Chapter 2.5

Investing in Gold

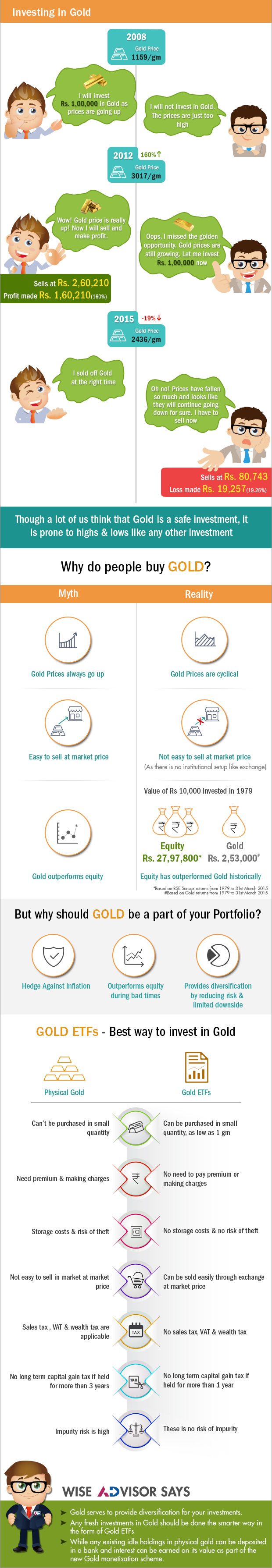

This chapter talks about Gold’s perception as a safe and evergreen investment versus the reality of investing in Gold. Also an introduction to a new way of investing in Gold –Gold ETFs is discussed.

Now let’s talk about something that evokes great emotion within us all - Gold. Indians own more gold than the people of any other country in the world. We like to own gold so much that numerous gold mines of the world have moved from geography books to history books. Indians love gold and have been accumulating it for generations.

Official estimates as of March 2015, put gold reserves with RBI at over 557.7 tonnes. While the gold held by households is estimated to be around 20,000 tonnes. Many people believe that gold is a safe investment. The fact is that gold has given negative returns in the past for an extensive period of time. The highest price of gold in January 1980 of about 835 U.S. Dollars (USD) per ounce was not crossed for 27 long years till December 2007. This lean period of gold for a couple of decades had laid the foundation for the "bull-run" in gold over the few years till 2012. And the next few years have again been a nightmare for Gold investors. This proves that Gold prices are cyclical and is not definitely as safe as what people think it to be.

Many people believe that gold is ready cash, i.e. it can be sold at any point of time and converted into cash. As per RBI regulations, banks cannot buy gold from retail investors, so the liquidity of gold for retail Investors is provided primarily by jewelers and commodity exchanges. If Indians decided to sell just 1% of their holding of gold due to high prices, jewelers would require over Rs. 44,000 crores of liquidity to pay for it. Such Liquidity would not be available without a significant impact cost (reduction in price of gold due to sudden selling pressure within a short period of time). Gold is probably considered liquid, because currently only a few people want to sell it.

Many people believe that gold has outperformed equity. However, they couldn't have been more wrong. It's like saying the sun rises from the West. Equity has outperformed Gold in the long run by a huge margin. An investment of Rs. 10,000 in 1979 would have grown to Rs. 2,53,000 by 2015, the same amount would have grown to Rs. 27,97,800 if invested in Equities.

The point being highlighted here is simple: "All that glitters about gold is not golden". Gold, like any other commodity, has a cycle. It has given negative return in the past and can give negative return in the future too. Gold has underperformed as compared to equity in India over a long period of time. Fundamentally, that is not surprising, given that gold is storage of value (gold can be used as an acceptable currency; It can be stored. and when retrieved, has a predictable value) and is expected to perform in time with inflation. Whereas equity, theoretically is supposed to outperform Inflation. Gold is illiquid, especially In India, as there is no Institutional mechanism for selling lt.

Gold, like any other commodity, has a cycle. It has given negative return in the past and can give negative return in the future too. Gold has underperformed as compared to equity in India over a long period of time.

If you were to accumulate all the Gold in the world, it would probably fill one large stadium and cost you about USD 10 trillion. With that amount, you could buy lndia's entire stock market capitalization more than 6.6 times (As on 31" March, 2013). Maybe with this equation, it would make sense to invest in India's entrepreneurs with a golden touch, rather than the yellow metal.

Despite all these setbacks, Gold needs to be a part of one’s portfolio when investing for long term. This is because

1. Gold can act as an Inflation hedge: This means even though a currency may lose its value due to inflation, Gold may hold its value and act as a hedge against inflation

2. Gold returns are negatively correlated with Equity. This means that typically Gold returns go up when equity returns go down and vice-versa. Thus whenever Equity underperforms, Gold typically outperforms.

Gold returns are negatively correlated with Equity. This means that typically Gold returns go up when equity returns go down and vice-versa. Thus whenever Equity underperforms, Gold typically outperforms.

3. Due to the properties stated above, Gold can act as a shock absorber for your portfolio. You can protect yourself from extreme downside in equity by making Gold a small part of your portfolio. This can limit the downside for your portfolio.

SMART WAY OF INVESTING IN GOLD – GOLD ETFs

In India, we love investing in gold. Gold ETFs (Exchange Traded Funds), which are mutual funds investing in gold and traded in the stock exchange, provide the following additional benefits over investing in physical gold:

• It can be purchased in small quantities, as low as 1 gram

• Unlike physical gold, there is no premium or making charges which you pay when buying gold bars or jewelry

• There is no risk of theft and there are minimal storage costs as the units are held in demat form.

• It can be sold easily through the exchange at a transparent market price. It is difficult to sell physical gold at market price. Banks do not buy back gold and most jewelers exchange gold but do not buy back gold at market price.

• There is no sales tax or VAT. It is treated like a stock and currently there is no wealth tax on gold ETFs

• While investing in Gold ETFs, long term capital gain tax is waived off if held for more than 1 year. This period to get tax waiver is 3 years in case of Physical Gold

• Unlike physical gold, which has risks of impurity when bought from unauthorized sellers, there is no such risk in Gold ETFs

Key Takeaways:

- Gold is prone to business cycles and its price may rise and fall

- Gold ETFs are the best way of investing in gold without having the headache of storage costs and taxes etc.

Next Course of action:

INDIA

INDIA NRI

NRI