Chapter 5.1

Life Insurance: Insure your worries away

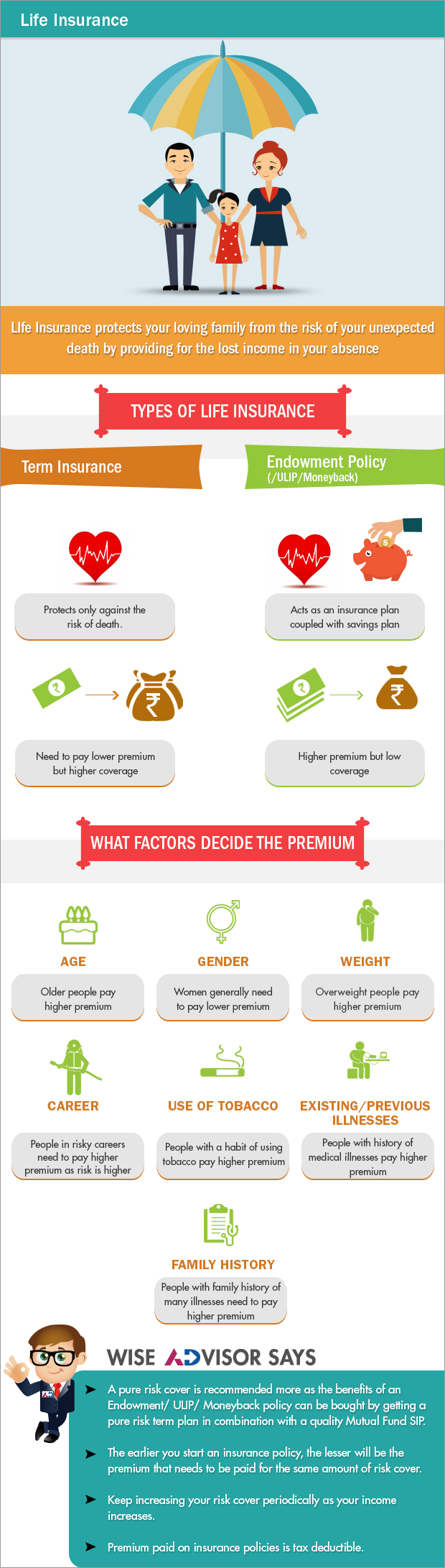

This chapter explains how Life Insurance plays a vital role in ensuring financial security for your loved ones. It introduces various types of Life policies and various factors affecting Premium

You work hard to earn money. You want your family and yourself to be able to enjoy the fruits of your efforts in the decades to come. You wish to lead a perfectly healthy and long life without having to face any major illnesses or physical problems. You wish your house must never have to face any natural calamities or disasters. We all pray for these wishes to come true. However, what would happen if any of the above untoward incidents were to happen? How would you prepare yourself and your family financially for such situations. This is where insurance comes in. For a small amount of money in the form of periodic payments (premium), it provides you and your loved ones with financial support when it is most needed.

lnsurance can be divided broadly into two categories – Life Insurance and General Insurance. We will discuss about Life Insurance in this chapter and General Insurance in the next chapter.

Life Insurance can help mitigate the financial Impact on your loved ones in the unfortunate event of your death. Your family can use the proceeds from the policy to help replace the lost income, eliminate debt (e.g. housing loan), pay for your children's college education, or address other financial needs and goals while they adjust to a life without you. However they would know that you have done your part by taking care of them.

Life Insurance can help mitigate the financial Impact on your loved ones in the unfortunate event of your death. Your family can use the proceeds from the policy to help replace the lost income, eliminate debt (e.g. housing loan), pay for your children's college education, or address other financial needs and goals while they adjust to a life without you.

There are various types of life Insurance policies. However, they can be broadly classified into two categories:

1. Term insurance - Policies that cover only risk: These types of policies protects the insured person for a defined period of time. In such a policy, a fixed sum of money called the 'sum assured' is paid to the beneficiaries (family) if the policyholder expires within the validity of the policy. For instance, if a person buys a policy worth Rs. 25 lakhs for 20 years, His family is entitled to the sum of Rs. 25 lakhs if he dies within that 20 year period. If the policyholder survives beyond the 20 year period, the premiums paid are not returned. Such policies have the lowest premium.

2. Endowment Policies, Unit linked Investment Plans, Money-Back policies - Policies that mix risk cover with Investments: In such plans, Part of the money provided is used for pure risk cover while the rest is used for investing in order to generate long term returns. The operating costs of such policies are usually higher than policies with only risk cover. Various types of life insurance policies have various pros and cons. Investment linked policies, other than providing risk cover, force you to invest periodically. However, if you are a disciplined investor, buying a pure risk cover together with investing in quality mutual fund SIPs can help you achieve the same objective at a much lower cost.

Buying a pure risk cover together with investing in quality mutual fund SIPs can help you achieve the same objective at a much lower cost.

While term insurance policies need a lower premium to be paid and give a higher Sum assured, Investment linked policies have higher premium and lower Sum assured. Unfortunately, many of us have the mental block of paying for pure risk cover, because we do not get anything back if we are alive. Thus we prefer investment linked insurance because it is a regulatory requirement to have car insurance). Every year we pay for car insurance. However, if we do not meet with an accident that year, the money does not come back to us. If we can get ourselves to think about risk cover and investment needs separately, we can plan our future in a smarter and more cost effective manner.

The premium paid depends on the risk of early death of the individual. The higher is the risk that the person will die earlier, the higher will be the premium charged. Women are generally expected to live longer and hence premium will be lesser for women. Being overweight, working in risky jobs like fire fighters, Military etc., history of tobacco usage, history of illnesses, chronic diseases running in family – all these factors increase the risk of early mortality and hence such people need to pay a higher premium.

The premium paid depends on the risk of early death of the individual. The higher is the risk that the person will die earlier, the higher will be the premium charged.

Key Takeaways:

- Whichever type of policy you choose, remember one fundamental principle. The earlier in your working life you buy your life insurance policy, that much lesser is the regular premium you would need to pay for the same amount of risk cover (i.e. the amount of money your family would receive in the event of your death). So go and grab it as soon as possible.

- In addition to this, do not forget to increase the risk cover periodically as your income increases.

Next Course of action:

- Secure your family's future by taking a Life Insurance Plan

- Check out our range of offerings and start investing to grow your investments

INDIA

INDIA NRI

NRI