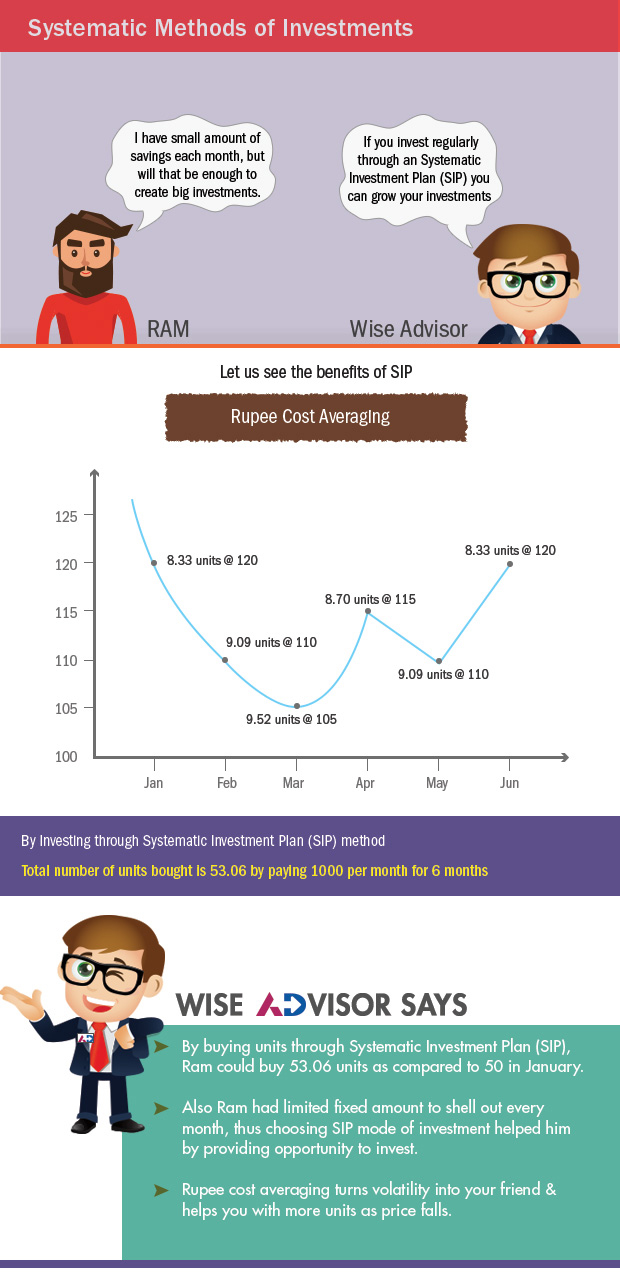

1) Rupee Cost Averaging

Rupee cost averaging is another significant reason why many investors are considering SIP nowadays. Considering a long term investment approach, rupee cost averaging can even out any market ups and downs in the long term, allowing the investor to gain maximum benefits on his or her investments over time. Investing a fixed amount of money every month towards any investment vehicle allows them to purchase more units or stocks when the price of the investment is lower. This reduces the average cost of purchasing of the financial asset over time.

A SIP investor, while investing every month would end up buying more units when markets go down and buying less units when market goes up.

