How to Place an Options Buy Order: Ring Mobile App

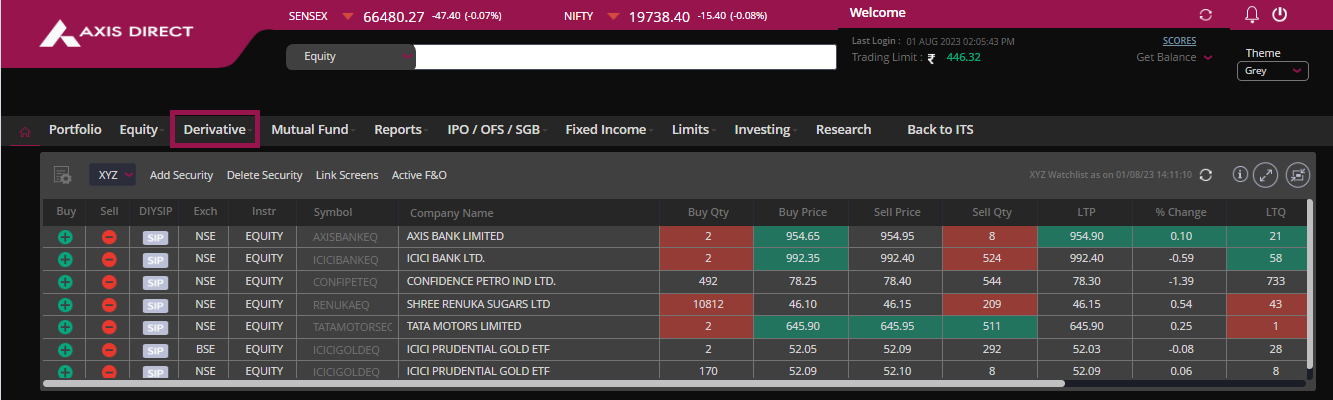

Step 1: Click Here to login to your account, then click on ‘SWIFT TRADE’ and select ‘Derivative’.

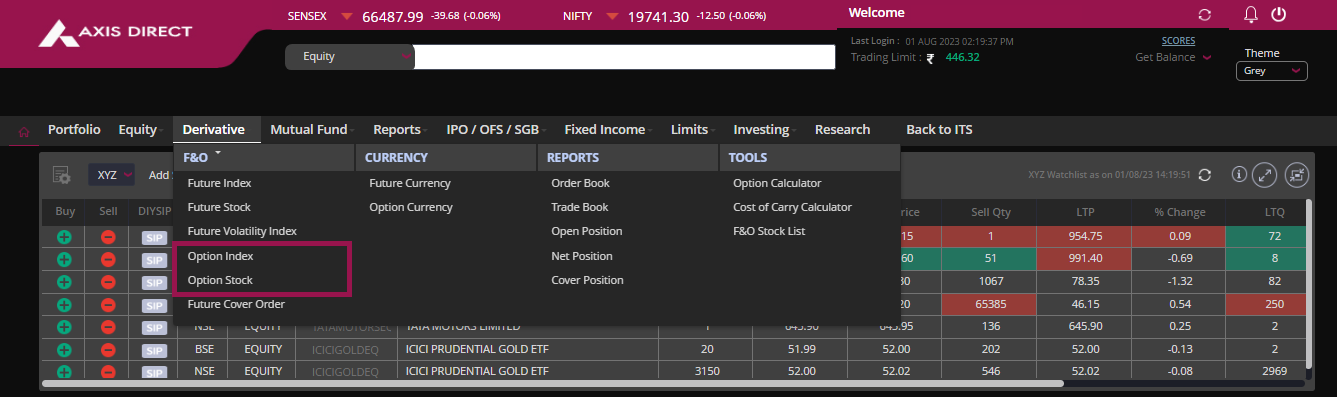

Step 2: Choose Stock or Index options:

Stock Option: The underlying asset is the stock.

Index Options: The underlying asset is the Index such as BSE, NIFTY, BANKNIFTY etc.

