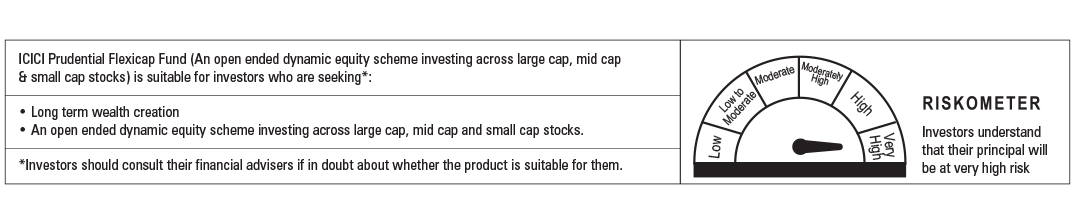

Investment Philosophy

Aim to identify and invest in opportunities across market caps through an in-house Marketcap model

Investment Approach

Mix of top-down and bottom-up approach to identify opportunities in large, mid and small cap space respectively

Security Selection

Stocks will be selected basis various factors such as, macros, company fundamentals, valuations, etc.

Investment Universe

Opportunities from S&P BSE 500 universe will be considered for investment

Re-balancing

The Large/Mid/Smallcap allocation will be assessed and re-balanced on a periodic basis, based on the in-house model

Investment Process

The Fund Manager decides the Marketcap attractiveness basis prevailing market conditions. The Fund Management team identifies opportunities in that particular segment

The asset allocation and investment strategy will be as per Scheme Information Document. The portfolio of the scheme is subject to changes within the provisions of the Scheme Information document of the Scheme.

Key Takeaways About The Scheme

The asset allocation and investment strategy will be as per Scheme Information Document. The portfolio of the scheme is subject to changes within the provisions of the Scheme Information document of the Scheme.

How is ICICI Prudential FLEXICAP FUND different?

The in-house Marketcap Model

Following parameters and other economic indicators will be considered for ascertaining Marketcap allocation.

Select Parameters of in-house Marketcap model

DISCLAIMER

Axis Securities Limited - ARN-64610-AMFI-Registered Mutual Fund Distributor. Mutual Fund investments are subject to market risks, read all scheme related documents carefully. Axis Direct is a brand under which Axis Securities Limited offers its retail broking and investment services. Investments in the securities market are subject to market risks. Read all the related documents carefully before investing."This information is only for consumption by the client and such material should not be redistributed”. Disclaimer & Statutory Information