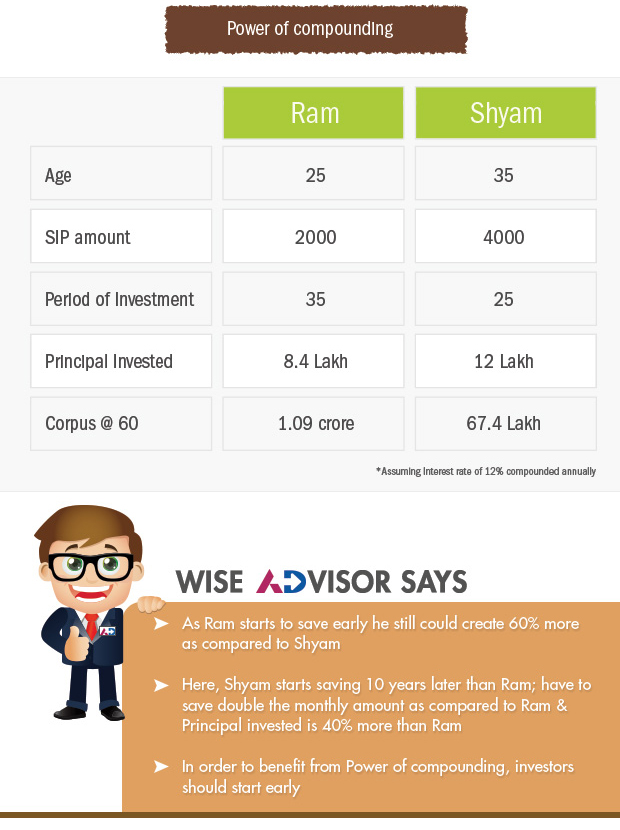

2) Power of compounding

An investor who starts early is the one who becomes successful. SIP allows one to invest with a minimal amount so anyone starting off early will be highly benefited than the one starting off with a big amount years later than him, since all investment and returns are based on the power of compounding which helps one earn return on returns.

How SIP wins over lumpsum investments

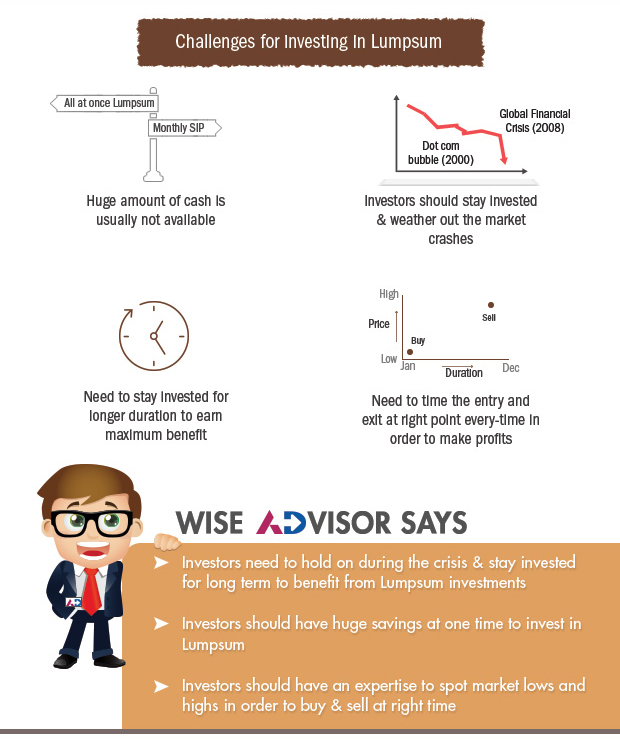

SIPs neatly solve the two main problems that prevent investors from getting the best possible returns from mutual funds.

Firstly, since SIPs mean investing with a fixed sum regularly regardless of the NAV or market level, investors automatically buy more units when the markets are low. This results in a lower average price, which translates to higher returns. If you invest a large sum at one go, you could end up catching a high point of the equity markets. This would mean that you have invested at a high NAV and that would reduce your gains if the market falls. An SIP is a good way to invest at an average price over a period.

Secondly, SIPs are also a great psychological help while investing. Investors inevitably try to time the market. When the market falls, they sell and stop investing. When it rises, they invest more. This is the opposite of what should be done. An SIP puts an end to all this by automating the process of investing regularly. It eliminates the mental load of deciding when to invest and leads to better returns.

