Advantage AxisDirect

- 20 investment products

- 3 great platforms to invest

- 5 fun-tastic learn courses

- 5 powerful research segments

- 4 prestigious awards

- 9 lakh+ happy investors

Quotes

Back To Menu

-

Offerings

- Markets

- Research

- Learn

- PORTFOLIO

What is Margin Trading in Stock Market& How Does it Work? – Axis Direct

Dec 26, 2019 | Source: AxisDirect-O-Nomics

What is Margin Trading in Stocks and How Does it Work to Grow Your Capital Faster?

The views and opinions expressed are of Mr. Arun Thukral, MD & CEO, Axis Securities.

What is Margin Trading in Stocks?

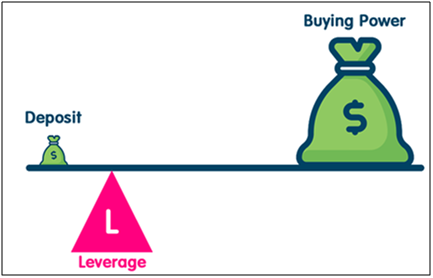

Margin trading is a system that allows you to make more money by spending a limited amount of cash. With this trading system you can buy more stocks than the available cash in your hand. Margin trading gives you buying power and leverage with a small deposit.

Source: Babypips.com [3]

Really?

Yes, it is called margin trading as it allows you to pay a marginal amount (fraction) of the actual value of the stocks. Margin trading can be used by any investor or trader to make a fast buck if they know what they are doing.

How does Margin Trading Work?

Margin trading is ideal for any investor or trader looking for an additional method to increase their capital.

Here’s an example of how it works.

Imagine that you want to buy 100 shares of DRS at Rs. 500 per share which will cost you Rs 50,000. But you have only Rs. 40,000 available as cash in your margin trading account. In this case, if you have a margin trading account, you can invest Rs. 40,000 and borrow the remaining Rs. 10,000 as margin money to make your purchase.

Two scenarios

Now, two things can occur once you have bought shares using a margin account.

Scenario 1

The price of DRS shares goes up and your investment is now worth Rs. 65,000. You sell the shares, pay back the margin money of Rs. 10,000 and keep your profit of Rs. 5,000. That is a 20% return on your investment of just Rs. 40,000 because of a 30% jump in share prices.

Scenario 2

While margin trading is a powerful tool for leverage when stock prices go up, there is also a downside or risk to it.

Assume that the price of DRS shares in your portfolio goes down in value to Rs. 45,000. But still you will have to pay Rs. 10,000 margin money back to your broker from Rs. 45,000. Therefore, for an investment of Rs. 40,000 you will only get Rs. 35,000 back (Rs. 45,000 – Rs. 10,000), and thereby suffer a loss of Rs. 5,000. That’s a 20% loss for just a 10% decrease in share prices.

There is a flipside to margin trading as well. If share prices go up, you can leverage your investments and make a lot of profit. The opposite is also true. That even a slight fall in prices can lead to big losses.

How to open a margin account?

In order to carry out margin trading, you need to open a margin trading account with your broker. This margin account will allow you to buy more shares than you can afford at any point of time.

To open a margin account, you need to pay an upfront amount in cash and sustain a maintenance margin (MM) at all times. Then, you also need to pay an initial margin (IM) which is a percentage of the total trade value. IM and MM are percentages of the total value of the shares which is specified by the broker.

Three golden rules of margin trading

1. Maintain the minimum balance or maintenance margin at all times.

Assume that ACC is trading at Rs. 400 and falls 4.25%. Initial margin (IM) for this trade is 8% and maintenance margin (MM) is 4%. If you deduct the percentage fall in prices from the IM (8%-4.25% = 3.75%), the value is lesser than the MM. In this case you will have to pay the remaining balance of 0.25% to maintain the MM or the trade will get squared off automatically by the broker. When a trade is squared off, you have to close your position – meaning either you have to buy or sell the share.

2. Margin trading positions are closed at the end of the day.

3. You need to keep cash ready to buy all the shares you have declared to buy during the session or trading day.

Some features and rules of margin trading

• As per SEBI regulations, only authorised brokers can offer margin trade accounts.

• Only stocks defined by SEBI and respective stock exchanges are margin-traded.

• Positions can be taken in a margin account against cash or securities (shares) as collaterals.

• Investors should create a Margin Trading Facility (MTF) account to engage in margin trading.

In conclusion, it’s important to understand that margin trading helps you grow your capital faster but you can also suffer magnified losses if things don’t go as expected. If you fail to pay the broker as per the terms of the margin trading account, the broker has the right to sell off your assets to recover the sum. Borrowing from a broker under a margin trade is as legally binding as borrowing from a bank.

For more such simplified knowledge on complex trading systems and methods, check Axis Direct daily and upgrade your financial skills and knowledge. At Axis Direct we can also help you succeed in derivatives trading with our streamlined trading platforms, in-depth research, cutting edge education and relentless support. Whether you are new to derivatives or a seasoned player, we have platforms, education and plans to cater to your needs.

Sources:

1. https://cleartax.in/s/margin-trading

2. https://economictimes.indiatimes.com/definition/margin-trading

3. https://www.babypips.com/learn/forex/margin-leverage-possible-deadly-combination

vV5.0.0.6-60 Thanks for Liking, Please spread your love by sharing...As you have logged in from a different device/browser. This session has expired.Image size cannot exceed 512 KB. - Markets

INDIA

INDIA NRI

NRI