Chapter 4.2

Axis Direct Courses

how to spot Multibagger stocks?

Multibaggers are stocks that provide investors with multi-fold returns over a period of time. This chapter tries to explain what factors you need to consider in order to help you spot Multibagger stocks

Multi-baggers as the name suggests are the stocks which can generate multiple bags of money over the next few years. These are the stocks which have the potential to report explosive growth over a period of time.

Spotting multi-baggers is the process of identifying future midcaps/Large caps stocks from the present day small caps stocks. They are the stocks which evolve gradually; they won’t give returns immediately when you invest into them. A structurally strong small cap company with good management & future strategy will evolve to become a multi-bagger over a period of time.

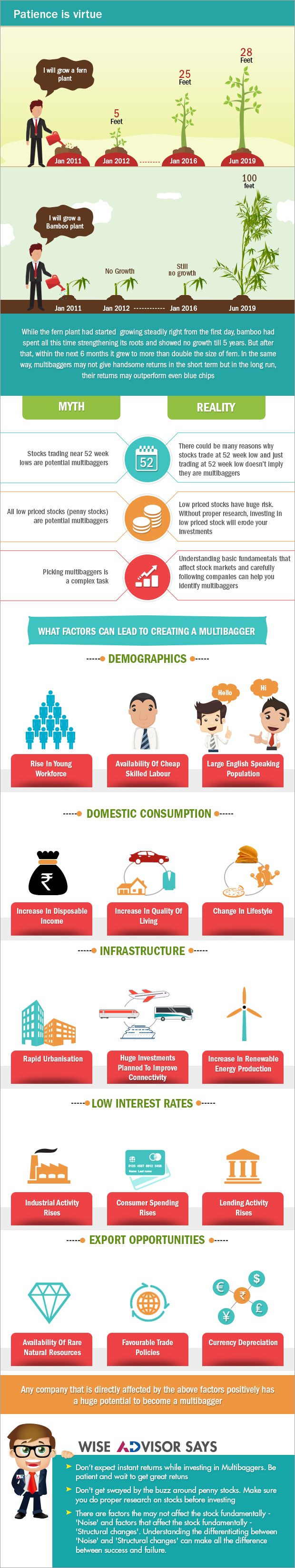

This can be explained by a story of a bamboo plant- you take a little seed, plant it, water it, and fertilize it for a whole year, and nothing happens. The second year you water it and fertilize it and nothing happens. The third year you water it and fertilize it and nothing happens. But in the fifth year, the bamboo tree sprouts and grows 100 feet in just six months. All these five years the bamboo tree makes its roots strong and gives it all what it needs to survive strong.

Many people have a lot of misconceptions about multibaggers. Many people think all stocks trading at their 52 week lows may turn around and become multibaggers. This is clearly wrong. Stocks trading at 52 week low can be due to many reasons. The decline in price maybe actually justified and stock might plummet further. Some people think all low priced stocks are potential multibaggers. But this is not true. Price of a stock on a standalone basis does not give any information about the future potential.

Many people think all stocks trading at their 52 week lows may turn around and become multibaggers. This is clearly wrong. Stocks trading at 52 week low can be due to many reasons. The decline in price maybe actually justified and stock might plummet further.

In fact penny stocks are highly risky and you should be very careful before making a decision to invest in them. Also people think that spotting a potential Multibagger stock is a complex task. But this may not be true. Picking a Multibagger may not be as difficult as it seems. Having a fair idea of what drives stocks and doing proper research before investing can be quite useful in spotting a Multibagger.

To pick multi-bagger stock it is important to invest in strong business models and good management. Whether the business is good or bad is depended on many factors demographics, domestic consumption, infrastructure, interest sensitivity & export opportunities in the economy.

How these parameters contribute while stock picking is explained as follows

Demographics in the economy like the age, education & culture contributes to the success or failure of a business in an economy. Currently 65% of India’s population is between 15-64 years of age. We have the world’s second largest English speaking population and the world’s largest number of Engineers passing out per year. All these are providing a unique opportunity availability of cheap skilled labor and a huge demographic advantage.