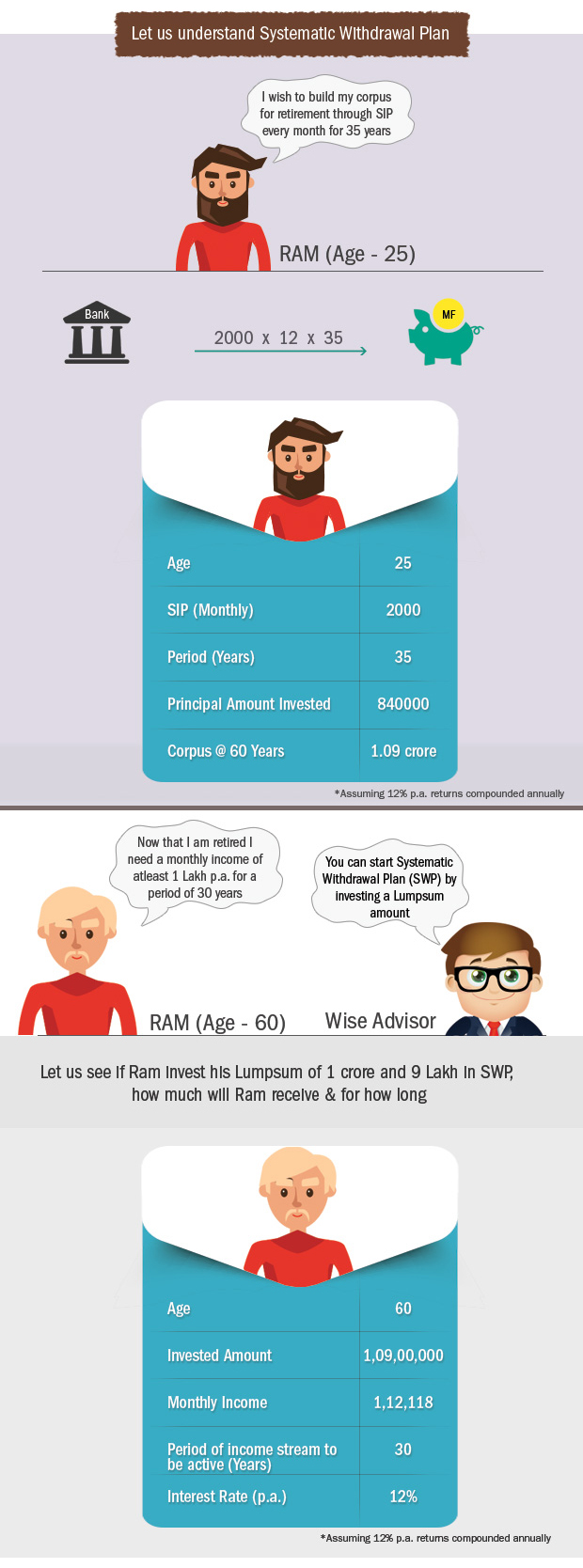

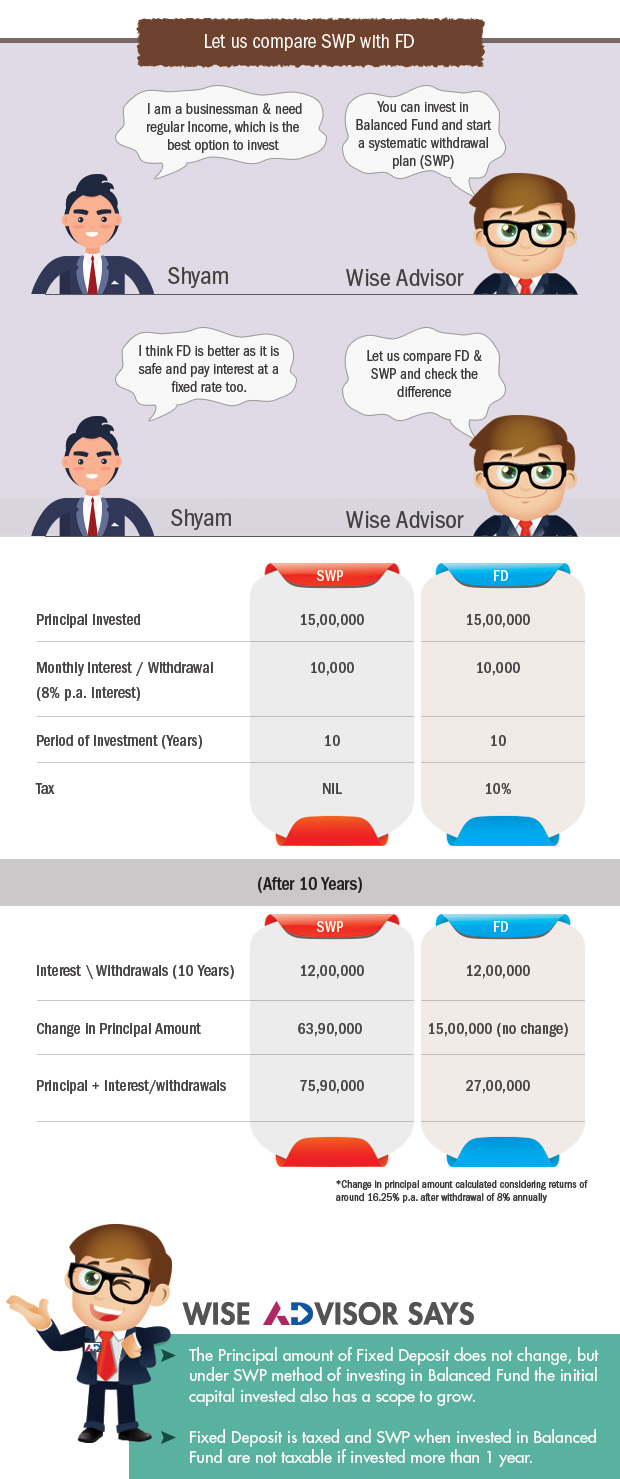

After understanding the benefits of Systematic Investment Plan, let us understand Systematic Withdrawal Plan.

A Systematic Withdrawal Plan or SWP is for withdrawal what an SIP is for investment. It allows an investor to withdraw a fixed amount of money or units from your fund portfolio at regular intervals. This would come handy for those wishing for a regular source of income. The key requirement is that you have a sizeable portfolio of funds. Without that, you would not be able to withdraw any funds. An SWP helps you meet your liquidity needs and can generate second source of income.

An SWP comes handy when you are unsure about the correct time to exit investments. You thus get your money irrespective of market conditions. So, when the market is up, you sell less number of units for the fixed amount, and when the market is down, you sell more units.

Another key advantage of an SWP is it spreads your tax liabilities across time too. You will have to pay capital gains tax over a period of years, instead of paying it in lump sum in one year. In the meanwhile, you may also enjoy further appreciation in the value of your mutual funds.

Benefits of SWP:

• SWP can ensure fixed amount coming to the bank account, on a fixed date just like salary income.

• Another advantage of the SWP is tax efficient returns.

This strategy is also very good for people who are retiring and may not get any regular salary income from coming months. Their retirement corpus can be used to create this regular stream of monthly inflow, similar to salary even after retirement.

Let us understand the return from different investment options:

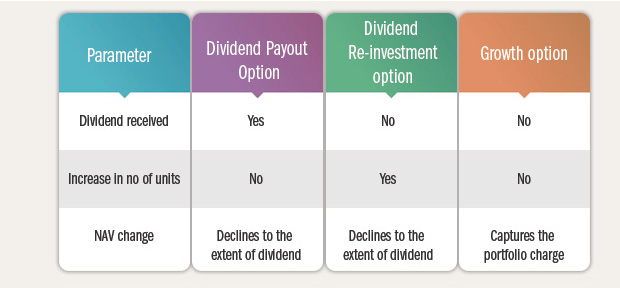

Following are the choices when an investor invests in mutual funds

