Chapter 10.2

Benefits of investing in Mutual Fund

Just like the stone acting as an obstacle, investors today face many obstacles such as no time, no knowledge to invest, and no big savings and so on which hinder them from investing. Here Mutual Funds come to their rescue.

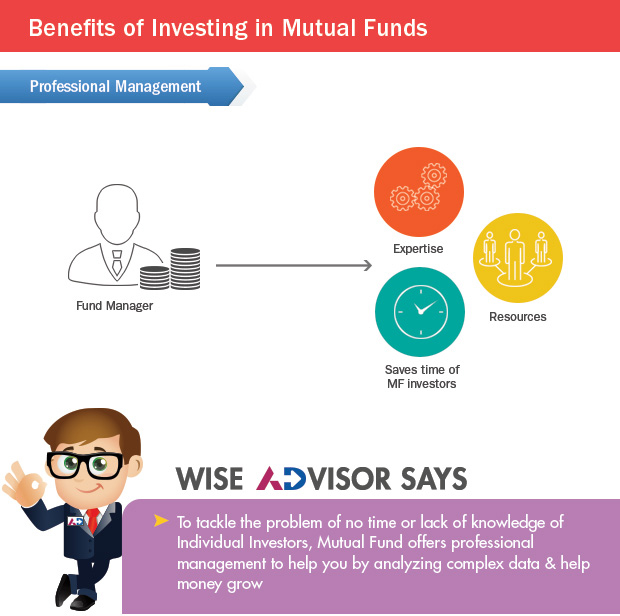

Mutual funds are managed by professional fund managers who have sufficient expertise and experience in picking the right stocks to get the best risk adjusted returns. Let us understand the benefits of mutual fund. .

The fund manager has the expertise as well as has a team of analysts who have the expertise of analyzing the stock and judge when to enter or exit a particular stock. The fund manager will research, purchase and sell securities, as defined in the Key Information Memorandum (KIM) of the scheme, in order to benefit the mutual fund’s shareholders.

The biggest advantage of investing in mutual funds is risk diversification. Every stock is subject to three types of risk – company risk, sector risk and market risk. Company risk and sector risk are unsystematic risk, while market risk is known as systematic risk. The stock price of a company may fall if the company’s financial performance is poor, even if the market rises. On the other hand, even if the company performs well, the stock price may still fall, if the market falls. Mutual funds help investors diversify unsystematic risks by investing in a diversified portfolio of stocks across different sectors.

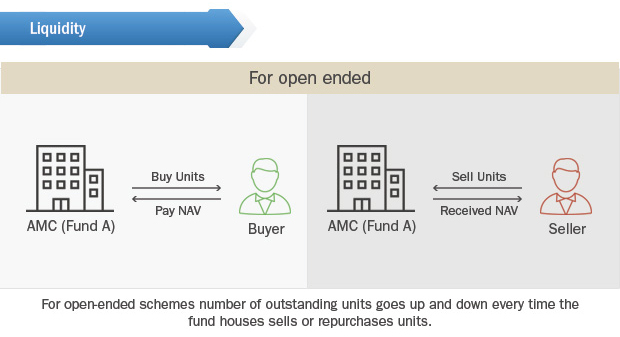

One of the biggest advantages of mutual funds is the ability to get in and out with relative ease. You can buy or sell on any working day for all the open – ended schemes. Although, there are few schemes e.g. close – ended funds or ELSS which have a particular lock-in period, otherwise liquidating your investments is quite easy.

