With record-smashing vaccination, dropped COVID19 cases, businesses resuming back, India is all set to unlock and ride the wave of economic growth. India has emerged as the fastest-growing the major economies in the world and is expected to be one of the top three economies in the world over the next 10-15 years.

These developments bring in an opportunity for you to celebrate Nivesh Utsav by investing in India’s growth story to earn potential handsome returns.

We suggest you focus on stocks that may expect pent-up demand with economic growth, have strong fundamentals and technicals.

Continue reading the page for long term, short term and mutual fund investing ideas and celebrate this Nivesh Utsav.

CMP as of October 26, 2021. For detailed research report and disclaimer click here

CMP as on September 22, 2021. For detailed research report and disclaimer click here

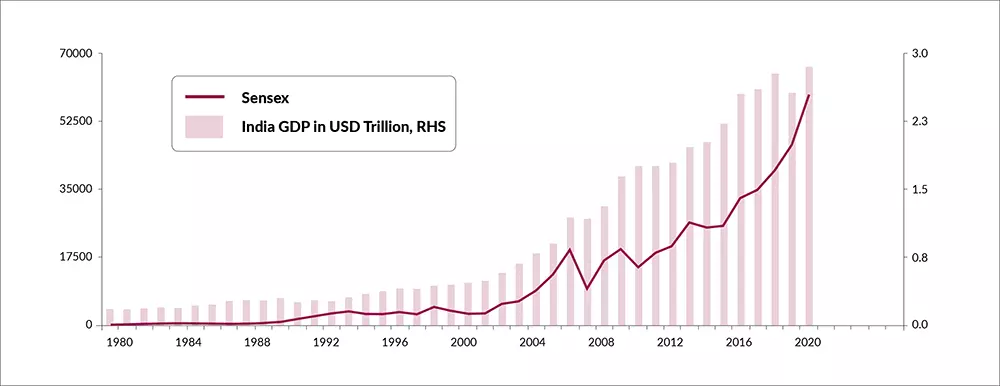

After a major crash in March 2020, the Indian stock market defies gravity and constantly moves up. India’s market cap in April 2020 was Rs 129 lac crore and now stands at Rs 264 lac crore-doubled in the last 18 months! The present rally has not seen more than 10 per cent corrections for 250 days-third longest periods and the second-highest gain with 60 per cent during the same period.

The sustained rally has made many investors suffer from “fear of height” syndrome. Investors get a little cautious when bad news comes in, thinking that the market may fall further, but that fall remains brief. Many investors thinking of booking profits have a fear of FOMO (fear of missing out). Every time investors sold and saw scrip moving up. Some investors have started calling the rally the “Most hated bull market”.

The market needs healthy corrections. The healthy corrections can make the market ready for the next leg of the rally. The higher market goes without corrections will make the market riskier. New investors who joined the market post-March 2020 does not know what correction is all about. They have not experienced the pain of the stock market investing. How they react when the correction happens is an area to watch out for.

Many of these investors may think that the gain made in the last 18 months may continue going forward. But that’s not true. The last 18 months returns are an exception and not a rule.

The market, on average, gives 11-12 per cent CAG returns. If you have the right guidance, you can make an additional 2-3 per cent potential returns over the benchmark indices. Hence the time has come that you need to tone down your expectation from the market.

But many retail investors even don’t make market returns. Their investments normally gets below-market returns as they don’t have proper guidance from an expert who helps to shortlist buy and sell stocks.

This is where SmartEdge plus facility comes in handy for investors. SmartEdge has done better because it removes human bias while buying and selling stocks. It follows investment principles in a disciplined manner.

Thousands of retail investors are using SmartEdge plus to gain for themselves, and you can also use this platform.

Remember market has become more complex, and hence you need an expert who can guide you to make your investment journey. Also, making money in the stock market is not only a selection but also rejection. You must also know which company you should avoid, or those companies can drag down your returns. SmartEdge plus does that too for you.

DISCLAIMER

Axis Direct is a brand under which Axis Securities Limited offers its retail broking and investment services. Investments in the securities market are subject to market risks. Read all the related documents carefully before investing. This information is only for consumption by the client and such material should not be redistributed. Disclaimer & Statutory Information