Advantage AxisDirect

- 20 investment products

- 3 great platforms to invest

- 5 fun-tastic learn courses

- 5 powerful research segments

- 4 prestigious awards

- 9 lakh+ happy investors

Quotes

Back To Menu

-

Offerings

- Markets

- Research

- Learn

- PORTFOLIO

smallcase Investment Details Explained – Axis Direct

AxisDirect-O-Nomics

Jul 27, 2018 | Source: smallcase

Investment in smallcases Explained

Taking a detailed look at the different numbers that are part of the investment overview for a particular smallcase.

Buying a smallcase

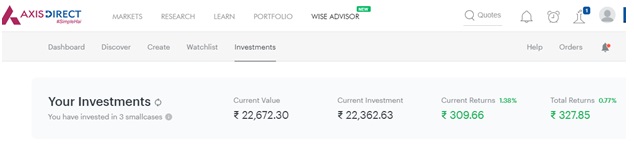

To track the performance of your smallcases, you need to come to your Investments page. Just Login to https://simplehai.axisdirect.in/, click on ‘Wise Advisor’ from our menu and select ‘Equity smallcase’. Just click on the ‘Investments’ button on the top right of the navigation bar and you would be directed to the page. On this page you would be able to see and track returns generated by your smallcases, as well as the cumulative performance of all the smallcases

At the top of the page you can see the cumulative summary of all the smallcases

Just below this, all the smallcases bought by you are arranged in a reverse chronological order with the most recently bought smallcase at the top of the list.

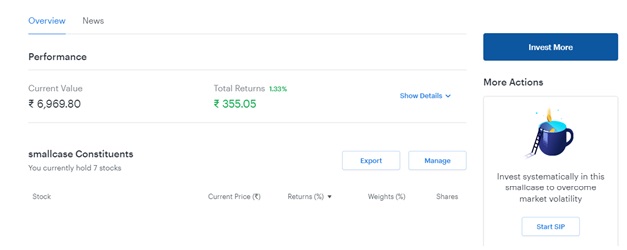

For every smallcase, there are four action buttons – Manage, Export and Invest More and Start SIP.

The Index Value of a smallcase is always equivalent to the P&L percentage. At any point you can quickly judge the returns generated by your smallcase, by looking at the index value. Just subtract 100 from the index value to arrive at the P&L percentage. Whenever you invest in a smallcase, we set your custom smallcase index to 100 for easy tracking

Let’s now look into the details of how this section will look immediately after you buy a smallcase and understand all the terms in the Investment Overview section:

Current Value

At any given point it represents the networth of the smallcase i.e. the amount you will receive, if you decide to sell the smallcase. It is the sum of current value of your holding in each of the stocks. If you sum the current values for all the stocks, you will arrive at the current value of the smallcase

Current Investment

It represents the amount of money currently invested in the smallcase. It is the sum of investments into each of the stocks. The value of the investment in a stock is average buy price multiplied by the number of shares.

Current P&L

It is the amount of profit that you will make if you decide to sell the smallcase. It is calculated as the difference between Current Value and the Current Investment

Realized P&L

It represents the total profit/loss that you have already booked. Whenever you make a transaction that results in selling few stocks from your smallcase, you will always be either booking some profit if the price of the stock has gone up since you bought the smallcase or booking some loss, in the opposite case.

Total P&L

It is the sum of realized and current P&L and shows how much money you have made using a particular smallcase. The % P&L is the Total P&L divided by the money put in i.e. how much % return you have made on the total money used in the smallcase

Now that we’ve gone over what the values under the investment overview section indicate, let’s understand how these values are impacted with the help of an example:

Investing More

Let’s say after 15 days of investing in this smallcase, you decide to check the performance and invest more into the same smallcase. Let’s say you decide to invest 30K more into the smallcase. Invest more page optimizes the investment amount, and in this case the value will be optimized to Rs 28,665.35. Based on the weighting scheme of the portfolio, smallcase decides how much money should go into each stock to maintain the scheme and how many shares of each stock need to be bought for the same. The average buy price will be changed for all the stocks.

After the trade, your current investment increases. As explained, it represents the amount currently invested in the smallcase. Let’s say previously it was Rs 23961.7. You invested Rs 28665.35 more into the smallcase, hence the total current investment becomes Rs 52627.05. Current value also increases by the same amount, i.e Rs.28665.35

The absolute current P&L number doesn’t change because you just invested more and have not made any profit or loss on the same. However the total P&L% dropped, this is because it represents the P&L generated on the total money put into the smallcase. As the money put in increased, total P&L% came down. This is because you now have a lot of money invested on which you haven’t yet made any profit.

Rebalance

Let’s say you receive an email from us on 1st of August that your smallcase has a rebalance update.

To apply the changes you go the Manage section and click on Apply Update.

When you rebalance a smallcase, two things happen:

• Stocks which got removed from the smallcase are sold and stocks which got added are bought

• smallcase moves the weighting scheme as close as possible to the prescribed weighting scheme

We make the above changes, while ensuring that we minimize the rebalance cost for you. Rebalancing smallcase is easy and takes just a couple of clicks!

Partial Exit

Let’s say we are in September now, and you need to draw some money out of smallcase for personal use.

You decide to use the Partial Exit feature to draw around Rs 23,000 from the smallcase. When you place the Partial Exit order for around Rs 23K, the trades are triggered. Let us say in this Partial Exit case, we sold 1, 19, 2 and 33 shares of Hinduja, KPIT, Hero and Gujrat Alkalies, respectively. In each case, current price was more than the average buying price, thus you booked profits.

The total amount sold was Rs 22,922.15, out of which Rs 20,717.89 was your investment and Rs 2,204.26 was the profit made on the investment. Money Put In remains the same, as it represents the total money put in by you to generate the total P&L. Total P&L includes the Realized P&L which was generated using the money taken out, thus Money Put In includes everything – amount current invested or previously invested. Again, you can see that the Total P&L remains same, it just gets redistributed between Realized and Current. Current P&L drops by Rs 2204.26 – the realized profit booked in the current trade and the realized P&L increase by the same amount.

Note: There could be slight differences between the investment overview values you see on smallcase and the values you see on AxisDirect. This can happen due to a couple of reasons such as difference in calculation methods used, corporate actions, etc.

vV5.0.0.6-60 Thanks for Liking, Please spread your love by sharing...As you have logged in from a different device/browser. This session has expired.Image size cannot exceed 512 KB. - Markets

INDIA

INDIA NRI

NRI