Currently 65% of India’s population is between 15-64 years of age. We have the world’s second largest English speaking population and the world’s largest number of Engineers passing out per year. All these are providing a unique opportunity availability of cheap skilled labor and a huge demographic advantage.

These factors recently had led to the emergence of India as a preferred IT destination. Starting in 1990’s information technology industry in India was in infancy but India’s population was young & education was ramping up. During this period Information technology companies were in nascent stage but the demand in U.S was huge and the population in India was developing to become a massive workforce to meet that demand. HDFC bank price in May 1995 was Rs 8.05 per share and today in May 2019 it is at the price of Rs.2424 i.e., approximately 303 times return.

So the investor who would have had the vision to look at the opportunity in the information technology sector in 1990’s & confidence in the management of the company would have invested in the same. So the investor who would have hold the investment in Infosys from 1990’s to 2015 has actually identified and reap the benefit of investing in a multi-bagger stock. But one of the principal rules while investing in multi-bagger ideas is to stick to your view point about the company and don’t follow the herd. If the markets are bearish due to some temporary news people tend to lose their confidence in the stock and don’t hold their investment.

Second important economic factor to measure the strength of a particular business is domestic consumption.

Domestic consumption means the products and services that are bought & used in the country that produces them. This is related to the consumption of goods by the people in the economy where these goods are produced. With increasing disposable incomes, increase in quality of living and changing lifestyles consumer preferences is ever changing.

Companies whose business profitability depends on the progress of economy of the country are called cyclical companies. For example Anil used to earn Rs.500000 lakhs per annum in 2006 when the economy is in a stable state. Since Anil used to spend around Rs.30000 per month on his livelihood expenses he still saved Rs.20000 (this saved Rs.20000 is called discretionary income) since he has that money with him he decides to buy a Maruti car on EMI basis. But in 2008-2009 when the economy was in a bad state Anil’s salary was cut to Rs.300000 per annum so he had money only for his necessary expenses so he sold his Maruti car.

So from the above example we understand that fast moving consumer goods companies, auto companies, consumer durables etc. depend on the economic conditions for their revenue and thus there profit. So these companies are called cyclical companies and domestic consumption is important for them to grow.

Fast moving goods companies (FMCG) are those companies which manufacture goods which can be sold easily & are at a low price. Example of FMCG goods are soaps, shampoos, processed food products etc.

Twenty years ago Marico Ltd. which manufactures parachute hair oil was a company trading at Rs.17 and today in 2019 its price is Rs.374 i.e., it has given 22 times returns. So an investor who would have the vision to see that hair oil is something very essential and bringing in cosmetic value to it with increasing disposable income of people would make a very successful business would have invested in Marico.

Infrastructure in a country is very important as an industry and also a major support for development of other industries. Example if a person named Raju wants to get educated he will require proper school/college to get his education further when he gets employed his company will be in any of the business parks which need to be constructed; Raju will also require proper roads, railways to commute to his office so there should be proper railway stations/roads build further he also requires a house where he can stay with his family which needs to be constructed. So who will construct all these schools/colleges, offices, houses, roads/railways etc this is where infrastructure industry becomes important.

In India there is vast scope of development in infrastructure industry compared to other developed nations in the world. In the past 19 years Larsen & Toubro Ltd. stock price has rallied from Rs.21 in May 2000 to Rs. 1557.95 in May 2019 i.e., 74 times return .In the 1990’s Infrastructure industry in India was at a very nascent stage and there was vast scope of for it to develop as the economy as a whole was developing. During that time Larsen & Toubro was a company which was trusted for its infrastructure order execution and did not have many big players as its competitors. So the investor who could have spotted the opportunity in the infrastructure sector in India in 90’s and who could have picked a structurally strong company like Larsen & Toubro would have benefited from the returns.

In the 1990’s Infrastructure industry in India was at a very nascent stage and there was vast scope of for it to develop. So the investor who could have spotted the opportunity in the infrastructure sector in India in 90’s and who could have picked a structurally strong company like Larsen & Toubro would have benefited from the returns

Also there is a huge fillip given to Renewable energy production in India by way of huge concessions to Wind and solar power producers. Companies in these industries may become multibaggers in future. Also connectivity is very poor in the country. With upcoming projects like Delhi-Mumbai Industrial corridor, 100 smart cities, Golden quadrilateral, developing new ports, Bullet rail plans etc. there will be a huge relief in logistics networks.