Growth: Any return or profits earned by the mutual fund is ploughed back in the mutual fund and hence investors are not paid any dividends. Since there is no declaration of dividends, the NAV increases which is a good sign for the fund. In such a case investors can sell their mutual fund at a higher NAV and get a return.

Dividend payout: Under this the profits of mutual funds are distributed amongst the investors at various intervals. These dividends will only be paid when a mutual fund performs well. It also depends upon the mutual fund manager’s decision as to when and how much dividend to pay. It’s basically a cut in the net asset value when dividends are declared. More the dividend declared higher will be a fall in the NAV, therefore payment of dividends is not very good for the fund value.

Dividend re-investment: In this case the dividend which is paid out is ploughed into the mutual fund that means an investor can buy more units in the mutual scheme from the dividend income which is declared at the existing NAV.

In short Growth fund option is best suited when you want to invest your money for a longer period and hence looking for a higher NAV with time. Dividend option must be selected if you are in need of money from time to time.

Key Takeaways:

- The various benefits of SIP are rupee cost averaging, power of compounding, discipline etc.

- You don’t have to collect a large sum to start investing. You can start investing even with a small amount of money through the route of SIP

Next Course of action:

- View the Top performing Stocks that would have created wealth for you

- Start investing with AxisDirect. View our best in class Investing ideas

- Check out our range of offerings and start investing to grow your investments

India

India NRI

NRI