Chapter 2.6

Investing in Real Estate

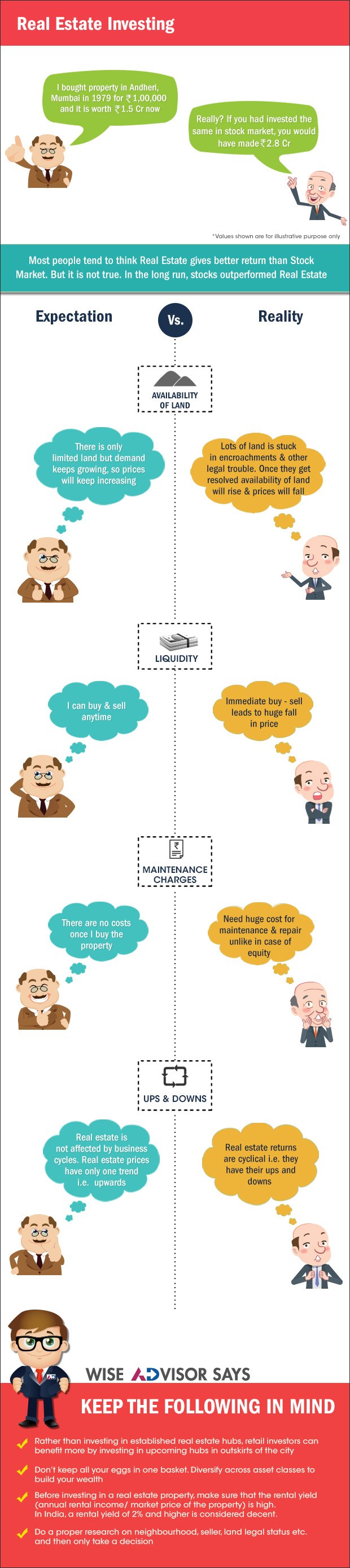

This chapter discusses truths about investing in real estate. While a lot of people tend to think of Real estate as an ever growing investment, there are much better investment opportunities out in the market

Most Indians believe that real estate is the best asset class to invest in. This belief comes from the ever increasing real estate prices and the stories of a number of 'quick rich' billionaires it has generated. However, the return that a developer or builder can make out of real estate is significantly higher than what an individual investor can make.

Real Estate vs Equity

Most people think that real estate gives a better return than equities. While the BSE Sensex has been up by 280 times since 1979 to 2015, a flat in Andheri, Mumbai would have been up by only 150 times. The average equity has outperformed one of the most renowned Mumbai properties by about 1.25 times, without even considering dividend reinvestment and maintenance outflows and the time value of money for 10 years early investment in real estate. Surely in the last 5 or 10 years, real estate has outperformed equities. But that is one of the reasons why equities seem cheaper compared to real estate today.

The average equity has outperformed one of the most renowned Mumbai properties by about 1.25 times, without even considering dividend reinvestment and maintenance outflows and the time value of money for 10 years early investment in real estate.

Sometimes real estate return comes from inherent leverage in the product, like booking of flats on down payment and paying money over a period of time. In equities we are comparing returns on a non-leveraged basis

Availability of Land

Since God has stopped creating land, people say real estate is the best thing to invest in. If one looks out of an airplane while travelling, one realizes the folly of this argument. There is plenty of land available. However, in a country like India, encroachment and little clarity compounds the issue for an ordinary investor. Over a period of time, as these issues are addressed by the government, the supply of land should increase.

Liquidity

Most people think that an advantage of investing in real estate is that you can buy and sell at any time. The fact is that most real estate investments will give a negative return if you try to sell immediately after buying. The transaction cost in real estate from brokerage to stamp duty and the difference between the buyer’s price and the seller’s price due to illiquidity creates an immediate negative return. Since people don't trade in real estate and hold it for a long period of time without looking at day-to-day prices, it gives them returns over a long period of time without having to worry about short-term volatility in prices. If the same principle were applied to equities, surely the returns would be just as great.

Maintenance charges

Most people also tend to think that while real estate requires outflow in the form of maintenance charges and repair costs, equity creates inflows in the form of dividend. Obviously if you rent out your property it can create an inflow, but then it creates another issue of getting the right tenant.

Effect of Business cycles

Lot of people have a misconception that Real estate is not affected by business cycles. This is not true. As explained earlier, while the period from 2007-2012 has been a golden period for investors, since 2012 Gold has been on a downtrend.

For a retail investor looking at exposure in real estate, projects in areas expected to emerge as the next residential or business hubs are attractive investment opportunities. If we analyze the Mumbai real estate scenario as it existed 15 years ago, investments in office and residential premises in the then emerging area of sub-urban Mumbai like Bandra-Kurla Complex have provided higher returns than investments in old hubs of Fort, Ballard Estate and Kalbadevi Road. In the city of Ahmedabad, smart money has shifted from Relief Road to Ashram Road to C.G. Road to Satellite Road to S.P. Road, and in the process, generated multi-fold returns for investors.

One attractive option for a retail investor with adequate investible surplus, interested in investing directly in real estate, is to select an emerging hub on the outskirts of a city and buy a commercial property there, which can be rented out to a reputed corporate tenant like a bank or an insurance company. Such an investment has the potential to provide attractive rental yields as well as capital appreciation over a period of time when the city extends its commercial activity.

One attractive option for a retail investor with adequate investible surplus, interested in investing directly in real estate, is to select an emerging hub on the outskirts of a city and buy a commercial property there

Finally, returns from real estate, like any other asset class, are cyclical. Returns from real estate vary over different time periods. Transaction cost, maintenance charges, illiquidity and non-transparency in this sector make life difficult for an ordinary investor. Real estate, like equity, has done well for long-term investors. However, one should not put all the eggs in one basket. Asset allocation is the best way to grow wealth over a period of time.

Key Takeaways:

- Real estate, like equity, has done well for long-term investors. However, one should not put all the eggs in one basket. Asset allocation is the best way to grow wealth over a period of time.

Next Course of action:

- Check out the Best Performing Real Estate Stocks

- Start investing with AxisDirect. View our best in class Research Ideas

INDIA

INDIA NRI

NRI