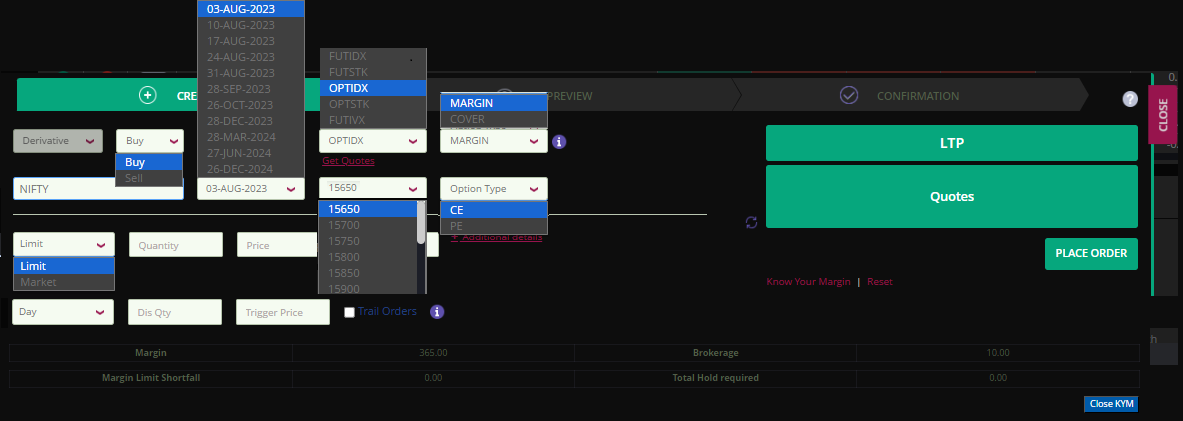

Step 3: A pop-up screen will appear to fill in the required trade details:

- 1) Buy/Sell: Choose BUY (Long) or Sell (Short).

- 2) FUTIDX, FUTSTK, OPTIDX, OPTSTK, FUTIVX: Choose any derivatives trade.

- 3) Margin/Cover: Choose and place a Margin/Cover order.

- 4) Enter the name of the stock or Index option you wish to invest in.

- 5) Expiry: Shows the contract expiry date.

- 6) Strike: Select the desired strike.

- 7) C.E/P.E: Choose a Call or a PUT option.

- 8) Limit/Market: Opt for Market or Limit order (For Sell orders it is strictly Limit).

- 9) Enter the quantity: Quantity in derivatives is as per the lot size. For example, the lot size for Nifty is 50; this means the premium would be calculated as amount x 50. If you wish to invest in more than one lot, enter the quantity as per the lot size x the number of lots.

- 10) Enter the desired price and click the ‘TAB’ key for the Order Value to auto-populate.

- 11) Click on the ‘Additional Details’ link to choose the order validity as Day/IOC and enter the ‘Trigger Price’ for placing a stop loss.

- 12) Click on ‘Know Your Margin’ for approximate margin charges for the preferred trade.

- 13) Click on the ‘PLACE ORDER’ tab to proceed.

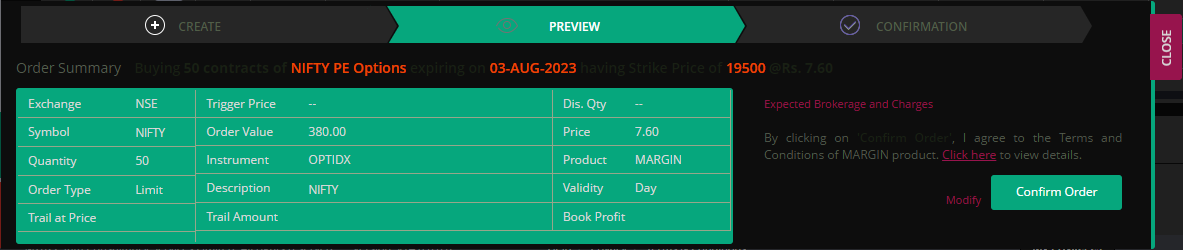

Step 4: Check the details of your order; click on ‘Modify’. To modify the order, you can also click on ‘Expected Brokerage and Charges’ to know the tentative Brokerage charges on the order. Click on ‘Confirm Order’ to proceed.

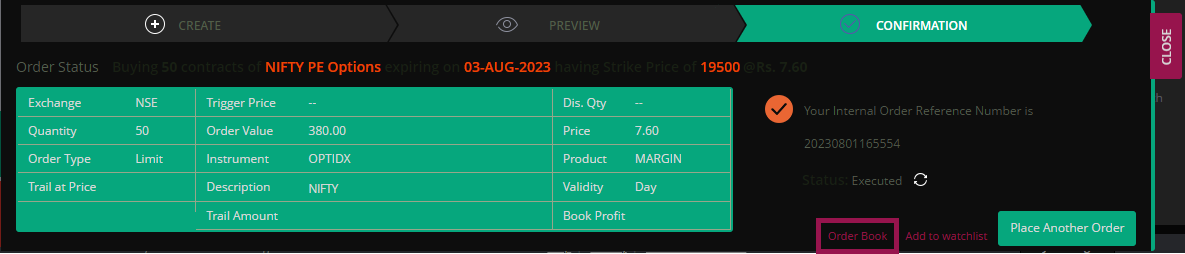

Step 5: Your order is placed; you can check the status of the order by clicking on the refresh icon next to the 'Status' field or click on ‘Order Book’ to view your confirmed orders.