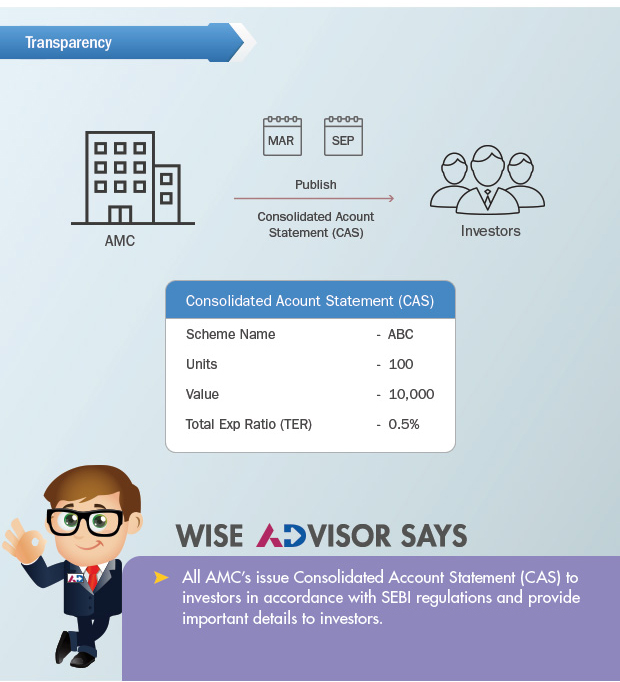

Mutual Fund industry is one of the most transparent industries in the BFSI sector. Several digital publications as well as rating agencies, track and record the performances of various mutual fund schemes. The Net Asset Value (NAV) as well as portfolio composition, No. of account holders are published. Factsheets are also published by almost all the Mutual Fund houses on a monthly basis where all the critical information are there in public forum for consumption.

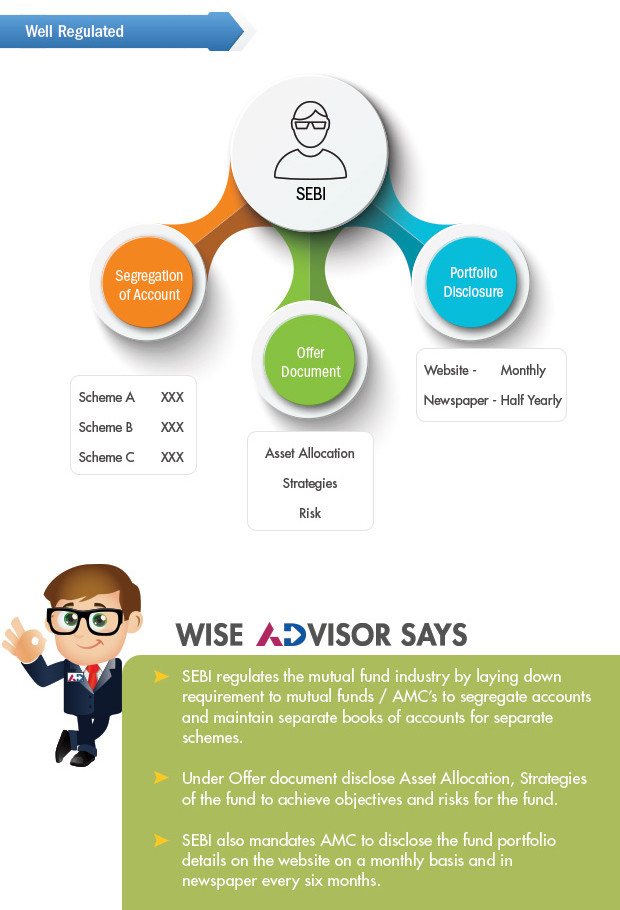

All mutual fund houses are registered with the Securities and Exchange Board of India (SEBI). Furthermore, they must follow and adhere to strict regulatory guidelines and rules that are provided for investor protection. Mutual Fund industry is well regulated and SEBI is the regulator for this industry. The regulator mandates about critical information of the scheme to be published e.g. Net Asset Value, expense ratio, fund managers managing their funds etc.

Key Takeaways:

- An investor finds various obstacles when it comes to investments

- A Mutual Fund offers solutions to these obstacles through various benefits

- The benefits are diversification, liquidity, transparency and it’s a well regulated industry.

Next Course of action:

- View the Top performing Stocks that would have created wealth for you

- Start investing with AxisDirect. View our best in class Investing ideas

- Check out our range of offerings and start investing to grow your investments

India

India NRI

NRI