Deductions Under Section 80 C: Triple Exemption and EEE– Axis Direct

Jan 24, 2020 | Source: AxisDirect-O-Nomics

80 C Deductions: Triple exemption from taxes? What is the EEE regime?

TMost people would have heard about Section 80C of the Income Tax Act, 1961Income Tax Act, 1961. This section of tax law deals specifically with tax deductions. There are several other sections of the ITA that detail investments that qualify for tax exemption or tax rebates as well. All these sections together help in saving taxes. However, not all investments are equally tax-efficient; some can help you save more taxes than others. This is largely due to the difference in tax treatment meted out by the government to different investments.

For instance, in order to promote retirement savings, the government may give more tax benefits to National Pension Funds than Equity-Linked Savings Scheme. Depending on the tax benefits provided to various investments in different stages, these can broadly be classified into three types—EEE, EET and ETE. But to understand the taxation regimes, you will have to know about the three phases of investment.

Investment Phase

This is the first phase of an investment, wherein you actually make the investment in an instrument. It could be the first contribution to EPF, mutual funds and NPS or a lump-sum investment in bank fixed deposits. Most instruments require multiple contributions at regular intervals rather than a lump-sum payment. In some cases, the investment phase can last as long as the tenure of the instrument.

Accumulation Phase

Investment instruments are of different types. Some instruments like term insurance don’t have a savings component and hence, the capital doesn’t accumulate and appreciate during the tenure of the investment. ButHowever, in most cases like mutual funds or EPF, the initial contribution earns interest and grows or the capital appreciates due to market movement. The value of the investment appreciates in the accumulation phase.

Withdrawal Phase

The principal amount along with the interest earned is withdrawn in this phase. Some instruments allow lump-sum withdrawal of the accumulated fund, while some allow partial withdrawal or staggered withdrawal. For instance, you can withdraw the entire amount of a fixed deposit as lump-sum, but only 60% of the accumulated fund can be withdrawn from an NPS account. The balance has to be invested in an annuity plan.

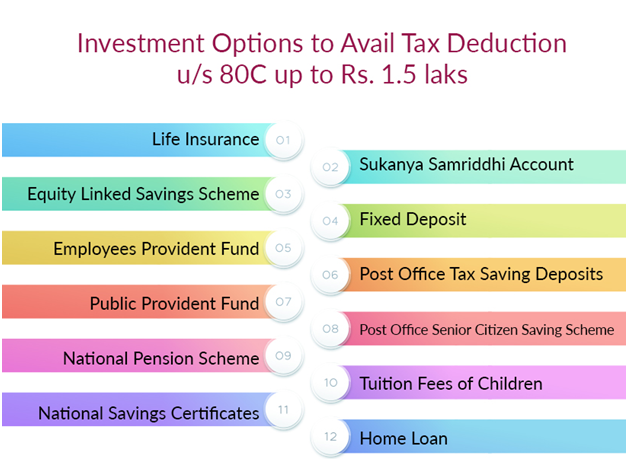

An understanding of the different phases of an investment instrument will make it easier to understand the triple exempt status or EEE ( (Exempt-Exempt-Exempt). There are certain instruments that do not attract tax at any stage of the investment, which means that investing, accumulating and withdrawing is essentially tax-free for some instruments. In the investment phase, the contribution generally qualifies for tax deductions under Section 80C of the Income Tax Act, 1961. The accumulation phase doesn’t attract any tax either and the lump-sum or staggered withdrawal is made tax-exempt. In India, the instruments that enjoy EEE status are:

Life Insurance Policies: Life insurance plans with a savings component like endowment plans or ULIPs enjoy tax benefits at every stage. The premiums are eligible for a tax deduction, while withdrawal after several years is tax-free.

PPF: The Public Provident Fund is a government-backed scheme. It has a minimum maturity period of 15 years, which can be extended in blocks of five years. The interest earned and the maturity amount of PPF are tax-free.

EPF: The Employee Provident Fund is a popular tax-saving option for salaried employees. The employee’s contribution qualifies for tax deductions under Section 80C; the interest accumulated is tax-free, while the withdrawal amount on maturity too is tax-exempt.

The Sukanya Samriddhi YojanaSukanyaSamriddhiYojana, a deposit scheme launched for the girl child enjoys the EEE status but is limited only to a certain section of society.

Conclusion

Besides the instruments categorisedcategorized as EEE, other instruments are classified as ETE (Exempt Taxable Exempt) and EET (Exempt Exempt Taxable) depending on the stage of taxation. The National Pension Scheme is considered to be effectively EEE, but it is not purely triple exempt. The payout of the annuity investment of NPS is taxed as per the income slab of the beneficiary.

However, to get optimum tax benefits, you should consider a combination of instruments. With Axis Direct’s tax saving solutions, picking the right financial instruments is simple anfand hassle-free. With our ELSS (Equity Linked Savings Schemes), you can avail the dual benefit of tax deductions under section 80 C, of up to Rs. 1.5 lakhs and also reap in the value of capital appreciation.

So, start your investment journey with Axis Direct's tax savings and wealth creation plans today.

Related Keyword

Mutual Funds

Financial Planning

SIP

Equity

Investment plans

AxisDirect-O-Nomics

ELSS

INDIA

INDIA NRI

NRI