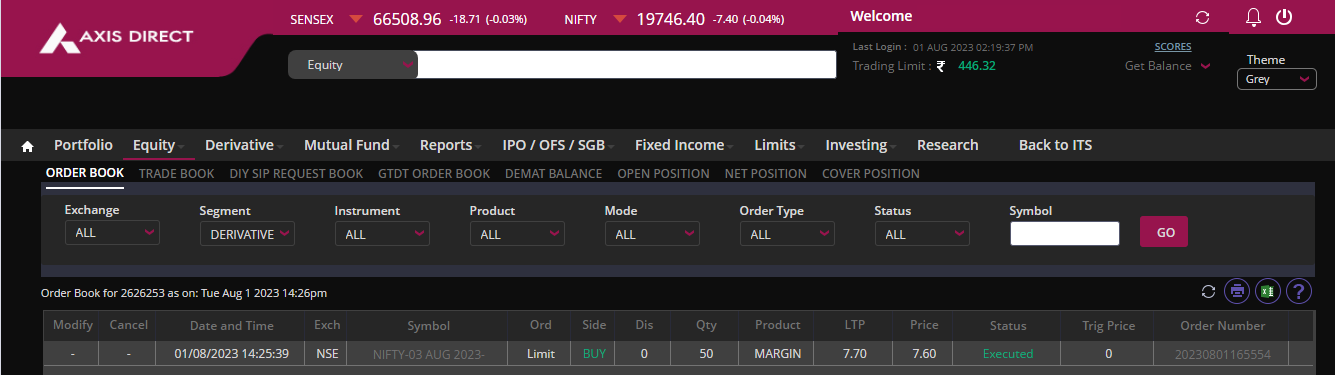

Order Book: The order book is also accessible from Derivatives >> REPORTS >> Order Book.

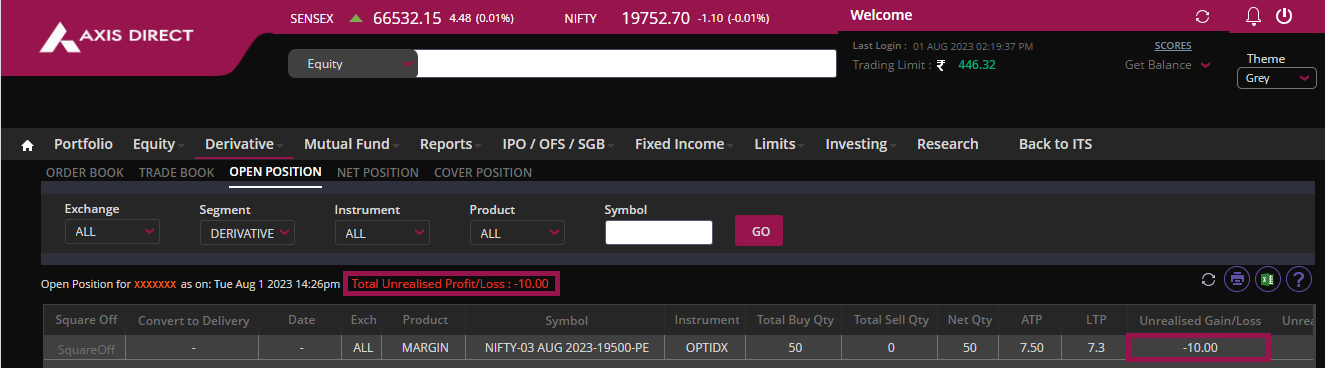

How to check real-time MTM (Profit and Loss) of your open positions?

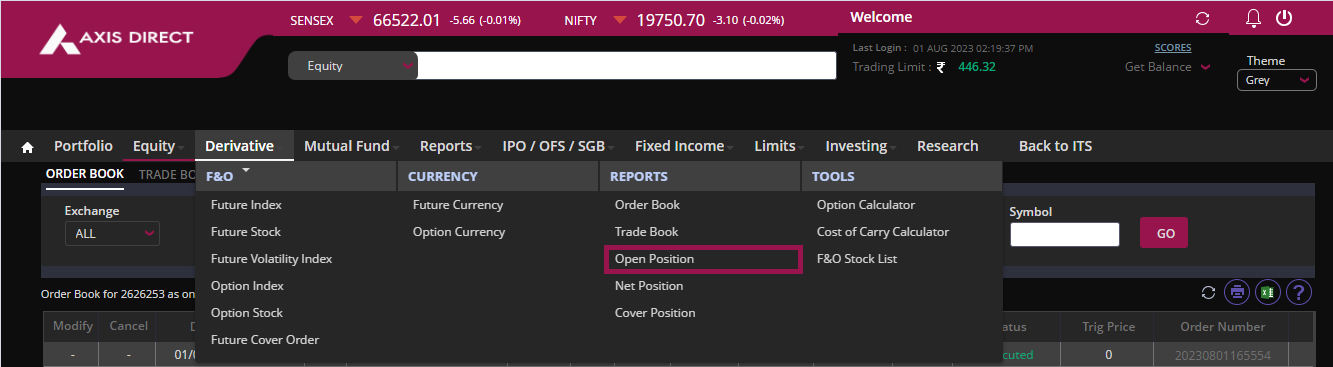

Select ‘Open position’ under the ‘REPORTS’ column.

You can see the MTM being updated in 2 different places. Your position will be under ‘Open Position’ until it is squared off; you can click on the grey ‘Square Off’ link anytime you wish to ‘Square Off/Sell/Exit’ the position.

Click Here to download this process document.

END

India

India NRI

NRI