Advantage AxisDirect

- 20 investment products

- 3 great platforms to invest

- 5 fun-tastic learn courses

- 5 powerful research segments

- 4 prestigious awards

- 9 lakh+ happy investors

Quotes

Back To Menu

-

Offerings

- Markets

- Research

- Learn

- PORTFOLIO

How different are the new hybrid fund categories from the old ones and how should you choose?

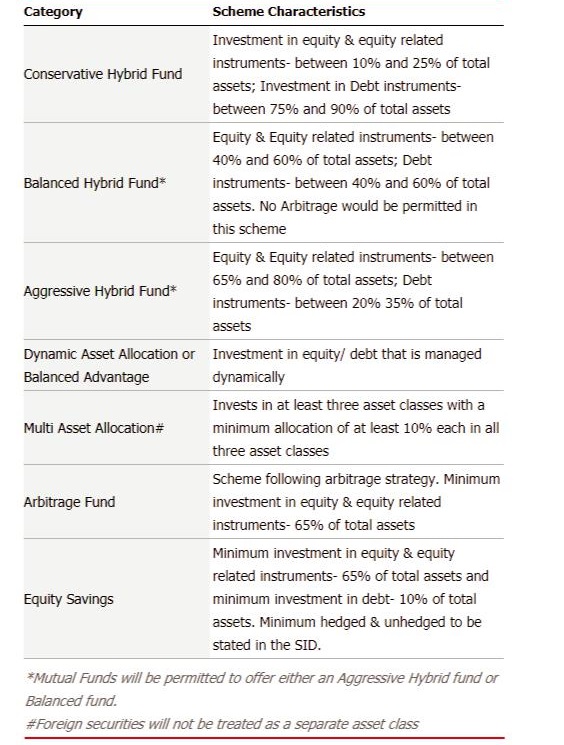

SEBI's prescriptions for the hybrid-fund category seek to retain all the existing fund types but have set right some misleading labels in this space. Under the new categorisation, mutual funds can offer six types of hybrid funds. Based on their equity-debt mix, there are conservative hybrid funds (10-25 per cent in equities, rest in debt), balanced hybrid funds (40-60 per cent in equities) and aggressive hybrid funds (65-80 per cent in equities). Effectively, the earlier 'balanced funds', which tended to be overweight in equities, have now been correctly slotted into the aggressive hybrid category. Similarly, the misnamed monthly income plans (MIPs) will be known as conservative hybrid funds so that investors can be aware of their equity component.

If you are looking to build a corpus towards a long-term goal, aggressive hybrid funds may still be your best bet, given their higher equity exposure. The minimum 65 per cent equity exposure also ensures that they get equity treatment for taxation of their short-term and long-term capital gains.

Conservative and balanced hybrid funds may be suitable for more risk-averse investors looking for a small equity kicker on top of their debt returns - say, retirees looking for inflation-beating returns or first-time investors just experimenting with equities. Both categories do not enjoy equity tax benefits and will be taxed on the lines of debt funds. But you can still reap the tax efficiency arising out of their automatic rebalancing feature as the fund manager, rather than the investor, will be selling and buying securities to maintain a steady asset allocation.

What of the other hybrid categories? Well, dynamic and multi-asset allocation funds promise to juggle between two or more asset classes based on market conditions. But such funds use divergent models to decide on their asset allocation, and different models seem to deliver results at different points in time. Therefore, it is quite hard to pick one dynamic or multi-asset fund that can serve as a good all-weather friend. We recommend that you stick to the fixed asset allocation promised by the aggressive, conservative or balanced hybrid funds for now.

Equity-savings and arbitrage funds use a combination of cash and derivative to deliver debt-like returns. These schemes offered a strong tax advantage over pure debt funds when equity funds enjoyed tax-free returns from long-term capital gains and dividends. But this tax edge has been blunted by the imposition of the 10 per cent tax on dividends and long-term gains on equity funds in the latest Budget. That has weakened the rationale for owning these funds.

Here's a list of the seven new hybrid categories.

vV5.0.0.6-60 Thanks for Liking, Please spread your love by sharing...As you have logged in from a different device/browser. This session has expired.Image size cannot exceed 512 KB. - Markets

INDIA

INDIA NRI

NRI