Chapter 10.3

How does Mutual Fund Work

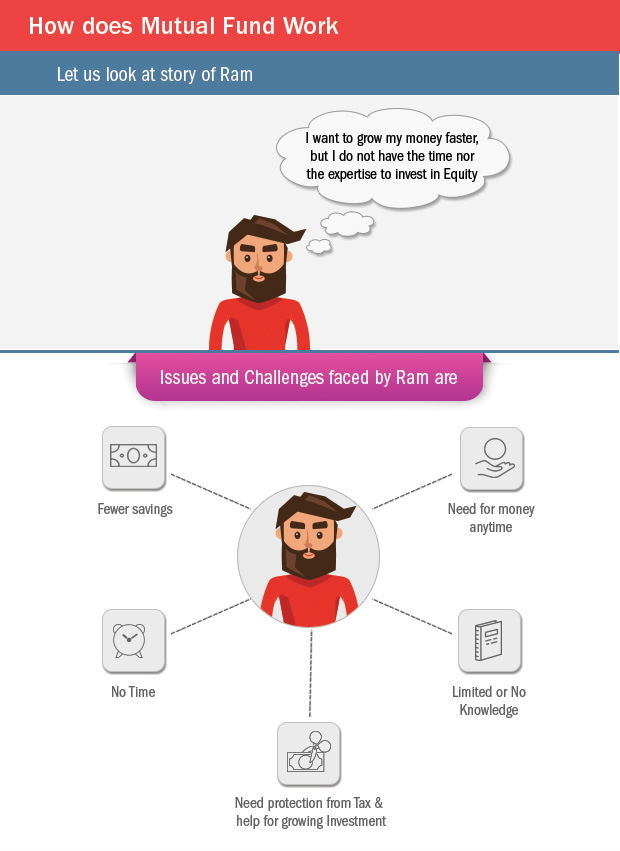

Like Ram, we also face a similar situation with our finances. We are either too busy with our work to heed importance to our savings & investments or we don’t have the expertise. We intend to earn more on our savings but because of limited knowledge we don’t invest aptly. Our savings are kept idle or in low yield assets. For few of us, we also invest basis the advice given by friends & family members. That is where Mutual Fund helps as an extremely efficient route to start investments.

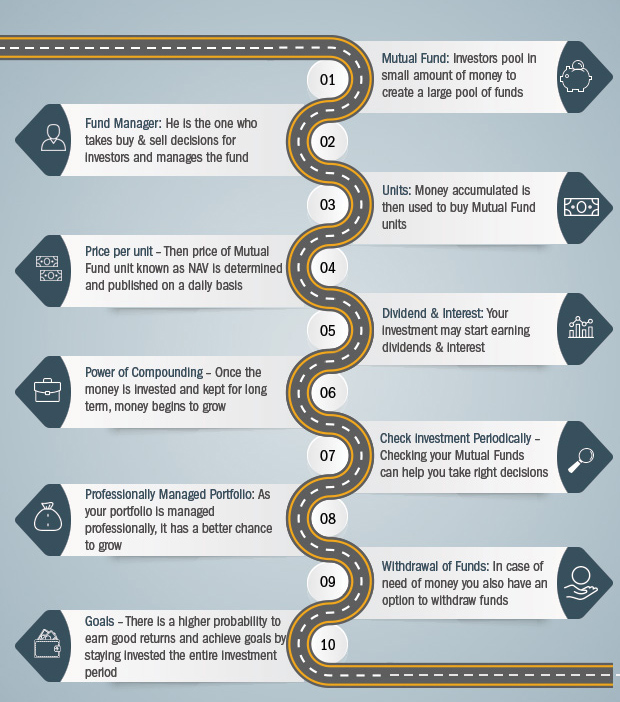

The expertise bought in by the Fund Managers to the pool of investments, is unparalleled. Not only the money enables the Fund Managers to buy desired stocks but the knowledge of Fund Managers to invest in the right financial instruments helps the funds to perform well, hence helping the end beneficiary i.e. the investors.

SEBI ensures that utmost priority is given to investor’s interest. SEBI’s role is critical as all the technical details pertaining to Mutual Fund investments/ expenses/ Fund Manager / key changes / load structure etc. are provided on a regular basis to the investors. It’s advisable for investors who have limited time and expertise to invest in funds.

Key Takeaways:

- Mutual Funds work are managed by Fund Managers who manages the fund to make it perform better

- NAV determines the price per unit of Mutual Fund

- Liquidity in Mutual Funds is extremely easy

Next Course of action:

- View the Top performing Stocks that would have created wealth for you

- Start investing with AxisDirect. View our best in class Investing ideas

- Check out our range of offerings and start investing to grow your investments

India

India NRI

NRI