Advantage AxisDirect

- 20 investment products

- 3 great platforms to invest

- 5 fun-tastic learn courses

- 5 powerful research segments

- 4 prestigious awards

- 9 lakh+ happy investors

Quotes

Quotes

Back To Menu

-

Offerings

- Markets

- Research

- Learn

- PORTFOLIO

Positive takeaways from reducing Current Account Deficit and rising Crude Oil Prices - AxisDirect

AxisDirect-O-Nomics

Jul 26, 2017 | Source: AxisDirect

Reducing CAD and Rising Crude Oil Prices - A Win for the Equity Markets

Rising crude oil prices could be a positive for Oil marketing companies

- Oil prices extended gains on Tuesday after Saudi Arabia pledged to curb exports from next month and Organization of the Petroleum Exporting Countries (OPEC) called on several members to boost compliance with output cuts to help reduce supply and tackle flagging prices.

- On the other hand, China's crude imports look to exceed 400 million tonnes (8 million bpd) this year and likely grow by double digits next year, as per experts.

- This will lead to falling crude-oil inventories and rising prices considering the balancing of the market. The oil marketing companies could benefit from this in coming months and keep an eye on this sector in Equity Markets

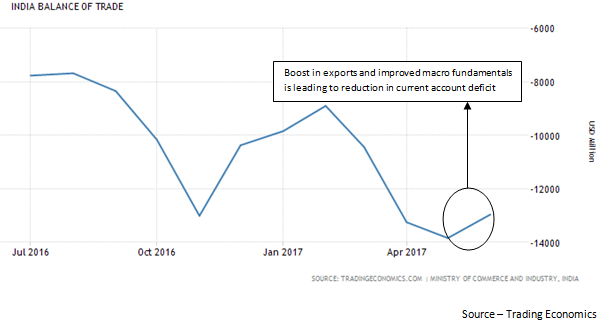

Reducing current account deficit makes India ‘safe heaven’ among emerging markets

- The CAD has reduced drastically from 5% of gross domestic product (GDP) in 2012-13 to less than 1% in 2016-17.

- Current Account Deficit (CAD) narrowing is also because of comparatively lower crude oil prices

- More generally, however, much of the improved balance of payments reflects distinctly improved macro fundamentals; which are reducing inflation and interest rate

- Also reducing Current Account Deficit has a salutary effect on the currency.

vV5.0.0.6-60 Thanks for Liking, Please spread your love by sharing...As you have logged in from a different device/browser. This session has expired.Image size cannot exceed 512 KB. - Markets

INDIA

INDIA NRI

NRI