smallcases are a new way to invest in stocks.

A smallcase is an intelligently weighted basket of upto 20 stocks that reflects a theme,

idea or strategy smallcases are centered around:

A trending market theme like

rising rural demand

A financial model like zero debt

Different risk profiles viz.

aggressive, balanced and conservative

You can choose a smallcase based on a theme that you are positive on, invest in it in 3 clicks and track & manage multiple portfolios seamlessly.

smallcases aren't a means of recommending or advising investors. Choosing a smallcase is up to each individual.

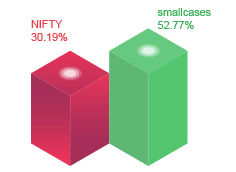

KEY BENEFITS

METHODOLOGY

Research & Stock Screening

The smallcase research team does in-depth research & numerous internal presentations to decide on various stock screening criteria:

1. The universe includes all publicly traded companies on the National Stock Exchange of India, covering 90% market capitalization

2. Proprietary liquidity filters are applied to remove ill-liquid stocks from the universe

3. Stocks where a significant part of the promoter holdings are pledged, to define the investable universe

4. All stocks in the investable universes, belonging to the selected sectors are checked individually to ensure perfect theme fit

Weighting

Each smallcase has a weighting scheme for individual stocks that is based on:

1. Revenue derived/expected from business activities

2. Market capitalization of the company

3. Future estimates and corporate governance record of the company

Rebalance

All smallcases are rebalanced on a periodic basis to ensure the current list of constituents and their weights remain true to the theme. Depending on the theme, this can be on a monthly, quarterly, or annual basis

Historical back-testing

All model-based smallcases are checked for historical outperformance to ensure that only consistently outperforming models are selected

and confirm

India

India NRI

NRI