True happiness is watching your dreams come true.

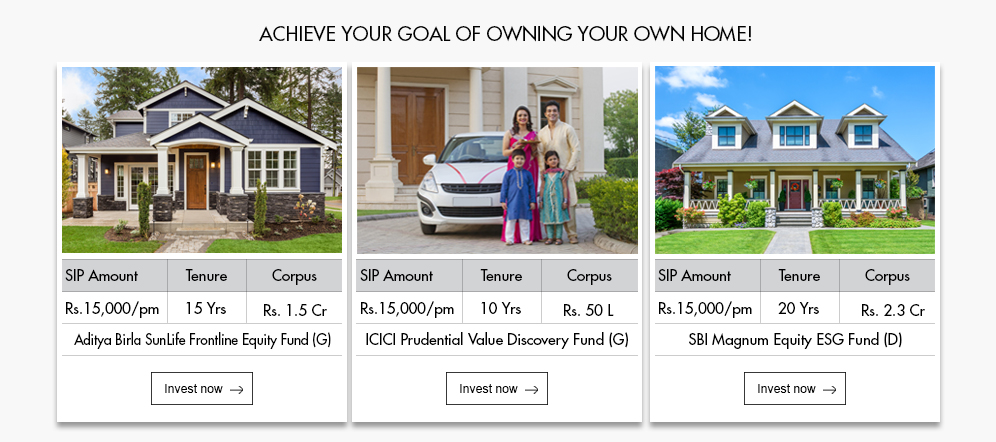

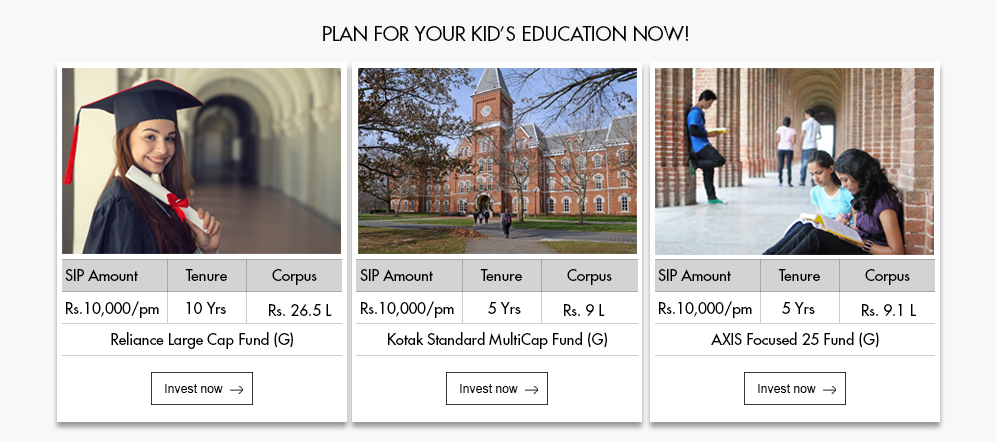

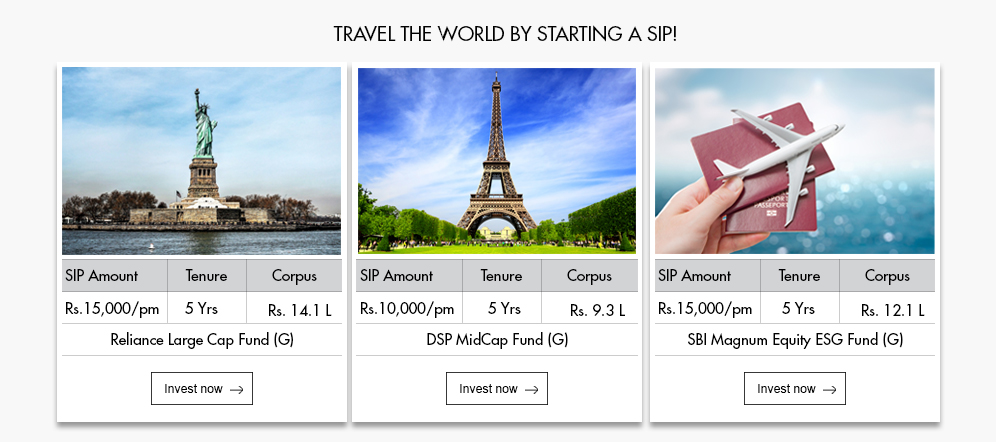

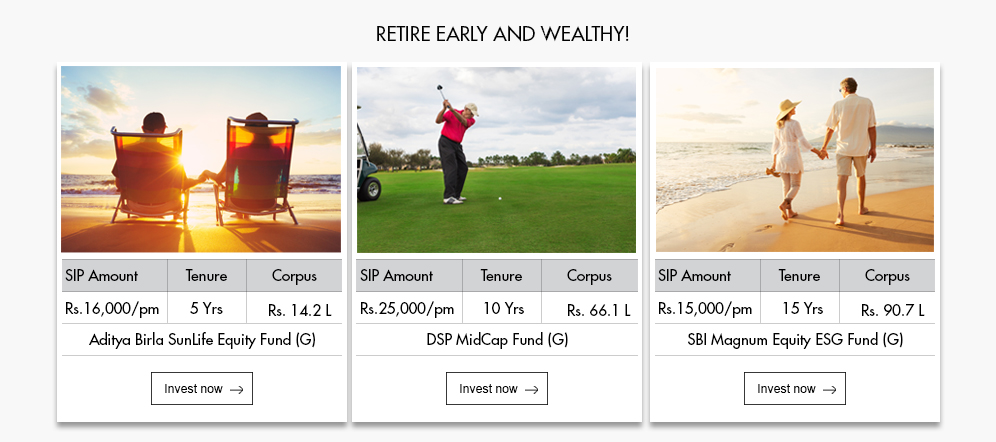

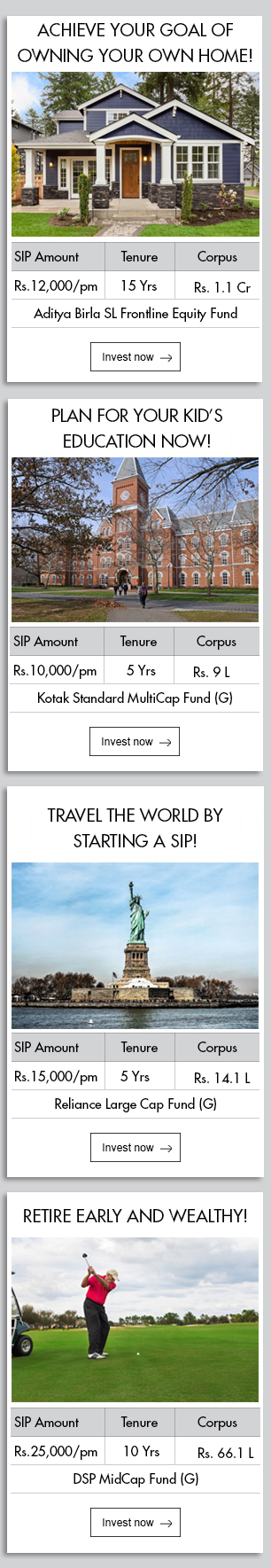

The world becomes a happy place if we are able to achieve what we had planned. Systematic Investment Plans (SIP) helps us gradually realize our goal with the discipline of savings, growing our investment and mitigating risk.

Start a SIP today and achieve your goals with the help of a simplied, effecient and secure method of investing in mutual funds!

As per Value Research Online Return on 4.10.18. Past performance is not an indication of future returns

WHY SIP?

WHY WISE ADVISOR

-

Personalization

Get tailor made MF portfolio customized to your needs & goals

-

Powerful & Consistent

Robust algo based intelligence

-

Flexible

Allows you flexibility to change schemes for investment within the category

-

Monitoring

Auto monitoring & rebalancing to help you achieve your goals, no matter what

India

India NRI

NRI