TCNS Clothing Co Ltd IPO

ABOUT THE ISSUER

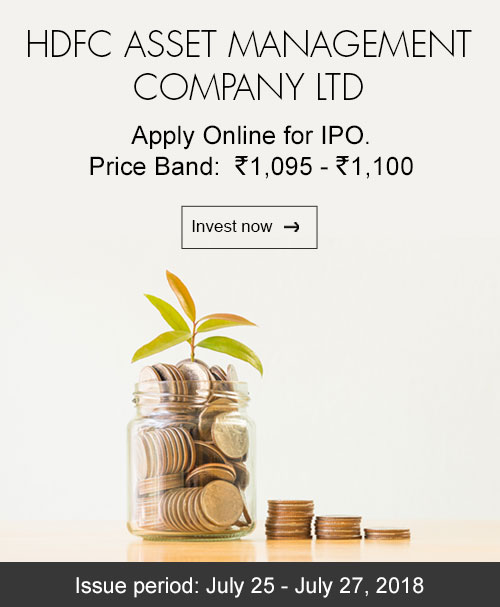

HDFC Asset Management Company operates as a joint venture between Housing Development Finance Corporation Limited (“HDFC”) and Standard Life Investments Limited (“SLI”). HDFC AMC is the largest Asset Management Company in India in terms of equity-oriented Asset under Management (“AUM”). HDFC AMC offers a large suite of savings and investment products across asset classes, which provide income and wealth creation opportunities to their customers. HDFC AMC offers their products and services through their online portal, HDFC MFOnline and mobile applications, both of which have become increasingly relevant to their business in recent years.

ISSUE DETAILS

-

Price Band

Rs.1,095 - Rs.1,100

-

Bid Lot

13 Shares and in multiple thereof

-

Issue Size

Rs.2,788 Cr – Rs.2,800 Cr

STEPS

-

Step 1

Log in to your AxisDirect account

-

Step 2

Under Trading tab, click on IPO/OFS section

-

Step 3

Click on “Current IPO/FD/OFS” tab

-

Step 4

Select ‘HDFC Asset Management Company Ltd' & “apply”

Check out the upcoming IPO stocks along with open and listing IPO dates & offer price.

5 Reasons to Invest in HDFC AMC IPO:

1. Consistent profitable growth

2. Focus on individual investors

3. Favorable asset mix

4. Multi-channel distribution network

5. Strong parentage

What is the objective of HDFC AMC IPO?

As HDFC AMC will not receive any proceeds from the IPO, the objective of this issue is to carry out the sale of equity shares by promoter selling shareholders.

Management of HDFC AMC:

Higher management of any company drives its decisions and decides the future of the company. Take a peep into their arsenal before investing in HDFC AMC IPO:

Deepak Parekh – Non-executive Director & Chairman on Board

Keki Mistry – Non-executive Director on Board

MilindBarve – MD & Executive Director

Prashant Jain – Chief Investment Officer

HDFC AMC IPO is a big ticket IPO and got over subscribed on the first day itself. Do not miss an opportunity to invest in this mega issue.

India

India NRI

NRI