Currency Derivatives Open Interest (OI) Permissible Trading Lot Limits

As per the exchange norms, whenever you trade in Currency derivatives, you are allowed to trade only in a certain permissible number of lots, which means at any given time your open positions (Across all trading members (Brokers) on PAN basis) should not cross the permissible number of lots mentioned in the CD- Client wise OI Limits report by the exchanges.

The exchanges update these limits on a daily basis, hence we request you to check the permissible limits (lots) on the NSE portal by following the path given below before you trade in Currency Derivatives:

https://www.nseindia.com/all-reports-derivatives >> Currency Derivatives >> Archives >> Select the desired date (Date: 13-Dec-2023 to be selected for Trade Date: 14-Dec-2023) >> Search for ‘CD- Client wise OI Limits’ >> Then click on the ‘Download’ icon next to the report

Please Note: The report will be downloaded in LST format; you can read the report by opening it in your Notepad, MS Word, Excel etc.

On any given day if your total open positions (based on PAN across all trading members) exceeds the client wise permissible limits a penalty of Rs 5000 + 18% GST is applicable per day for each UCC.

How to Read the Report?

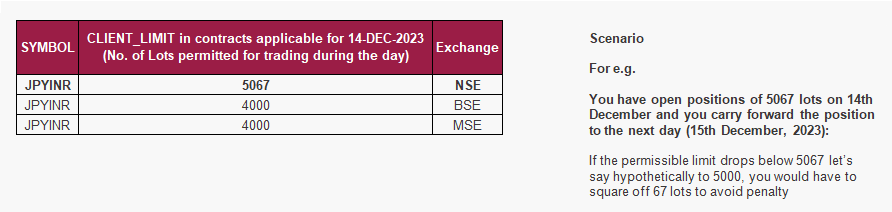

Let us look at the ‘x_oi_cli_limit_13-DEC-2023’ file with CLIENT_LIMIT in contracts applicable for 14-DEC-2023 pasted below, as per the following report if you wish to trade in JPYINR, the maximum lots you could trade in JPYINR across all the DPs (Brokers) would be

5067 in NSE

At Axis Direct we allow trades in currency derivatives trade in NSE only.

Snapshot of the Report:

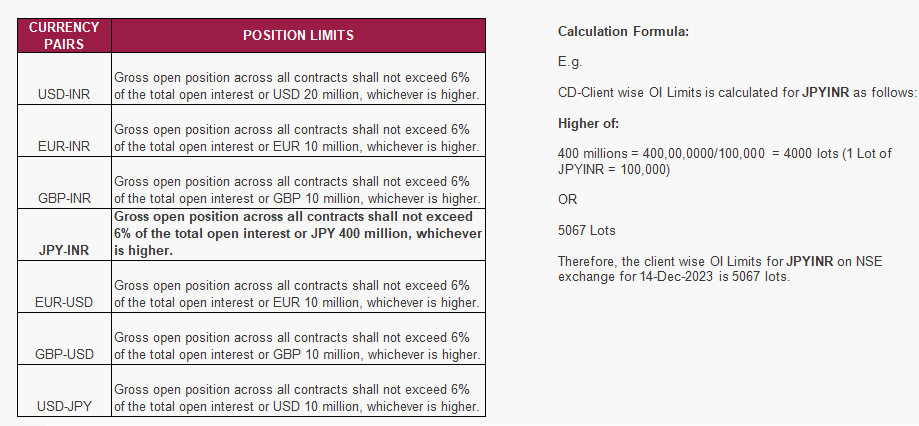

How the limits are calculated?

Path for Position Limit of clients: https://www.nseindia.com/products-services/currency-derivatives-position-limits

Position Limits of Clients

The gross open positions of the clients across all contracts in the respective currency pairs shall not exceed the limits as mentioned below. For the purpose of computing the client level gross open position, Long position shall be considered as Long Futures, Long Calls; and Short Puts and Short Position shall be considered as Short Futures, Short Calls, and Long Puts.

END

India

India NRI

NRI