Advantage AxisDirect

- 20 investment products

- 3 great platforms to invest

- 5 fun-tastic learn courses

- 5 powerful research segments

- 4 prestigious awards

- 9 lakh+ happy investors

Quotes

Back To Menu

-

Offerings

- Markets

- Research

- Learn

- PORTFOLIO

Zero Debt smallcase Introduction & Operation – Axis Direct

AxisDirect-O-Nomics

Jul 16, 2018 | Source: AxisDirect

Zero Debt smallcase

Zero debt, high ROE companies with an established track record of high earnings growth

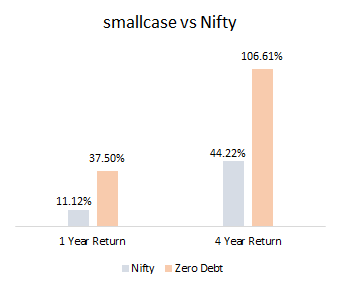

This rockstar smallcase has given the 1 year return of whopping 40.78%! The compounded annual growth rate of this smallcase is 22.86%

This smallcase combines criteria like zero debt, constant earnings growth and return on equity to select quality stocks.

• Constant growth in earnings indicates good management performance and proves that the company is making money for its shareholders. This smallcase includes companies whose earnings per share have been growing consistently by more than 15% over the last 5 years

• Return on equity indicates how much profit is generated with each rupee of the shareholders’ equity. Average ROE of companies included in this smallcase is 27%, indicating good capital management

• Companies with zero debt do not pay any interest, which boosts their profitability. This smallcase consists of debt free companies

Use this smallcase to invest in debt free quality companies that have been growing rapidly.

Click here to invest in this smallcase

Related Keyword

Earnings

growth

AxisDirect-O-Nomics

RoE

smallcase

ZERO DEBT

Similar Articles

Demonetization’s impact on growth may pan out in the next couple of quarters

Dec 09, 2016 | Source: Mint

Show more...vV5.0.0.6-60 Thanks for Liking, Please spread your love by sharing...As you have logged in from a different device/browser. This session has expired.Image size cannot exceed 512 KB. - Markets

INDIA

INDIA NRI

NRI