Interest Rate Sensitivity: Once upon a time a person wanted to buy a car worth Rs 10,00,000. He decided to take a loan from the bank to buy this car. He went to his nearest bank to ask for the loan worth Rs 10,00,000 for a duration of 10 years. The bank told him the interest he will be charged on the loan amount will be 10%. He calculated the total interest amount and found it to be coming to Rs 5,85,808. Hence on a loan of Rs 10,00,000 he will have to pay Rs 15,85,808 to the bank. He found the amount to be too high and postponed his plans to buy the car.

After 2 years his vehicle was completely in shabbles and he decided to buy a brand new car again costing Rs 10,00,000. He went to the nearest bank to ask for the loan worth Rs 10,00,000. The bank this time said to him that interest rate on his loan amount is 7%. He calculated the loan amount on his home @7% and found it to be Rs 3,93,301. On calculating his amount again he found that the on loan of Rs 10,00,000 he will have to pay Rs 13,93,301. He found the amount manageable this time and readily took the loan to buy the car.

Similar to this story interest rate affects sectors like Auto, Banking and Finance, Consumer Durables and Reality Sector. When interest rates are low, the loans become cheap and the people start buying houses, consumer durables and automobiles thus increasing consumer spending. Also borrowers which are mostly huge corporations are motivated to expand their operations thereby increasing industrial activity which is a good sign. Thus these sectors are quite related to interest rates. Also banking sector loan book starts increasing because of increase in people appetite to spend. The down cycle of these sectors happen when the interest rates are high.

When interest rates are low, the loans become cheap and the people start buying houses, consumer durables and automobiles thus increasing consumer spending. Also borrowers which are mostly huge corporations are motivated to expand their operations thereby increasing industrial activity which is a good sign

Export Opportunities: To gain over the competitors in exports, a country has to have pricing advantage over its competitors. Pricing advantage comes when there is cost advantage to other exporters without compromising on quality. India shows such advantage in the IT market and is one of the biggest IT services market in the world. The advantage comes from the pricing power which India has because of the low cost. For example 10 years ago IT companies in India used to give its new skilled joinee Rs 3,00,000.

Pricing advantage comes when there is cost advantage to other exporters without compromising on quality. India shows such advantage in the IT market and is one of the biggest IT services market in the world

Currently also major IT companies still pay the new skilled joinee Rs 3,00,000. Thus their manpower cost which is the biggest contributor of expenses has remained in control. Countries like China, Indonesia and Malaysia also have low manpower cost but their manpower is not quite skilled. Their manpower doesn’t have know how of English language which is the major requirement as main markets are English speaking nations of Americas and Europe.

Similar to IT, the sectors like textiles and Chemicals have similar behavior. India is in a beneficial position in terms of low man power cost and technological ability in these sectors. When a time will come when India will lose the pricing advantage the export advantage will be lost by India. Also favorable trade policies like GST promote entrepreneurship and reduce cost structures for exporters. Also one of the main reasons for the successes of Indian IT and Pharma sectors is because the Indian rupee is cheaper and hence acts as a key advantage for exporters. We have been able to maintain that cheaper advantage by constantly devaluing the currency which had made us quite competitive.

Warren Buffet said that when a good manager meets bad business, it is usually the business that wins

Key Takeaways:

- We need to keep in mind that cheap stock or stocks at their 52 week low do not mean that they are multi-bagger stocks.

- To pick up multi-bagger stock one needs to invest in strong business models and good management.

- Multi-bagger stocks are also compared with a bamboo plant which shows hardly any growth for few years and then grows very fast later on. Lot of patience is needed when one invests in Multi-bagger stock but the rewards are also high if correct stocks are selected.

Next Course of action:

- Start investing with AxisDirect. View the best in a class research ideas

- Watch our experts give valuable feedback on Investing, visit Direct Speak

- Check out our range of offerings and start investing to grow your investments

- Open 3 in 1 account with us and start investing in stock market

India

India NRI

NRI