Chapter 1.3

Common Sense Investing

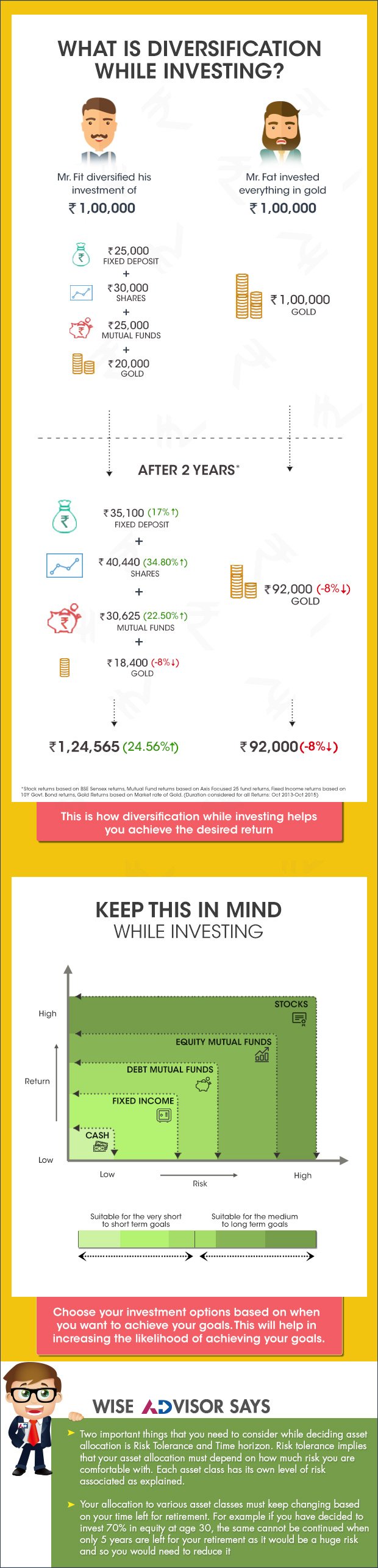

Diversification is one of the basic building blocks in creating a portfolio. Learn why it is so important to diversify your investments.

We spend nearly all of our time working hard and making sincere efforts to earn an income. However, we spend very little time on conserving or growing it, once it is converted into wealth. We're disrespecting this hard-earned wealth by risking it on 'speculative' tips in the stock market, greedily investing it in ponzi schemes, or keeping it idle and stagnant in a savings account.

The volatility of the stock market, non-transparency of real estate deters many from investing in these assets or instruments. Most investors find solace in the safety of bank deposits and gold.

Most people focus on the risk of losing money while investing. They often ask themselves, "If I invest money on something now, will it dip in value later? Will it lead to a negative return? Will my hard-earned money reduce in value? “. However, few people look at the destruction of wealth by inflation.

Most people focus on the risk of losing money while investing. They often ask themselves, "If I invest money on something now, Will it dip in value later? Will it lead to a negative return? Will my hard-earned money reduce in value?“. However few people look at the destruction of wealth by Inflation

What is the solution to this for a common retail investor? Should he put all of his money in Safe bank deposits and allow inflation to destroy his wealth? Should he invest everything in stock markets and take risk? There is a solution to this wherein you not only protect your wealth from inflation but also grow your wealth overtime. The answer is by building a diversified portfolio.

For an investor planning for long term goals, diversification is the best strategy to invest. You can diversify by allocating your investments across various asset classes, specific sectors and instruments and other categories. This type of investing maximizes your returns by minimizing the risk. Let’s see how this works.

As we can see from the image, while Mr. Fit invested in all asset classes and protected himself from the negative return of Gold, Mr. Fat has lost out as he had invested everything in Gold. In this way, Diversification helps in protecting the portfolio from extreme downside in one of the asset classes by the outperformance in the other asset classes, thereby reducing risk. Thus diversifying across asset classes makes your portfolio immune to market cycles and maximizes your return by minimizing the risk. Since all asset classes do not react in the same way to market events and business cycles, this limits the downside to your portfolio

How much proportion you need to allocate to each asset class is a very subjective issue based on how much risk you are willing to take. So ask yourself a question: How much maximum downside are you willing to bear and based on that you can decide your allocation. If you are a high risk taker, stocks and equity mutual funds can form major part of your portfolio while if you are not a risk taking person, then fixed income investments and debt mutual funds should be a bigger part of your portfolio.

Even within each asset class, you need to diversify across various types of instruments. For example, in case of stocks, diversify based on size - largecap, midcap and smallcap; While largecaps are low risk investments, small cap stocks carry high risk.

Even within each asset class, you need to diversify across various types of instruments. For example, in case of stocks, diversify based on size - largecap, midcap and smallcap; While largecaps are low risk investments, small cap stocks carry high risk.

Such careful allocation of investments can minimize the impact of market swings and will go a long way in securing as well as growing your wealth.

Key Takeaways:

- Regardless of what goals you plan to achieve and what time period you are investing, Diversification is the smartest strategy of investing.

- Based on your risk appetite, decide how much proportion of your investments is allocated to each asset class.

Next Course of action:

- Know the overall market by visiting Market Overview

- Check out our range of offerings and start investing to grow your investments

INDIA

INDIA NRI

NRI